Dimon's Warning: US Economy Faces Deterioration Risk

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dimon's Warning: US Economy Faces Growing Deterioration Risk

JPMorgan Chase CEO Jamie Dimon issued a stark warning about the US economy, citing a looming risk of deterioration. His comments, delivered during a recent earnings call, sent shockwaves through financial markets, highlighting growing concerns about inflation, interest rate hikes, and geopolitical instability. Dimon's reputation for astute economic forecasting makes his warning particularly significant for investors and consumers alike.

This isn't just another bearish prediction; Dimon paints a picture of a potentially bumpy road ahead, urging caution and preparedness. He's not alone; several leading economists share similar concerns, pointing towards a potential recession or significant economic slowdown. Let's delve into the key factors contributing to Dimon's pessimistic outlook:

H2: Inflation's Persistent Grip:

Inflation remains stubbornly high, eroding consumer purchasing power and impacting business profitability. While the Federal Reserve has aggressively raised interest rates to combat inflation, the effects haven't been as swift or significant as hoped. Dimon highlights the persistent inflationary pressures as a major driver of economic uncertainty, potentially leading to further interest rate hikes and slower economic growth. This prolonged period of high inflation also significantly impacts [link to article about inflation's impact on consumer spending].

H2: The Looming Shadow of Recession:

Dimon's warning isn't solely focused on inflation; he also alluded to the increasing probability of a recession. While he didn't explicitly predict a recession, he emphasized the heightened risks and urged businesses and individuals to prepare for a potentially challenging economic climate. This aligns with concerns voiced by other financial experts who see several indicators pointing towards a possible recession in the near future. [Link to article discussing recession indicators].

H2: Geopolitical Instability Adds Fuel to the Fire:

The ongoing war in Ukraine and other geopolitical tensions are adding further complexity to the economic landscape. These factors contribute to global uncertainty, impacting supply chains, energy prices, and overall economic stability. Dimon's assessment highlights the interconnectedness of the global economy and the significant impact of geopolitical events on the US economy.

H3: What Does This Mean for You?

Dimon's warning isn't a call for panic, but rather a call for preparedness. For consumers, it means being mindful of spending, building emergency funds, and potentially adjusting financial plans to navigate potential economic headwinds. Businesses should carefully monitor economic indicators, manage cash flow effectively, and reassess investment strategies.

H2: Dimon's Advice: Prepare for a Stormy Weather

The JPMorgan Chase CEO's message is clear: buckle up. The economic climate is becoming increasingly unpredictable, and proactive measures are crucial. While the exact trajectory of the economy remains uncertain, Dimon's warning underscores the need for vigilance and strategic planning. This isn't a time for complacency; it's a time for informed decision-making and careful financial management.

H2: Looking Ahead: What to Watch For

In the coming months, several key economic indicators will provide further insight into the direction of the US economy. Closely monitoring inflation data, employment figures, and consumer spending will be crucial in gauging the severity of the potential economic slowdown. The Federal Reserve's future interest rate decisions will also play a significant role in shaping the economic landscape.

Conclusion:

Jamie Dimon's warning serves as a potent reminder of the inherent uncertainties in the global economy. While the future remains uncertain, preparedness is key. By understanding the factors contributing to the potential economic deterioration, individuals and businesses can better navigate the challenges that lie ahead. Staying informed and adapting to changing economic conditions will be crucial in mitigating the risks and seizing opportunities in the evolving economic landscape. What steps are you taking to prepare for potential economic uncertainty? Share your thoughts in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dimon's Warning: US Economy Faces Deterioration Risk. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

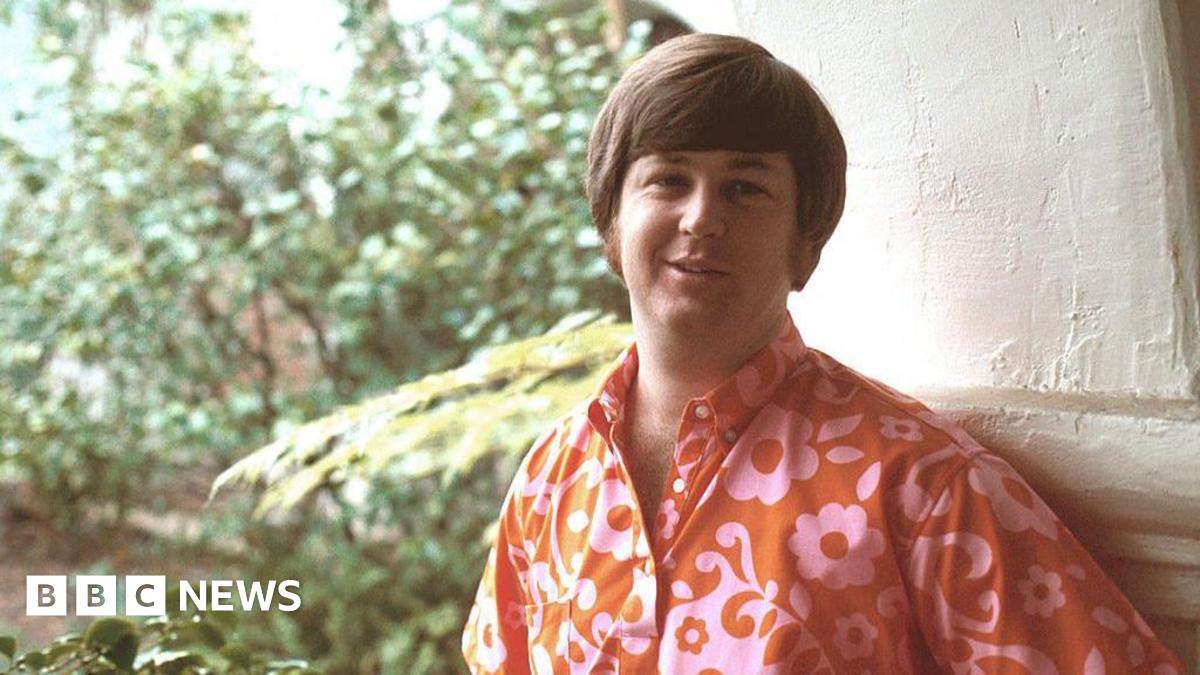

Remembering Brian Wilson A Tribute To The Beach Boys Genius

Jun 13, 2025

Remembering Brian Wilson A Tribute To The Beach Boys Genius

Jun 13, 2025 -

Is There A New Love Island Usa Episode On June 11th

Jun 13, 2025

Is There A New Love Island Usa Episode On June 11th

Jun 13, 2025 -

The Impact Of Ai On Adobe Stock Opportunities And Challenges Nasdaq Adbe

Jun 13, 2025

The Impact Of Ai On Adobe Stock Opportunities And Challenges Nasdaq Adbe

Jun 13, 2025 -

86 Year Old Soap Opera Legend Passes Away

Jun 13, 2025

86 Year Old Soap Opera Legend Passes Away

Jun 13, 2025 -

Lawlers Town Hall Controversy Medicaid Cuts Ice And Tax Hikes Dominate Debate

Jun 13, 2025

Lawlers Town Hall Controversy Medicaid Cuts Ice And Tax Hikes Dominate Debate

Jun 13, 2025

Latest Posts

-

Boeings Future Navigating The Aftermath Of The Air India Crash

Jun 14, 2025

Boeings Future Navigating The Aftermath Of The Air India Crash

Jun 14, 2025 -

Dramatic Rescue Five Survive Tournament Boat Fire At Sea

Jun 14, 2025

Dramatic Rescue Five Survive Tournament Boat Fire At Sea

Jun 14, 2025 -

Africa Relocation Scam Sons Successful Lawsuit Against Parents

Jun 14, 2025

Africa Relocation Scam Sons Successful Lawsuit Against Parents

Jun 14, 2025 -

2025 Nba Finals Game 4 Four Pivotal Points To Watch

Jun 14, 2025

2025 Nba Finals Game 4 Four Pivotal Points To Watch

Jun 14, 2025 -

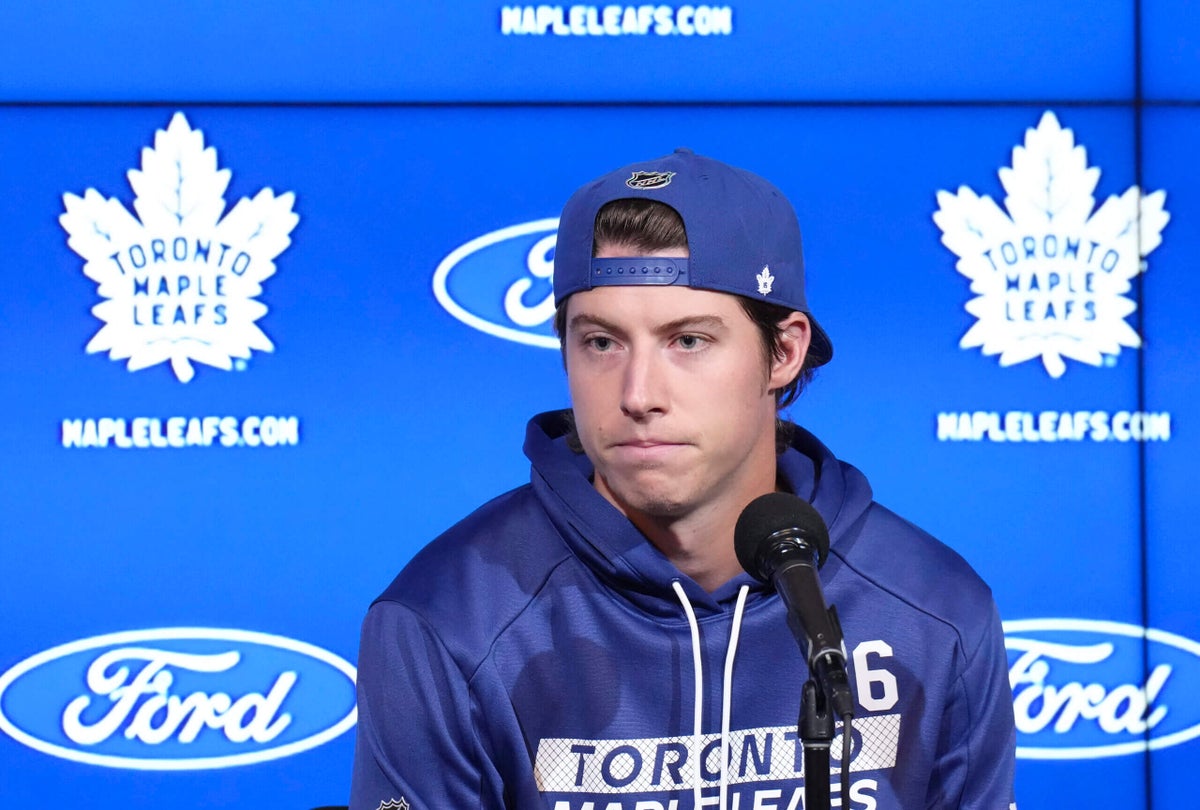

High Stakes Breaking Down Mitch Marners Upcoming Contract Negotiations

Jun 14, 2025

High Stakes Breaking Down Mitch Marners Upcoming Contract Negotiations

Jun 14, 2025