Double-Digit Increase: State Farm's California Home Insurance Rates Approved

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Double-Digit Increase: State Farm's California Home Insurance Rates Approved

California homeowners face a significant blow as State Farm secures approval for double-digit home insurance rate hikes. The decision, impacting hundreds of thousands of policyholders, has sparked outrage and renewed calls for insurance reform in the Golden State. This substantial increase underscores the growing crisis in California's home insurance market, driven by factors like wildfires, extreme weather events, and rising construction costs.

The California Department of Insurance (CDI) recently approved State Farm's request to raise its home insurance premiums by an average of 10-12 percent. While the exact percentage varies by location and specific policy details, this represents a substantial increase for many Californians already struggling with the high cost of living. This isn't an isolated incident; other major insurers have also sought and received significant rate increases recently.

Why the Steep Increase?

Several factors contribute to the dramatic surge in home insurance premiums:

-

Wildfire Risk: California's increasingly frequent and devastating wildfires pose a massive financial risk to insurance companies. The cost of rebuilding homes after wildfires, coupled with the increasing frequency of these catastrophic events, necessitates higher premiums to cover potential payouts. Areas deemed high-risk are experiencing the most substantial increases.

-

Climate Change Impacts: The effects of climate change, including more intense heatwaves, droughts, and severe storms, are significantly increasing the likelihood and severity of insured losses. This increased risk translates directly into higher premiums for all policyholders.

-

Construction Costs: The cost of building materials and labor has skyrocketed in recent years, meaning the cost of rebuilding a damaged home is considerably higher than it was previously. This increased rebuilding cost significantly impacts insurance payouts and, consequently, premiums.

-

Litigation Costs: The high cost of litigation in California also contributes to rising insurance premiums. Insurers must factor in the potential for expensive legal battles into their pricing models.

What This Means for California Homeowners

This double-digit increase will directly impact the budgets of countless Californians. Many homeowners may find themselves struggling to afford their insurance premiums, potentially leading to policy cancellations and leaving them uninsured. This situation highlights the urgent need for comprehensive solutions to address the California insurance crisis.

Potential Solutions and Future Outlook

The California legislature is actively exploring various solutions to address the escalating insurance costs, including:

- Increased wildfire prevention measures: Investing heavily in forest management and community wildfire protection plans is crucial to mitigating future losses.

- Incentivizing insurers to remain in the market: Policies aimed at supporting insurers and encouraging competition could help stabilize the market.

- Expanding access to affordable insurance: Programs designed to provide affordable insurance options to low- and moderate-income homeowners are vital.

The future of California's home insurance market remains uncertain. While State Farm's rate increase is a significant development, it reflects a broader trend across the industry. The CDI and state lawmakers must work collaboratively to find sustainable solutions that protect both consumers and insurers.

Call to Action: Stay informed about legislative developments related to California home insurance and contact your state representatives to express your concerns. Understanding your insurance policy and exploring options for reducing your risk are crucial steps in navigating this challenging environment. Consider consulting with an independent insurance agent to compare rates and find the best coverage for your needs.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Double-Digit Increase: State Farm's California Home Insurance Rates Approved. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Wisconsin Judge Fights Back Against Immigration Charges A Case Of Obstruction

May 17, 2025

Wisconsin Judge Fights Back Against Immigration Charges A Case Of Obstruction

May 17, 2025 -

Wes Anderson On His New Project Cannes Festivities And The Value Of A Second Viewing

May 17, 2025

Wes Anderson On His New Project Cannes Festivities And The Value Of A Second Viewing

May 17, 2025 -

Ohtanis Two Home Runs Highlight Bobblehead Night Rout

May 17, 2025

Ohtanis Two Home Runs Highlight Bobblehead Night Rout

May 17, 2025 -

Dodgers Recall Pitcher From Triple A Roster Move Announced

May 17, 2025

Dodgers Recall Pitcher From Triple A Roster Move Announced

May 17, 2025 -

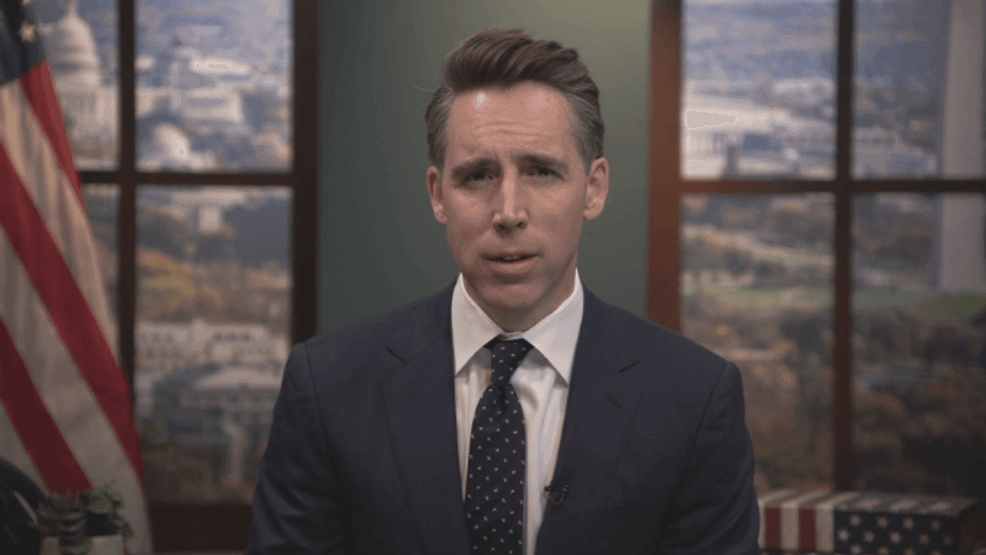

Senate Hearing Investigates State Farm Allstate Hawley Leads The Charge

May 17, 2025

Senate Hearing Investigates State Farm Allstate Hawley Leads The Charge

May 17, 2025

Latest Posts

-

Ukraine Peace Talks Us Urges Trump And Putins Participation For Resolution

May 18, 2025

Ukraine Peace Talks Us Urges Trump And Putins Participation For Resolution

May 18, 2025 -

Dodgers Kenley Jansen A Costly Walk Off Home Run In Recent Game

May 18, 2025

Dodgers Kenley Jansen A Costly Walk Off Home Run In Recent Game

May 18, 2025 -

Friendship Soars Detroit Celebrates Local Success Specialty Film Preview Announced

May 18, 2025

Friendship Soars Detroit Celebrates Local Success Specialty Film Preview Announced

May 18, 2025 -

Kenley Jansen Gives Up Walk Off Home Run Impact On Dodgers Playoff Hopes

May 18, 2025

Kenley Jansen Gives Up Walk Off Home Run Impact On Dodgers Playoff Hopes

May 18, 2025 -

Wes Andersons The Phoenician Scheme Cannes Repeat Viewings And Directorial Genius

May 18, 2025

Wes Andersons The Phoenician Scheme Cannes Repeat Viewings And Directorial Genius

May 18, 2025