Dismal Jobs Report: Private Sector Adds Mere 37,000 Jobs, Signaling Economic Slowdown

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dismal Jobs Report: Private Sector Adds Mere 37,000 Jobs, Signaling Economic Slowdown

The latest jobs report has sent shockwaves through the financial markets, revealing a surprisingly weak performance in private sector hiring. Instead of the robust growth many economists predicted, the private sector added a mere 37,000 jobs in July, a figure significantly below expectations and raising serious concerns about a potential economic slowdown. This underwhelming number follows a similar trend of disappointing job growth in previous months, fueling anxieties about the overall health of the US economy.

A Stunning Underperformance:

Economists had widely anticipated job growth closer to 200,000, making the actual figure of 37,000 a significant miss. This dismal performance is particularly concerning given the relatively low unemployment rate currently hovering around 3.5%. The stark contrast between the low unemployment and weak job creation suggests a potential weakening in the labor market's overall strength. The discrepancy raises questions about the accuracy of existing economic models and highlights the complexity of the current economic situation.

What's Behind the Slowdown?

Several factors may contribute to this sluggish job growth. One prominent theory points to the lingering effects of the Federal Reserve's aggressive interest rate hikes aimed at curbing inflation. These hikes, while designed to cool the economy, have also resulted in higher borrowing costs, potentially stifling business investment and hiring.

Furthermore, uncertainty surrounding the ongoing debt ceiling debate and potential government spending cuts likely played a role. Businesses often hesitate to make significant hiring decisions amidst political and economic uncertainty. This hesitancy translates to fewer job openings and slower overall economic growth.

Industry-Specific Impacts:

The weak job growth wasn't evenly distributed across all sectors. While some industries showed modest gains, others experienced significant declines. [Insert specific industry data if available, citing reputable sources such as the Bureau of Labor Statistics (BLS)]. This uneven performance further underscores the complexity of the current economic landscape and the need for a nuanced understanding of its various components. Analyzing these sectoral trends will be crucial for policymakers and businesses alike in navigating the coming months.

Looking Ahead: A Potential Recession?

The weak jobs report has reignited concerns about a potential recession. While not a definitive indicator of a recession, this figure, coupled with other economic indicators like slowing consumer spending and manufacturing output, strengthens the case for a potential economic downturn. Many economists are now revising their growth forecasts downward, with some predicting a significant slowdown or even a mild recession in the near future.

What to Watch For:

The coming months will be critical in determining the trajectory of the economy. Investors and economists alike will be closely monitoring several key indicators, including:

- Consumer spending: Will consumer confidence remain resilient, or will weakening economic conditions lead to reduced spending?

- Inflation rates: Will the Federal Reserve's efforts to combat inflation bear fruit, or will further interest rate hikes be necessary?

- Business investment: Will businesses regain confidence and increase investment in expansion and hiring?

The extremely weak July jobs report serves as a stark reminder of the challenges facing the US economy. While it's too early to definitively declare a recession, the data paints a concerning picture requiring careful monitoring and proactive policy responses. The situation warrants close observation by policymakers, businesses, and individuals alike, underscoring the importance of staying informed and adapting to the evolving economic climate. Stay tuned for further updates as the situation unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dismal Jobs Report: Private Sector Adds Mere 37,000 Jobs, Signaling Economic Slowdown. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

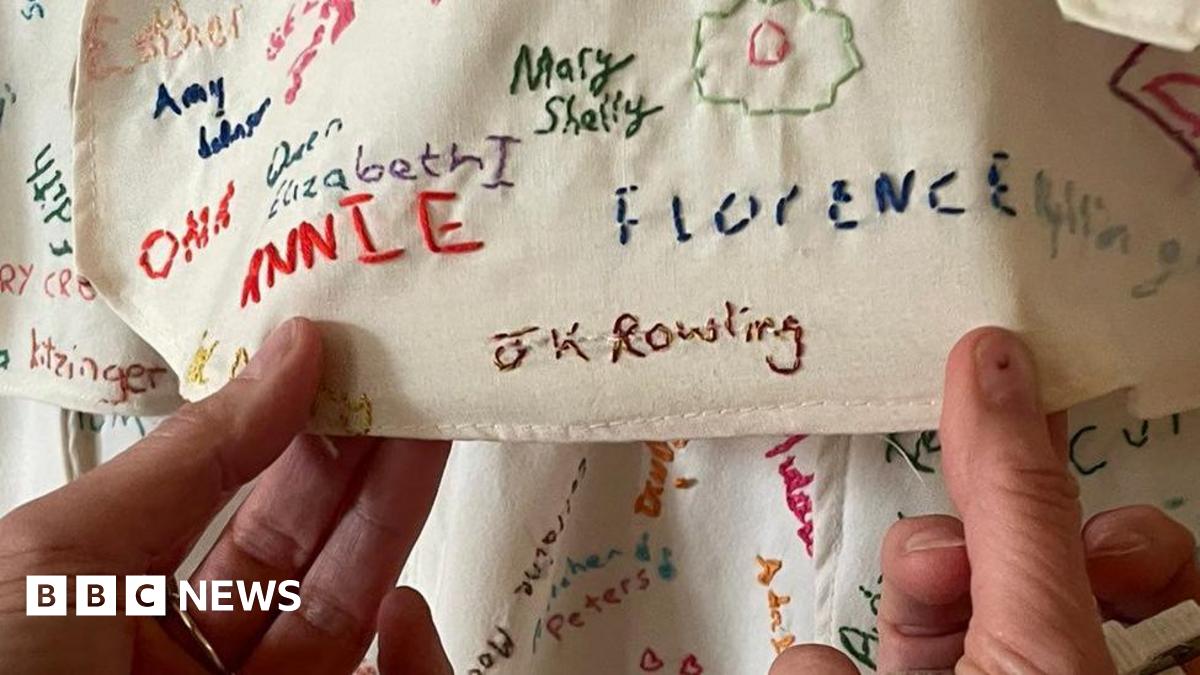

Investigation Launched Into Tampered Artwork At Derbyshire National Trust Property J K Rowling Connection

Jun 06, 2025

Investigation Launched Into Tampered Artwork At Derbyshire National Trust Property J K Rowling Connection

Jun 06, 2025 -

Friday June 6th Maxwell Anderson Faces Trial For Sade Robinsons Death

Jun 06, 2025

Friday June 6th Maxwell Anderson Faces Trial For Sade Robinsons Death

Jun 06, 2025 -

3 000 Car Ship Fire Dramatic Rescue Of 22 Crew Members

Jun 06, 2025

3 000 Car Ship Fire Dramatic Rescue Of 22 Crew Members

Jun 06, 2025 -

Ibm Stock Underperforms Market Analysis And Reasons For Lagging

Jun 06, 2025

Ibm Stock Underperforms Market Analysis And Reasons For Lagging

Jun 06, 2025 -

Former World Darts Champion Rob Cross Banned From Directorships Over Unpaid Taxes

Jun 06, 2025

Former World Darts Champion Rob Cross Banned From Directorships Over Unpaid Taxes

Jun 06, 2025

Latest Posts

-

Steve Guttenbergs Kidnapped By A Killer A Look At The New Movie

Jun 06, 2025

Steve Guttenbergs Kidnapped By A Killer A Look At The New Movie

Jun 06, 2025 -

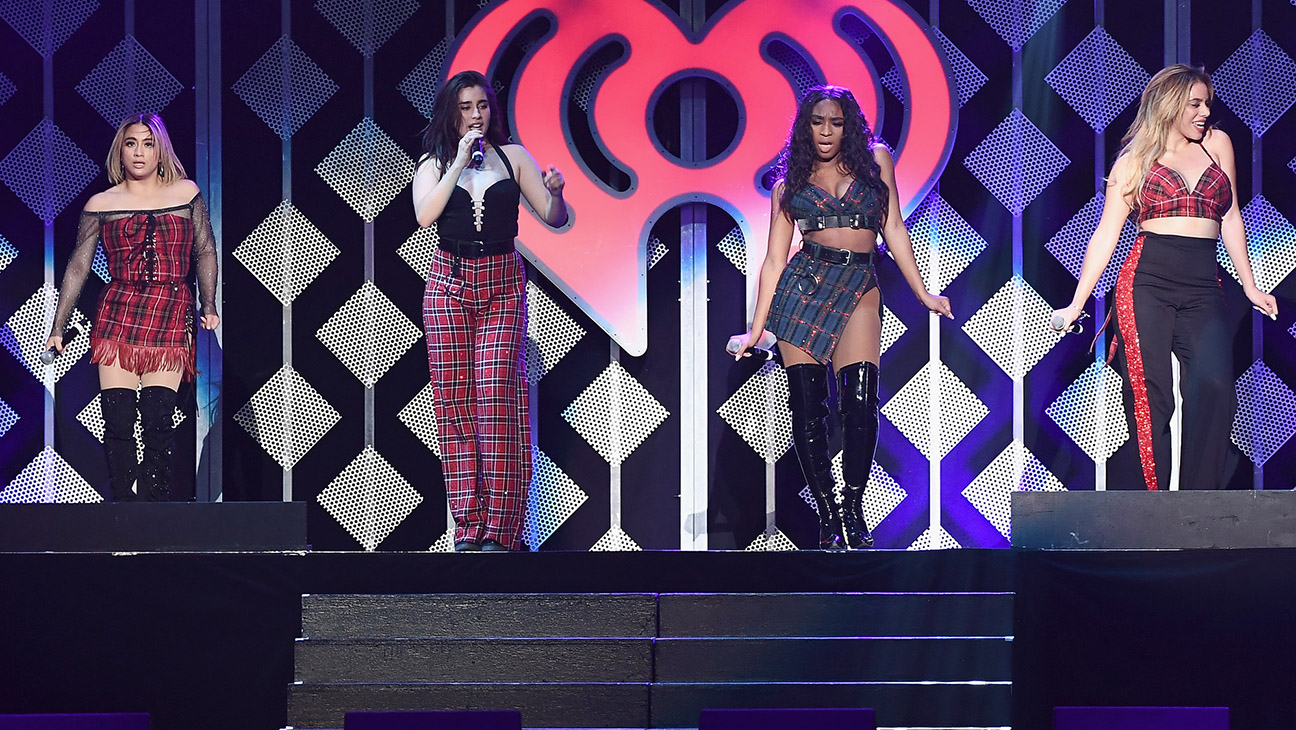

Is A Fifth Harmony Reunion Happening Details On Talks Without Camila

Jun 06, 2025

Is A Fifth Harmony Reunion Happening Details On Talks Without Camila

Jun 06, 2025 -

Steve Guttenbergs New Lifetime Movie Kidnapped By A Killer

Jun 06, 2025

Steve Guttenbergs New Lifetime Movie Kidnapped By A Killer

Jun 06, 2025 -

Peter De Boer Out Dallas Stars Playoff Failure Costs Coach His Job

Jun 06, 2025

Peter De Boer Out Dallas Stars Playoff Failure Costs Coach His Job

Jun 06, 2025 -

Ni Product Launch Creates 15 Hour Overnight Queue For Teens

Jun 06, 2025

Ni Product Launch Creates 15 Hour Overnight Queue For Teens

Jun 06, 2025