Decoding VRNA: A Practical Guide To Your My Stocks Page

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Decoding VRNA: A Practical Guide to Your My Stocks Page

Are you overwhelmed by the information on your "My Stocks" page? Do terms like VRNA (Volume-Weighted Average Price) leave you scratching your head? You're not alone. Many investors find navigating their portfolio's detailed data daunting. This guide provides a clear, concise, and practical explanation of key metrics, focusing on understanding your VRNA and other crucial data points to make informed investment decisions.

Understanding Your My Stocks Page: Beyond the Price

Your "My Stocks" page, whether on a brokerage platform like Fidelity, Schwab, or a dedicated investment app, is your central hub for monitoring your portfolio's performance. But simply glancing at the current price isn't enough for effective portfolio management. Understanding the underlying data provides crucial context for your investment strategy. Let's break down some key components:

-

Current Price: This is the most straightforward metric – the price at which the stock is currently trading. However, it’s just a snapshot in time.

-

Day's High/Low: This shows the highest and lowest prices the stock reached during the current trading day. This helps assess price volatility.

-

Volume: This indicates the number of shares traded during a specific period (usually the day). High volume often suggests increased investor interest or activity.

-

VRNA (Volume-Weighted Average Price): This is where things get interesting. VRNA calculates the average price of a stock over a given period, weighted by the volume traded at each price. This is far more informative than a simple average price, as it reflects the actual trading activity more accurately. A high volume at a particular price point will significantly influence the VRNA.

Why VRNA Matters for Informed Decisions

Understanding VRNA offers several advantages:

-

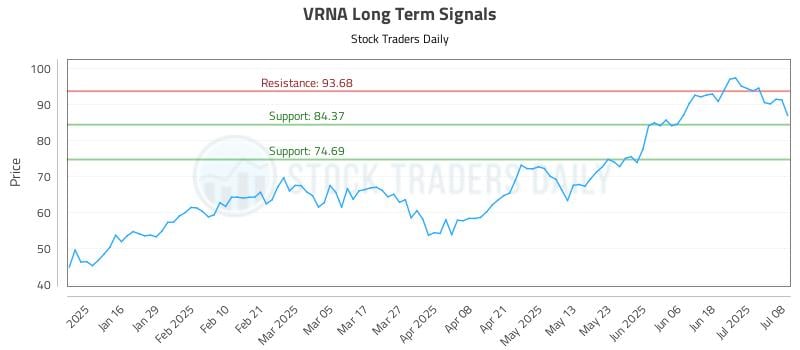

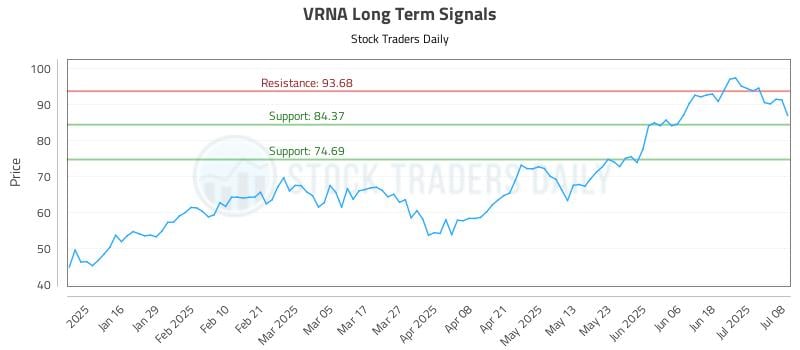

Identifying Support and Resistance Levels: VRNA can help pinpoint price levels where buying or selling pressure was significant. These levels can act as support (price unlikely to fall below) or resistance (price unlikely to rise above) in the future.

-

Gauging Market Sentiment: A consistently high VRNA compared to the closing price might indicate a bearish sentiment (more selling pressure). Conversely, a low VRNA compared to the closing price could suggest a bullish sentiment.

-

Evaluating Investment Performance: Comparing the VRNA to your purchase price provides a more comprehensive picture of your investment's performance than just looking at the current price.

-

Improving Trading Strategies: Traders often use VRNA to set stop-loss orders or identify potential entry/exit points.

Beyond VRNA: Other Important Metrics

While VRNA is crucial, don't neglect other essential data points on your "My Stocks" page:

-

Day's Change: The percentage or dollar amount by which the stock's price has changed compared to the previous day's closing price.

-

Year-to-Date (YTD) Change: The percentage or dollar amount by which the stock's price has changed since the beginning of the year.

-

52-Week High/Low: The highest and lowest prices reached by the stock in the last 52 weeks.

-

Market Capitalization: The total value of all outstanding shares of a company.

Mastering Your My Stocks Page: A Path to Better Investing

Your "My Stocks" page is a powerful tool. By understanding the data presented, particularly the significance of VRNA and other key metrics, you can move beyond simply observing price fluctuations and engage in more informed, strategic investment decisions. Remember to consult with a financial advisor before making any significant investment choices.

Call to Action: Take a few minutes today to review your "My Stocks" page. Familiarize yourself with the data presented and how it can improve your investment understanding. Learning to interpret this information effectively is a crucial step toward becoming a more successful investor.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Decoding VRNA: A Practical Guide To Your My Stocks Page. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Us Firm Bcg Under Scrutiny Uk Parliament Probes Gaza Operations

Jul 11, 2025

Us Firm Bcg Under Scrutiny Uk Parliament Probes Gaza Operations

Jul 11, 2025 -

Ai Music Controversy Dissecting The Velvet Sundown Case

Jul 11, 2025

Ai Music Controversy Dissecting The Velvet Sundown Case

Jul 11, 2025 -

Sexual Violence As A Weapon Israeli Experts Link Hamas Actions To Genocide

Jul 11, 2025

Sexual Violence As A Weapon Israeli Experts Link Hamas Actions To Genocide

Jul 11, 2025 -

Hollingbourne Police Shooting Investigation Underway After Man Seriously Injured

Jul 11, 2025

Hollingbourne Police Shooting Investigation Underway After Man Seriously Injured

Jul 11, 2025 -

The Chris Marriott Case Exploring The Unintended Consequences Of Helping Others

Jul 11, 2025

The Chris Marriott Case Exploring The Unintended Consequences Of Helping Others

Jul 11, 2025