Double-Digit Increase: State Farm's California Car Insurance Rates Soar

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Double-Digit Increase: State Farm's California Car Insurance Rates Soar

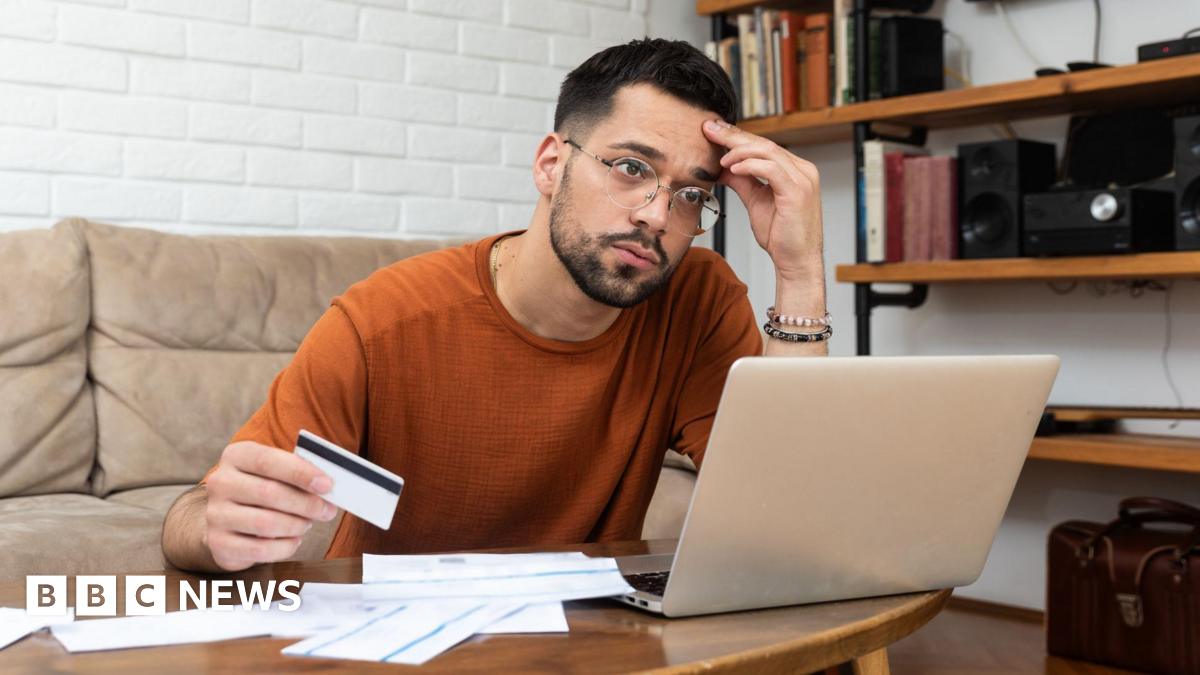

California drivers face a significant blow as State Farm, one of the nation's largest insurers, announces a double-digit hike in car insurance premiums. The increase, impacting thousands of policyholders across the Golden State, has sparked outrage and renewed concerns about the affordability of auto insurance in California. This substantial rate jump raises questions about the future of insurance accessibility for many residents.

State Farm hasn't explicitly stated the exact percentage increase, citing various contributing factors. However, reports from affected policyholders indicate hikes ranging from 10% to upwards of 20%, depending on location and individual policy details. This dramatic surge comes at a time when Californians are already grappling with rising living costs, including soaring gas prices and inflation.

Why the Steep Increase?

State Farm attributes the substantial premium increases to several interconnected factors:

- Increased Claims Costs: The insurer cites a rise in the cost of vehicle repairs, particularly for newer vehicles with advanced safety features and expensive parts. The complexity of modern car technology means more extensive and costly repairs following even minor accidents.

- Higher Legal and Medical Expenses: Legal fees associated with car accident claims and the escalating costs of medical care following accidents are also contributing to the increase. California's tort system, allowing for significant payouts in injury claims, plays a significant role.

- Inflationary Pressures: Like many industries, the insurance sector is battling inflation. Rising operational costs, including administrative expenses and employee salaries, further contribute to higher premiums.

- Catastrophic Events: California's susceptibility to wildfires and earthquakes also plays a part. The potential for large-scale payouts from catastrophic events necessitates higher premiums to maintain financial stability.

What Can California Drivers Do?

Facing a sudden jump in insurance premiums can be daunting. Here are some steps California drivers can take:

- Shop Around: Don't automatically accept the increased rate. Contact other insurers to compare quotes and find more competitive options. Utilizing online comparison tools can streamline this process. [Link to reputable insurance comparison website]

- Review Your Coverage: Carefully examine your current policy. Are you carrying unnecessary coverage? Could you increase your deductible to lower your premium? Small adjustments can sometimes make a big difference.

- Improve Your Driving Record: Maintaining a clean driving record is crucial for securing lower insurance rates. Avoid traffic violations and accidents to demonstrate responsible driving habits.

- Consider Bundling: Bundling your car insurance with homeowners or renters insurance can sometimes lead to discounts. Check with your insurer to see if this option is available and beneficial.

The Broader Implications

This significant rate hike by State Farm highlights a larger issue: the increasing unaffordability of car insurance in California. This situation disproportionately affects lower-income individuals and families, potentially forcing some to forgo necessary insurance coverage, which carries its own risks. The impact on California's already strained transportation system and its economic landscape warrants further investigation and potential legislative action.

This situation underscores the need for transparency and accountability within the insurance industry and calls for ongoing dialogue between insurers, regulators, and consumers to find sustainable solutions that ensure affordable and accessible car insurance for all Californians. Stay tuned for further updates as this story develops.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Double-Digit Increase: State Farm's California Car Insurance Rates Soar. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Co Operative Banks Cyber Security Failure How A Major Attack Was Prevented

May 17, 2025

Co Operative Banks Cyber Security Failure How A Major Attack Was Prevented

May 17, 2025 -

Walk Off Woes Kenley Jansens Recent Struggles

May 17, 2025

Walk Off Woes Kenley Jansens Recent Struggles

May 17, 2025 -

Cold Shooting Dooms Dallas 5 Crucial Moments From Stars Jets Game 5

May 17, 2025

Cold Shooting Dooms Dallas 5 Crucial Moments From Stars Jets Game 5

May 17, 2025 -

Financial Instability In The Uk One In Ten Lack Any Savings

May 17, 2025

Financial Instability In The Uk One In Ten Lack Any Savings

May 17, 2025 -

Angels Despair Kenley Jansens Underperformance And Injury Woes Lead To Last Place

May 17, 2025

Angels Despair Kenley Jansens Underperformance And Injury Woes Lead To Last Place

May 17, 2025

Latest Posts

-

Mlb 2024 Ten Troubling Numbers From The Seasons Start

May 18, 2025

Mlb 2024 Ten Troubling Numbers From The Seasons Start

May 18, 2025 -

Dodgers Make Roster Changes Pepiot Called Up Bruihl Optioned

May 18, 2025

Dodgers Make Roster Changes Pepiot Called Up Bruihl Optioned

May 18, 2025 -

Early Mlb Season Warning Signs 10 Stats That Should Worry Fans

May 18, 2025

Early Mlb Season Warning Signs 10 Stats That Should Worry Fans

May 18, 2025 -

The Scheme Behind Benicio Del Toros Fortune A Closer Look

May 18, 2025

The Scheme Behind Benicio Del Toros Fortune A Closer Look

May 18, 2025 -

State Farm Wins Approval For Significant Rate Hike In California

May 18, 2025

State Farm Wins Approval For Significant Rate Hike In California

May 18, 2025