Dogecoin's Volatility: Understanding The Factors Behind Price Fluctuations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dogecoin's Volatility: Understanding the Factors Behind Price Fluctuations

Dogecoin (DOGE), the meme-inspired cryptocurrency, has captivated the world with its dramatic price swings. While its playful origins might suggest otherwise, understanding the factors driving Dogecoin's volatility is crucial for anyone considering investing in this digital asset. From Elon Musk's tweets to broader market trends, let's delve into the forces shaping DOGE's unpredictable price action.

The Meme Factor: Social Media's Powerful Influence

Dogecoin's initial success stemmed largely from its meme-based appeal and strong online community. Unlike established cryptocurrencies with clearly defined use cases, DOGE's value is heavily influenced by sentiment and social media trends. A single tweet from a high-profile figure like Elon Musk can send its price soaring or plummeting, highlighting the significant role of social media hype in driving volatility. This reliance on social sentiment makes Dogecoin highly susceptible to market manipulation and FOMO (fear of missing out), leading to unpredictable price fluctuations.

Market Speculation and Pump-and-Dump Schemes:

Dogecoin's low market capitalization relative to other cryptocurrencies makes it particularly vulnerable to pump-and-dump schemes. These coordinated efforts to artificially inflate the price before quickly selling off, causing a sharp drop, are unfortunately common in the volatile cryptocurrency market. Retail investors, often drawn in by the hype, can suffer significant losses if caught in such schemes. Understanding these risks is vital before investing in Dogecoin.

Correlation with Bitcoin and the Broader Cryptocurrency Market:

While Dogecoin operates independently, its price is often correlated with Bitcoin (BTC) and the overall cryptocurrency market. When Bitcoin experiences a significant price increase or decrease, Dogecoin frequently follows suit, albeit often with amplified volatility. This interconnectedness exposes DOGE to the broader risks associated with the crypto market, including regulatory uncertainty, macroeconomic factors, and technological developments.

Lack of Fundamental Value and Practical Use Cases:

Unlike some cryptocurrencies designed for specific purposes (like Ethereum's smart contracts), Dogecoin lacks robust fundamental value or widespread practical applications. This absence of inherent utility contributes to its volatile nature. Its price is less anchored to tangible use cases and more driven by speculation and sentiment.

Regulatory Uncertainty and Governmental Actions:

The regulatory landscape surrounding cryptocurrencies remains uncertain globally. Changes in government policies and regulations can have a significant impact on the entire crypto market, including Dogecoin. Announcements regarding cryptocurrency taxation or bans can trigger significant price swings, underscoring the importance of staying informed about regulatory developments.

How to Navigate Dogecoin's Volatility:

Investing in Dogecoin requires a high-risk tolerance. If you're considering investing, remember these key points:

- Diversify your portfolio: Never invest more than you can afford to lose, and always diversify your investments across multiple assets.

- Conduct thorough research: Understand the risks involved before investing in any cryptocurrency.

- Stay informed: Keep up-to-date with news and developments in the crypto market and pay close attention to social media sentiment.

- Avoid FOMO: Don't chase short-term price gains driven by hype.

Conclusion:

Dogecoin's volatility is a complex interplay of social media influence, market speculation, and broader market forces. While its whimsical origins and community appeal have propelled its popularity, understanding these factors is crucial for navigating the risks and rewards associated with this unique cryptocurrency. Remember to always conduct thorough research and proceed with caution. Investing in cryptocurrencies carries significant risks, and you could lose your entire investment. This article is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dogecoin's Volatility: Understanding The Factors Behind Price Fluctuations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dogecoin Price Prediction Whale Moves Fuel Breakout Hopes

Jul 08, 2025

Dogecoin Price Prediction Whale Moves Fuel Breakout Hopes

Jul 08, 2025 -

How To Get The New Spirit Empress Legendary Card In Clash Royale For Free

Jul 08, 2025

How To Get The New Spirit Empress Legendary Card In Clash Royale For Free

Jul 08, 2025 -

From Despair To Survival The Texas Flood Victims Fight For Life

Jul 08, 2025

From Despair To Survival The Texas Flood Victims Fight For Life

Jul 08, 2025 -

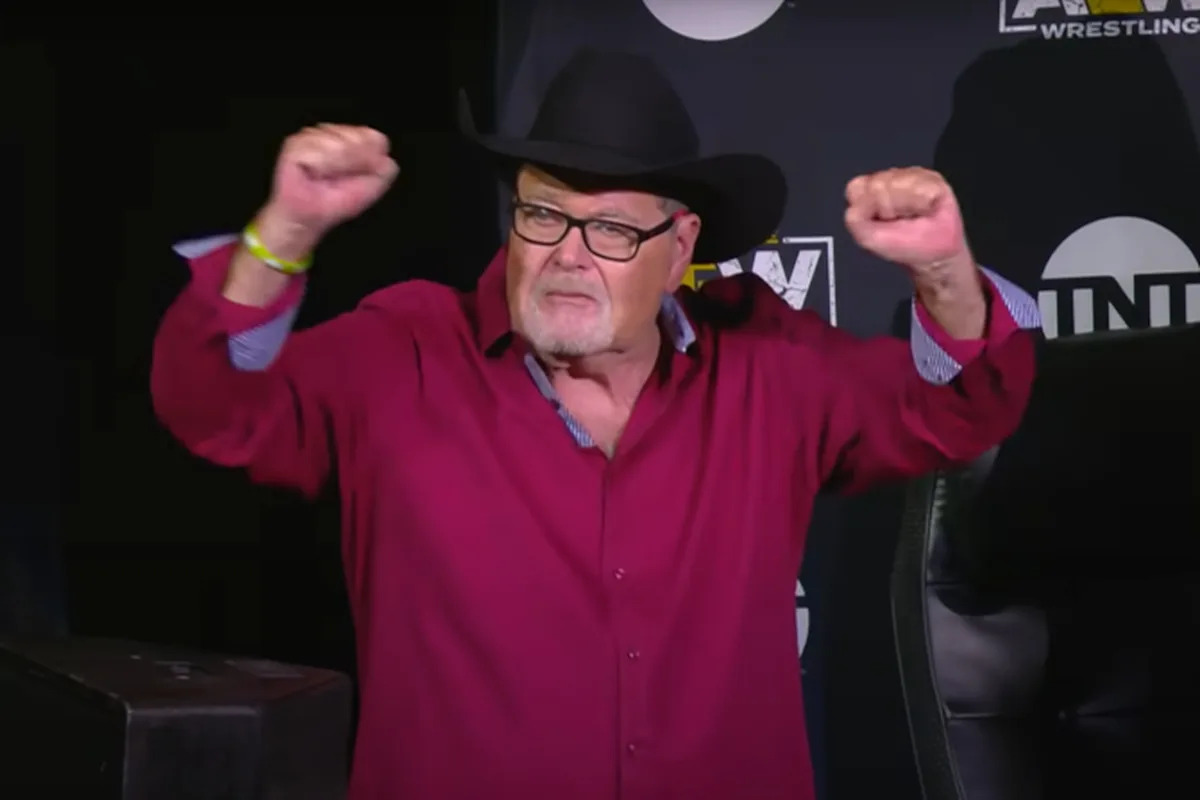

Cancer Free Jim Ross Confirmed For All In Wrestling Event In Texas

Jul 08, 2025

Cancer Free Jim Ross Confirmed For All In Wrestling Event In Texas

Jul 08, 2025 -

The Power Of Shared Emotion Examining The Headlines You Ll Never Walk Alone And Swept Away

Jul 08, 2025

The Power Of Shared Emotion Examining The Headlines You Ll Never Walk Alone And Swept Away

Jul 08, 2025

Latest Posts

-

Guest Leaves Baby Shower After Infertility Joke A Story Of Hurt Feelings

Jul 08, 2025

Guest Leaves Baby Shower After Infertility Joke A Story Of Hurt Feelings

Jul 08, 2025 -

Cnn Mounted Volunteers Aid In Locating Missing Individuals

Jul 08, 2025

Cnn Mounted Volunteers Aid In Locating Missing Individuals

Jul 08, 2025 -

Archita Phukans Shocking Confession R25 Lakh Paid To Leave Prostitution

Jul 08, 2025

Archita Phukans Shocking Confession R25 Lakh Paid To Leave Prostitution

Jul 08, 2025 -

Fergie Snubs King Charles Offer Protecting Andrews Feelings

Jul 08, 2025

Fergie Snubs King Charles Offer Protecting Andrews Feelings

Jul 08, 2025 -

Thousands Of Flights Disrupted In The Us Holiday Weekend Travel Aftermath

Jul 08, 2025

Thousands Of Flights Disrupted In The Us Holiday Weekend Travel Aftermath

Jul 08, 2025