Delay Farm Inheritance Tax: MPs' Plea For One-Year Extension

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Delay Farm Inheritance Tax: MPs' Plea for a One-Year Extension

Farmers across the UK are breathing a collective sigh of relief as MPs from across the political spectrum unite in a plea for a one-year extension to the inheritance tax deadline for agricultural land. The current economic climate, coupled with volatile market conditions and the ongoing impact of Brexit, has left many farming families facing crippling financial burdens. This urgent call for a delay aims to provide crucial breathing room and prevent the forced sale of generations-old family farms.

The pressure is mounting on the government to act swiftly. MPs argue that the current tax regime, already complex and challenging for farmers, is exacerbating existing difficulties caused by rising input costs, labor shortages, and unpredictable weather patterns. A one-year extension, they contend, is not a handout but a necessary measure to prevent the irreversible loss of valuable agricultural land and the erosion of rural communities.

The Urgent Need for a Reprieve

The situation is dire for many farming businesses. Rising inflation and interest rates are impacting profitability, making it increasingly difficult for farmers to meet their tax obligations. Many are already facing crippling debt and the prospect of inheritance tax adds an insurmountable burden. Losing a family farm, often passed down through generations, is not just a financial loss but a devastating blow to family heritage and rural economies.

Key arguments put forward by the MPs include:

- Economic hardship: The current economic climate makes it impossible for many farmers to meet the inheritance tax demands.

- Preservation of agricultural land: Losing family farms leads to a loss of valuable agricultural land and food security.

- Rural community impact: The closure of family farms has devastating consequences for local economies and rural communities.

- Unfair burden: The current inheritance tax rules place an unfair burden on family-run farming businesses compared to other sectors.

What are the potential solutions?

While a one-year extension is the immediate focus, MPs are also calling for a longer-term review of inheritance tax legislation specifically concerning agricultural land. They suggest exploring options such as:

- Increased agricultural relief: A higher percentage relief on the value of agricultural land passed on through inheritance.

- Simplified tax rules: Streamlining the complex inheritance tax rules to make them easier for farmers to understand and comply with.

- Targeted support schemes: Government support schemes specifically designed to assist farmers facing financial hardship.

These calls for reform are gaining traction, with various farming organizations lending their support. The National Farmers' Union (NFU), for example, has actively campaigned for fairer inheritance tax rules and is urging its members to contact their MPs to express their concerns.

Looking Ahead: What Happens Next?

The government's response to this urgent plea will be closely watched. While no concrete promises have been made, the growing bipartisan support for a delay suggests a positive outcome is possible. The coming weeks will be crucial as pressure mounts on the government to provide clarity and relief to the farming community. Failing to address this issue could result in a significant loss of agricultural land and further damage to the UK's food security. This is not just an issue for farmers; it’s an issue for all of us.

Further Reading:

- – replace with actual link

- – replace with actual link

Call to Action: Stay informed about the latest developments by following reputable news sources and engaging with your local MP. Your voice matters.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Delay Farm Inheritance Tax: MPs' Plea For One-Year Extension. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

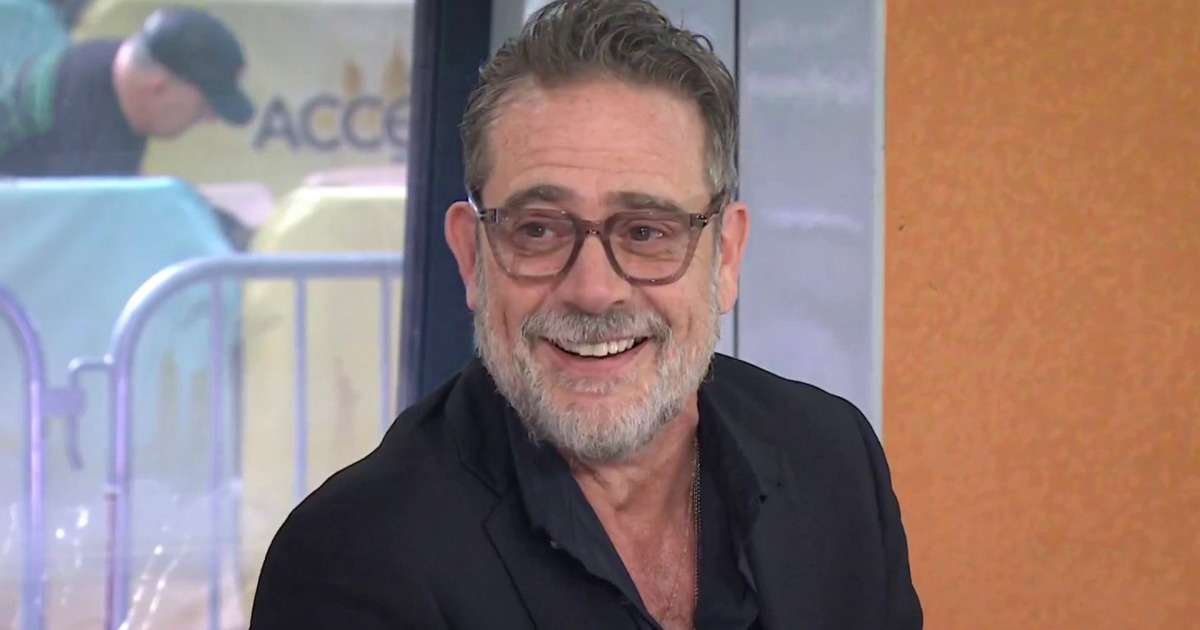

Beyond Negan Jeffrey Dean Morgan Opens Up About Destination X And Future Projects

May 18, 2025

Beyond Negan Jeffrey Dean Morgan Opens Up About Destination X And Future Projects

May 18, 2025 -

State Farm Wins Approval For Significant Rate Hike In California

May 18, 2025

State Farm Wins Approval For Significant Rate Hike In California

May 18, 2025 -

The Unseen Cannes Fun Crazy And Ludicrous Images From A Bygone Era

May 18, 2025

The Unseen Cannes Fun Crazy And Ludicrous Images From A Bygone Era

May 18, 2025 -

Nat Geos Searching For Italy Stanley Tuccis Food Documentary

May 18, 2025

Nat Geos Searching For Italy Stanley Tuccis Food Documentary

May 18, 2025 -

Fun Crazy And Ludicrous A Look At Pre Camera Phone Cannes

May 18, 2025

Fun Crazy And Ludicrous A Look At Pre Camera Phone Cannes

May 18, 2025

Latest Posts

-

Aydos Dagi Nda Metrekareye 32 Kg Yagis Istanbul Un Su Durumu

May 18, 2025

Aydos Dagi Nda Metrekareye 32 Kg Yagis Istanbul Un Su Durumu

May 18, 2025 -

50 Cent Vs Jay Z The Diddy Connection Fuels Another Hip Hop Beef

May 18, 2025

50 Cent Vs Jay Z The Diddy Connection Fuels Another Hip Hop Beef

May 18, 2025 -

Kerri Peggs Affair Revealed Encro Chat Investigation Uncovers Inmate Romance

May 18, 2025

Kerri Peggs Affair Revealed Encro Chat Investigation Uncovers Inmate Romance

May 18, 2025 -

Dispute Erupts Passenger Claims British Airways Refused Boarding Despite Confirmation

May 18, 2025

Dispute Erupts Passenger Claims British Airways Refused Boarding Despite Confirmation

May 18, 2025 -

From Evictions To Epic Showdowns Ranking The 10 Most Intense Games In Ny Baseball History

May 18, 2025

From Evictions To Epic Showdowns Ranking The 10 Most Intense Games In Ny Baseball History

May 18, 2025