Dismal Jobs Report: Just 37,000 Private Sector Jobs Added In May

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dismal Jobs Report: Just 37,000 Private Sector Jobs Added in May - Signaling Economic Slowdown?

The May jobs report delivered a sobering blow to hopes of a robust economic recovery, revealing a far weaker-than-expected increase in private sector employment. With only 37,000 new private sector jobs added, the numbers fell drastically short of economists' predictions, sparking concerns about a potential economic slowdown and raising questions about the Federal Reserve's future monetary policy decisions. This marks a significant drop from the revised 152,000 jobs added in April, further fueling anxieties within the market.

The underwhelming figure, released by the U.S. Bureau of Labor Statistics (BLS), immediately sent ripples through financial markets, causing a dip in stock prices and raising questions about the resilience of the U.S. economy. Analysts are scrambling to understand the contributing factors behind this significant decline in job growth.

What Drove the Weak Job Creation?

Several factors likely contributed to the disappointing May jobs report. These include:

-

High Interest Rates: The Federal Reserve's aggressive interest rate hikes throughout 2022 and into 2023 are starting to bite. Higher borrowing costs make it more expensive for businesses to expand, invest, and hire new employees. This chilling effect on business activity is a key suspect in the weak job growth.

-

Lingering Inflationary Pressures: While inflation has cooled somewhat, it remains stubbornly above the Federal Reserve's target rate. This persistent inflation continues to erode consumer purchasing power and business confidence, impacting hiring decisions.

-

Uncertainty in the Global Economy: Geopolitical instability, particularly the ongoing war in Ukraine, continues to create uncertainty in the global economic landscape. This uncertainty can lead businesses to adopt a more cautious approach to hiring.

-

Potential for a Recession: The weak jobs report further fuels fears of a potential recession. While the economy hasn't officially entered a recession, the slowdown in job growth, coupled with other economic indicators, raises serious concerns.

Impact on the Federal Reserve's Policy

The dismal jobs report complicates the Federal Reserve's already challenging task of balancing inflation control with economic growth. While inflation is showing signs of easing, the weak job growth may lead the Fed to reconsider further interest rate increases, or at least proceed with caution. The coming months will be crucial in determining the Fed's next move and its impact on the overall economy.

What Lies Ahead?

The disappointing May jobs report highlights the complexities of the current economic environment. While the long-term outlook remains uncertain, experts suggest keeping a close eye on several key economic indicators in the coming months, including:

-

Consumer Spending: Continued robust consumer spending could help offset the weakness in the job market. However, a slowdown in consumer spending could signal further economic contraction.

-

Business Investment: Increased business investment is crucial for driving job growth. Any further decline in business confidence could exacerbate the situation.

-

Inflation Rates: A continued decline in inflation would ease pressure on the Federal Reserve and potentially pave the way for a more supportive monetary policy.

The coming months will be critical in determining whether this weak jobs report is a temporary blip or a harbinger of a more significant economic slowdown. The situation demands careful observation and analysis to better understand the evolving economic landscape and its potential consequences. For more in-depth analysis and economic forecasts, consider exploring resources from the and the .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dismal Jobs Report: Just 37,000 Private Sector Jobs Added In May. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Karen Reads Defense Files Indicate She Wont Testify

Jun 06, 2025

Karen Reads Defense Files Indicate She Wont Testify

Jun 06, 2025 -

Easier Reverse Discrimination Claims After Supreme Court Decision

Jun 06, 2025

Easier Reverse Discrimination Claims After Supreme Court Decision

Jun 06, 2025 -

Ohio Woman Wins Landmark Supreme Court Case Against Workplace Discrimination

Jun 06, 2025

Ohio Woman Wins Landmark Supreme Court Case Against Workplace Discrimination

Jun 06, 2025 -

Expert Warns Unsettling Trends In Artificial Intelligence

Jun 06, 2025

Expert Warns Unsettling Trends In Artificial Intelligence

Jun 06, 2025 -

Easier Reverse Discrimination Claims Supreme Courts Impact On Employment Law

Jun 06, 2025

Easier Reverse Discrimination Claims Supreme Courts Impact On Employment Law

Jun 06, 2025

Latest Posts

-

Steve Guttenbergs Kidnapped By A Killer A Look At The New Movie

Jun 06, 2025

Steve Guttenbergs Kidnapped By A Killer A Look At The New Movie

Jun 06, 2025 -

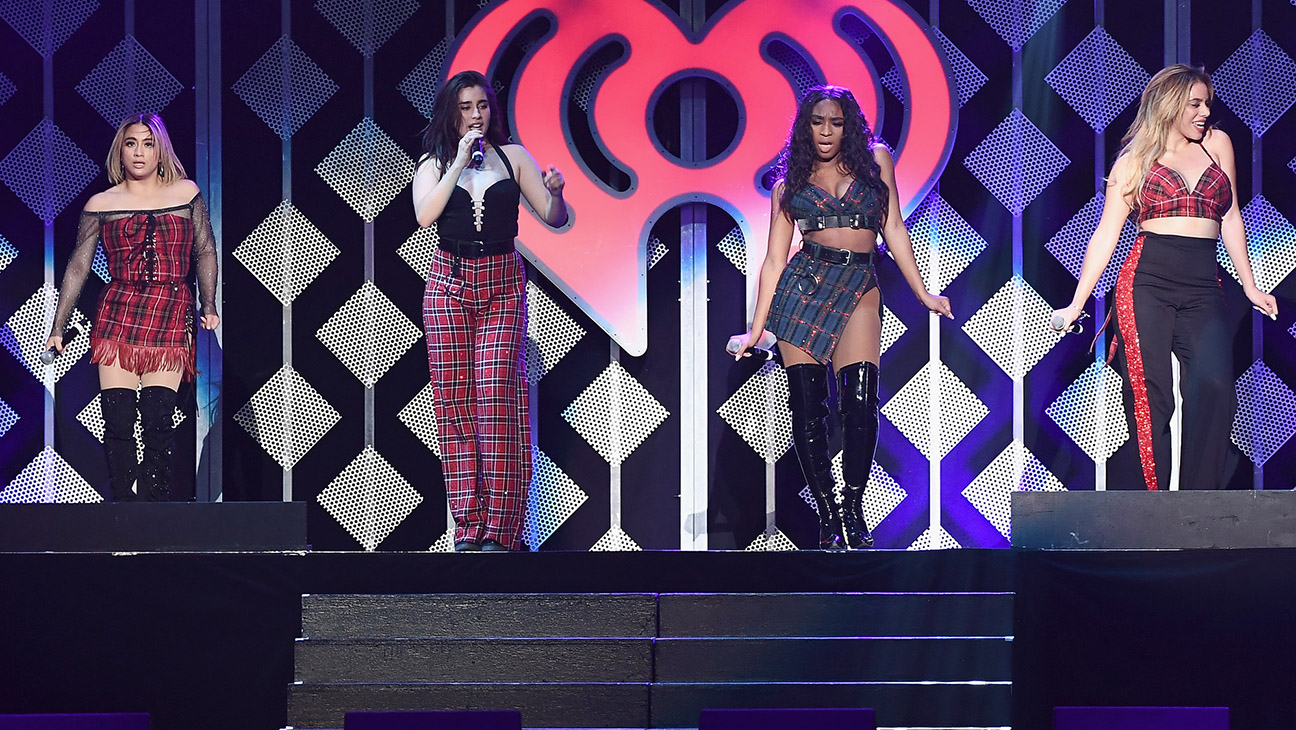

Is A Fifth Harmony Reunion Happening Details On Talks Without Camila

Jun 06, 2025

Is A Fifth Harmony Reunion Happening Details On Talks Without Camila

Jun 06, 2025 -

Steve Guttenbergs New Lifetime Movie Kidnapped By A Killer

Jun 06, 2025

Steve Guttenbergs New Lifetime Movie Kidnapped By A Killer

Jun 06, 2025 -

Peter De Boer Out Dallas Stars Playoff Failure Costs Coach His Job

Jun 06, 2025

Peter De Boer Out Dallas Stars Playoff Failure Costs Coach His Job

Jun 06, 2025 -

Ni Product Launch Creates 15 Hour Overnight Queue For Teens

Jun 06, 2025

Ni Product Launch Creates 15 Hour Overnight Queue For Teens

Jun 06, 2025