Dimon's Dire Prediction: US Economy Could Soon Weaken

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dimon's Dire Prediction: US Economy Could Soon Face a Rough Patch

Jamie Dimon, the CEO of JPMorgan Chase, has issued a stark warning about the US economy, predicting a potential downturn in the near future. His comments, delivered during a recent earnings call, sent shockwaves through financial markets, prompting widespread discussion about the health of the American economy and the potential for a recession. This isn't just another Wall Street prediction; Dimon's long track record and insightful analysis make his concerns worthy of serious consideration.

The Warning Signs: More Than Just Inflation

Dimon's prediction isn't solely based on persistent inflation, although that remains a significant factor. He points to a confluence of challenges, including:

-

The lingering effects of the war in Ukraine: The conflict continues to disrupt global supply chains and energy markets, contributing to inflationary pressures and economic uncertainty. This geopolitical instability adds an unpredictable element to economic forecasting. Learn more about the economic impact of the Ukraine war . (Replace with a relevant external link)

-

Aggressive Federal Reserve interest rate hikes: While intended to curb inflation, these hikes also carry the risk of triggering a recession by slowing economic growth too drastically. The delicate balancing act the Fed faces is a key factor in Dimon's assessment.

-

Consumers' dwindling savings: After years of pandemic-related savings, consumers are beginning to deplete their reserves, potentially leading to reduced spending and a slowdown in economic activity. This decreased consumer spending can have a ripple effect throughout the economy.

-

Uncertain geopolitical landscape: Beyond Ukraine, global tensions and instability add to the overall economic uncertainty, making accurate predictions more challenging.

What Does a "Weakening" Economy Mean?

Dimon hasn't explicitly predicted a full-blown recession, but his use of "weakening" suggests a significant slowdown in economic growth. This could manifest in several ways, including:

-

Increased unemployment: A slowing economy often translates to job losses as businesses cut back on expenses.

-

Reduced consumer spending: As mentioned earlier, dwindling savings and economic uncertainty can lead to decreased consumer confidence and spending.

-

Lower corporate profits: Businesses may see reduced revenues and profits due to decreased demand and increased costs.

-

Potential market volatility: Uncertainty about the economic outlook can lead to increased volatility in stock markets and other financial assets.

Preparing for Potential Economic Headwinds

While Dimon's prediction is concerning, it's not necessarily a cause for panic. Individuals and businesses can take steps to prepare for potential economic headwinds:

-

Review your personal budget: Assess your spending habits and identify areas where you can cut back. Building an emergency fund is crucial during uncertain times.

-

Diversify your investments: Don't put all your eggs in one basket. Diversification can help mitigate risk during market volatility. . (Replace with a relevant external link)

-

Businesses should monitor cash flow: Closely monitor cash flow and explore strategies to manage expenses and maintain profitability.

Conclusion: Navigating Uncertainty

Jamie Dimon's warning serves as a crucial reminder that economic forecasts are not guarantees, but rather probabilities. While the future remains uncertain, understanding the potential challenges and taking proactive steps can help individuals and businesses navigate whatever economic headwinds lie ahead. Staying informed and adapting to changing economic conditions will be key to weathering any potential storm. This is a developing situation, so stay tuned for further updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dimon's Dire Prediction: US Economy Could Soon Weaken. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Access Korn Ferrys Q2 2025 Financial Results Via Live Webcast

Jun 12, 2025

Access Korn Ferrys Q2 2025 Financial Results Via Live Webcast

Jun 12, 2025 -

Colorado Rockies Game 68 Birdsong Vs Senzatela A Pitching Duel

Jun 12, 2025

Colorado Rockies Game 68 Birdsong Vs Senzatela A Pitching Duel

Jun 12, 2025 -

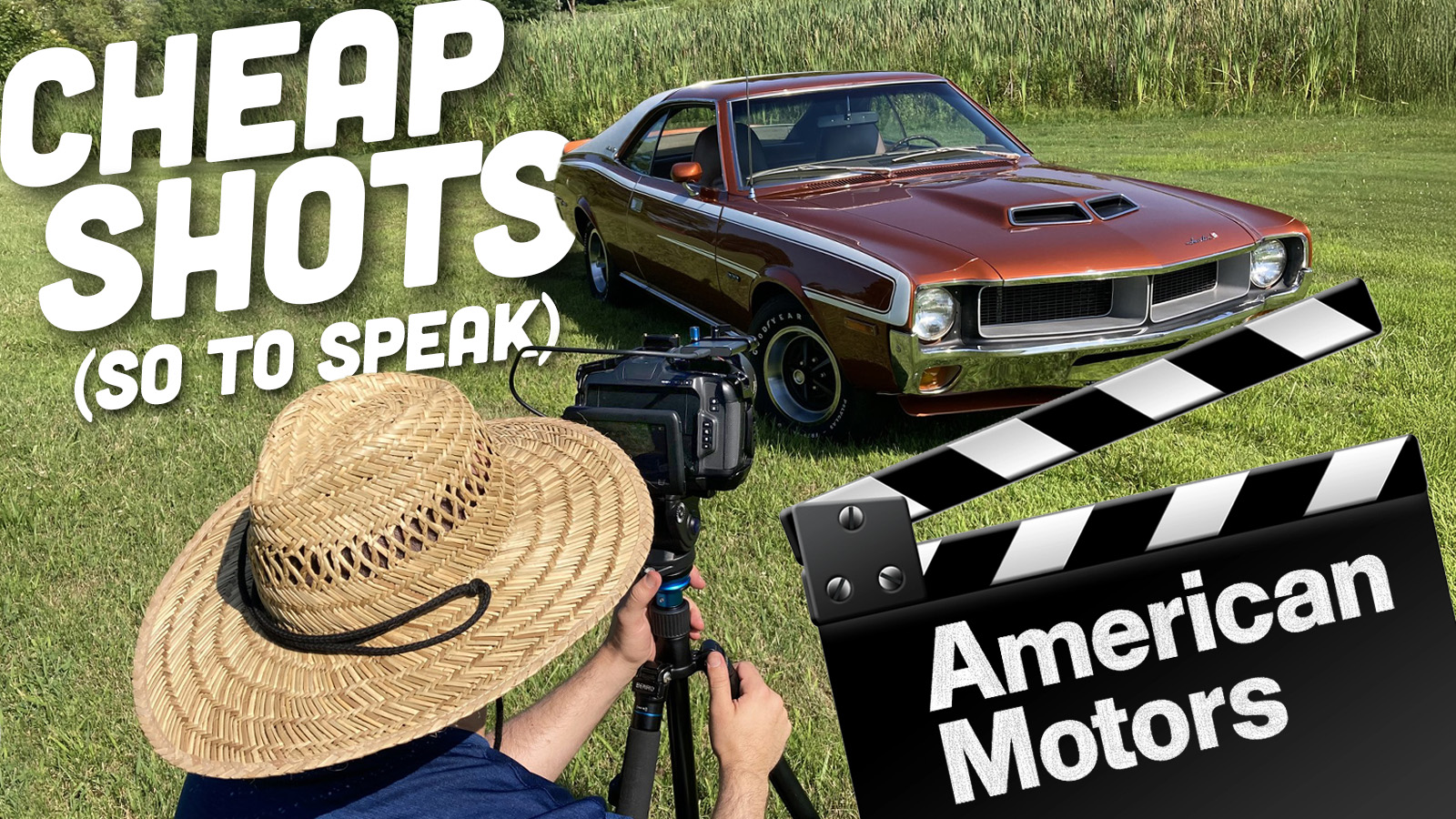

The Last Independent Automaker A Documentary Made On A Shoestring Budget

Jun 12, 2025

The Last Independent Automaker A Documentary Made On A Shoestring Budget

Jun 12, 2025 -

Father Suspected In Disappearance Of 2 Year Old Montrell Williams

Jun 12, 2025

Father Suspected In Disappearance Of 2 Year Old Montrell Williams

Jun 12, 2025 -

Super Spectacle Unveiled Key Moments From The New Superman Trailer

Jun 12, 2025

Super Spectacle Unveiled Key Moments From The New Superman Trailer

Jun 12, 2025

Latest Posts

-

U S Open Teenager Faces Off Against Experienced Rarity

Jun 14, 2025

U S Open Teenager Faces Off Against Experienced Rarity

Jun 14, 2025 -

Crews Halt Carlsbad Brush Fire Evacuations End

Jun 14, 2025

Crews Halt Carlsbad Brush Fire Evacuations End

Jun 14, 2025 -

Illini Mens Golf A Look At The Class Of 2025 And Beyond In Professional Golf

Jun 14, 2025

Illini Mens Golf A Look At The Class Of 2025 And Beyond In Professional Golf

Jun 14, 2025 -

Air India Crash Investigation What It Means For Boeings 737 Max Program

Jun 14, 2025

Air India Crash Investigation What It Means For Boeings 737 Max Program

Jun 14, 2025 -

Tournament Fishing Boat Catches Fire Five Rescued

Jun 14, 2025

Tournament Fishing Boat Catches Fire Five Rescued

Jun 14, 2025