Dimon's Dire Prediction: Economic Downturn Looms

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dimon's Dire Prediction: Economic Downturn Looms – Is a Recession Inevitable?

Jamie Dimon, CEO of JPMorgan Chase, has issued a stark warning: an economic downturn is looming. His recent comments, delivered during the bank's second-quarter earnings call, have sent shockwaves through financial markets, prompting widespread discussion about the potential severity and timing of a recession. But how credible is Dimon's prediction, and what should we expect?

This article delves into the details of Dimon's warning, examining the factors contributing to his pessimistic outlook and considering alternative perspectives on the economic landscape.

The Factors Behind Dimon's Warning

Dimon's prediction isn't based on unfounded speculation. He points to several significant factors increasing the likelihood of a recession:

-

Inflation and Interest Rates: The persistent high inflation rate, currently stubbornly above the Federal Reserve's target, necessitates continued interest rate hikes. These hikes, while intended to curb inflation, also risk slowing economic growth to the point of triggering a recession. The offers further insights into their monetary policy decisions.

-

Geopolitical Instability: The ongoing war in Ukraine, coupled with escalating global tensions, creates significant uncertainty in the global economy. These geopolitical risks contribute to supply chain disruptions and increased energy prices, further fueling inflationary pressures. Experts are warning about the potential for to destabilize markets.

-

Consumer Spending Slowdown: Despite a strong labor market, there are signs that consumer spending is beginning to cool. High inflation is eroding purchasing power, forcing consumers to cut back on discretionary spending. This decrease in consumer demand could significantly impact economic growth.

-

Commercial Real Estate Concerns: Dimon also expressed concerns about the commercial real estate market, suggesting a potential downturn in this sector could have significant ripple effects across the broader economy. Experts are already noting .

Is a Recession Inevitable? Alternative Views

While Dimon's warning is significant, it's crucial to remember that it's just one perspective. Not all economists share his pessimism. Some argue that the resilience of the labor market and continued consumer spending, albeit at a slower pace, could mitigate the risk of a severe recession. Further, the recent positive economic data in some sectors offers a counter-narrative to the looming doom scenario.

The debate remains ongoing, and the actual economic trajectory will depend on a complex interplay of various factors. It's crucial to stay informed and follow reputable economic sources for the most up-to-date information.

What to Expect and How to Prepare

Regardless of the timing or severity of a potential downturn, preparation is key. For individuals, this might involve:

- Reviewing your budget: Identifying areas where you can cut back on spending and build an emergency fund.

- Managing debt: Prioritizing debt repayment to reduce financial vulnerability.

- Diversifying investments: Reducing exposure to risk through a diversified investment portfolio.

For businesses, proactive planning and risk management strategies are crucial.

Conclusion: Navigating Uncertainty

Dimon's prediction of an economic downturn is a serious warning, highlighting significant risks facing the global economy. While a recession isn't guaranteed, the factors he cites are undeniable. Staying informed, understanding the potential risks, and taking proactive steps to prepare are crucial for navigating the economic uncertainty ahead. The coming months will be critical in determining the actual economic trajectory. Continue to monitor reputable economic news sources and expert opinions for the latest updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dimon's Dire Prediction: Economic Downturn Looms. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

U S Open 2025 The Oakmont Challenge Awaits

Jun 13, 2025

U S Open 2025 The Oakmont Challenge Awaits

Jun 13, 2025 -

Beyond Quick Fixes Analyzing Rachel Reeves Approach To The Economy

Jun 13, 2025

Beyond Quick Fixes Analyzing Rachel Reeves Approach To The Economy

Jun 13, 2025 -

No Quick Fixes Assessing Rachel Reeves Economic Strategy For The Uk

Jun 13, 2025

No Quick Fixes Assessing Rachel Reeves Economic Strategy For The Uk

Jun 13, 2025 -

Selena Gomezs Relaxed Outfit New Photos With Fiance Benny Blanco

Jun 13, 2025

Selena Gomezs Relaxed Outfit New Photos With Fiance Benny Blanco

Jun 13, 2025 -

Transparency Concerns Lawlers Actions After Blocking Reporter From Town Hall

Jun 13, 2025

Transparency Concerns Lawlers Actions After Blocking Reporter From Town Hall

Jun 13, 2025

Latest Posts

-

Payson Area Sr 87 Closed Due To Wildfire Traffic Alert

Jun 14, 2025

Payson Area Sr 87 Closed Due To Wildfire Traffic Alert

Jun 14, 2025 -

Reports British Passenger In Seat 11 A Lives Through India Air Disaster

Jun 14, 2025

Reports British Passenger In Seat 11 A Lives Through India Air Disaster

Jun 14, 2025 -

Against All Odds Pacers Unsung Players Defeat Thunder

Jun 14, 2025

Against All Odds Pacers Unsung Players Defeat Thunder

Jun 14, 2025 -

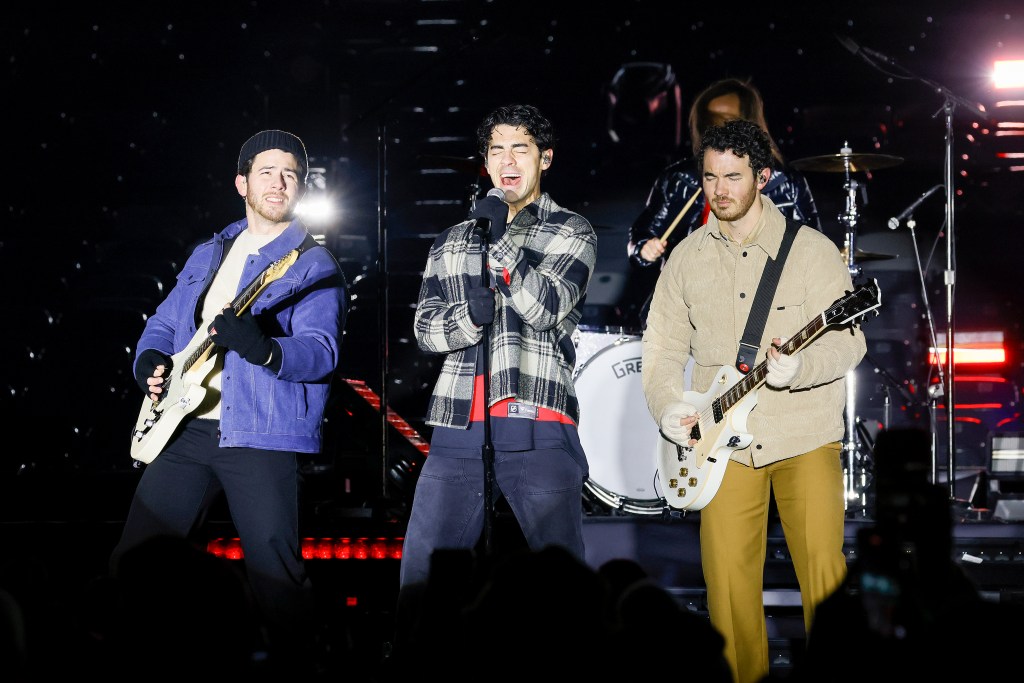

This Weeks Hottest Releases Jonas Brothers J Hope And More New Music

Jun 14, 2025

This Weeks Hottest Releases Jonas Brothers J Hope And More New Music

Jun 14, 2025 -

Wrigley Field Concert Canceled Jonas Brothers Postpone Tour Dates

Jun 14, 2025

Wrigley Field Concert Canceled Jonas Brothers Postpone Tour Dates

Jun 14, 2025