Denmark's Pension Plan Overhaul: Impact And Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Denmark's Pension Plan Overhaul: A Seismic Shift with Far-Reaching Implications

Denmark, a nation renowned for its robust social welfare system, is undergoing a significant transformation of its pension plan. This overhaul, years in the making, promises to reshape the future of retirement for Danish citizens and has implications far beyond its borders, serving as a case study for other nations grappling with aging populations and strained pension systems. The changes are complex, but understanding their impact is crucial for both Danish residents and international observers interested in pension reform.

The Core Changes: A Move Towards Personal Responsibility

The fundamental shift in Denmark's pension system involves a greater emphasis on individual responsibility and market-based investments. The previous system, characterized by a defined-benefit structure, provided a guaranteed level of retirement income. The new model, however, incorporates elements of a defined-contribution system, meaning the final pension amount is directly linked to the performance of individual retirement savings accounts.

This change is driven by several factors:

- Aging Population: Denmark, like many developed nations, faces an aging population, placing increasing strain on the existing pension system.

- Increased Life Expectancy: Longer lifespans mean individuals need larger retirement savings to maintain their living standards.

- Market Volatility: The inherent risk associated with market-based investments is a key consideration, although the government has implemented safeguards.

Impact on Danish Citizens: A Double-Edged Sword

The implications for Danish citizens are multifaceted:

- Increased Risk: The shift to a more market-driven system introduces greater investment risk. While potentially leading to higher returns, it also increases the potential for lower payouts depending on market performance.

- Greater Personal Responsibility: Individuals are now more responsible for managing their retirement savings and making informed investment decisions. This requires a higher level of financial literacy.

- Potential for Higher Returns: Successful investment strategies could lead to significantly higher retirement incomes than under the previous system.

Implications for the Danish Economy and Beyond:

The pension reform has broader implications for the Danish economy:

- Increased Private Sector Involvement: The reform encourages greater private sector involvement in pension management, potentially boosting the financial services industry.

- Impact on Savings Rates: The reform may influence savings rates, with individuals needing to save more aggressively to secure a comfortable retirement.

- International Benchmark: Denmark's experience with this major pension reform will be closely watched by other countries facing similar challenges, offering valuable lessons and insights into pension system reform strategies.

Navigating the New Landscape: Resources and Support

The Danish government has recognized the need for increased financial literacy among citizens. Various resources and support programs have been implemented to help individuals navigate the complexities of the new system. These include educational initiatives, online tools, and guidance from financial advisors. Further research into these resources is recommended for a comprehensive understanding of the government's support network.

Conclusion: A Necessary Evolution or a Risky Gamble?

Denmark's pension plan overhaul is a bold move aimed at addressing the long-term sustainability of its retirement system. While the increased individual responsibility and market risk introduce uncertainty, the potential for higher returns and the adaptation to demographic shifts make it a significant development in global pension reform. The long-term success of this reform will depend on several factors, including market performance, government oversight, and the effectiveness of public education programs. Only time will tell whether this seismic shift proves to be a necessary evolution or a risky gamble.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Denmark's Pension Plan Overhaul: Impact And Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

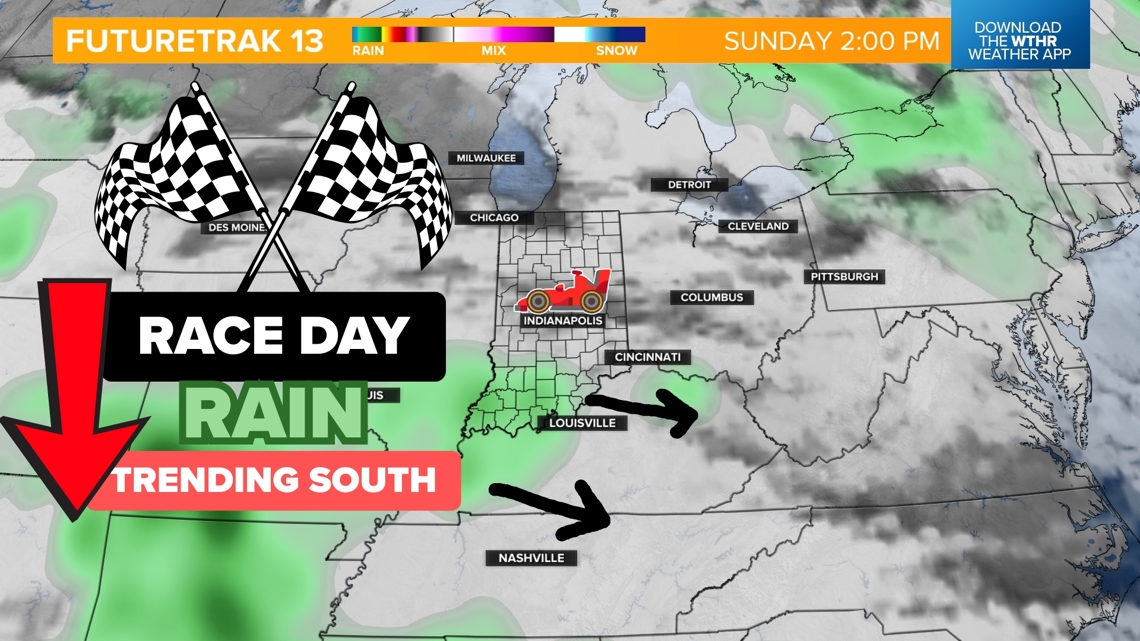

Indy 500 2025 Weather Forecast And Race Weekend Outlook

May 25, 2025

Indy 500 2025 Weather Forecast And Race Weekend Outlook

May 25, 2025 -

Debris Field And Audio Confirm Titan Sub Implosion A Tragic End

May 25, 2025

Debris Field And Audio Confirm Titan Sub Implosion A Tragic End

May 25, 2025 -

French Open 2025 Assessing The Leading Seeds And Potential Winners

May 25, 2025

French Open 2025 Assessing The Leading Seeds And Potential Winners

May 25, 2025 -

Late Game Robbery Johan Rojas Crucial Defensive Play In The 8th Inning

May 25, 2025

Late Game Robbery Johan Rojas Crucial Defensive Play In The 8th Inning

May 25, 2025 -

Post Update I Phone Issues Lag Freezing Overheating A Potential I Os 18 5 1 Fix

May 25, 2025

Post Update I Phone Issues Lag Freezing Overheating A Potential I Os 18 5 1 Fix

May 25, 2025