E-commerce Giant PDD Holdings To Report Q1 2025 Earnings: What To Expect

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

E-commerce Giant PDD Holdings to Report Q1 2025 Earnings: What to Expect

PDD Holdings, the Chinese e-commerce behemoth behind the popular Pinduoduo platform, is set to release its first-quarter 2025 earnings report soon. This announcement is highly anticipated by investors and industry analysts alike, given PDD Holdings' significant impact on the global e-commerce landscape and its recent strategic maneuvers. What can we expect from this crucial report? Let's delve into the key factors likely to shape the narrative.

Key Areas of Focus for PDD Holdings' Q1 2025 Earnings:

-

Revenue Growth: Analysts will be keenly observing PDD Holdings' revenue growth trajectory. While the company has demonstrated impressive growth in previous quarters, factors such as macroeconomic conditions in China and evolving consumer spending habits will play a crucial role in determining the Q1 performance. Any significant deviation from predicted growth figures will likely trigger market reactions. Will PDD Holdings maintain its upward trend or experience a slowdown? This is a primary question investors will be seeking to answer.

-

User Acquisition and Engagement: PDD Holdings' success hinges on its ability to attract and retain users. The report will likely provide insights into user growth, active buyer numbers, and average order values. Strategies employed to enhance user engagement, such as improvements to the platform's user interface, personalized recommendations, and expanded product offerings, will be under scrutiny.

-

Temu's Performance: The explosive growth of Temu, PDD Holdings' fast-fashion e-commerce platform targeting international markets (particularly the US), will be a major talking point. The report should provide data on Temu's revenue contribution and user acquisition, offering a glimpse into its long-term potential and competitive positioning against established players like Amazon and Shein. [Link to relevant Temu news article or analysis].

-

Profitability and Margins: While rapid expansion often comes at the cost of profitability, investors will be looking for signs of improved margins and a path towards sustained profitability. PDD Holdings' ability to optimize its operational efficiency and manage costs will be a key indicator of its long-term financial health. This includes examination of logistics costs, marketing expenses, and overall operational expenditure.

What Could Impact PDD Holdings' Q1 2025 Earnings?

Several external factors could influence PDD Holdings' Q1 2025 results:

-

China's Economic Recovery: The pace of China's economic recovery will undoubtedly impact consumer spending and, consequently, PDD Holdings' performance. Any unforeseen economic slowdown could negatively affect revenue growth.

-

Competition: Intense competition within the Chinese e-commerce market, as well as from global players expanding into the region, will continue to put pressure on PDD Holdings' market share.

-

Geopolitical Factors: Geopolitical tensions and international trade policies could also impact PDD Holdings' operations, particularly its international expansion efforts through Temu.

Analyzing the Earnings Report: What to Look For:

Beyond the raw numbers, analysts will be scrutinizing the management's commentary on future guidance, strategic initiatives, and the overall outlook for the remainder of 2025. Pay close attention to any discussions regarding:

- New strategic partnerships or acquisitions.

- Plans for further international expansion.

- Investment in technology and innovation.

- Sustainability initiatives.

Conclusion:

The upcoming Q1 2025 earnings report from PDD Holdings will be a crucial event for investors and the wider e-commerce industry. By carefully analyzing the key performance indicators and considering the broader economic and geopolitical context, we can gain a clearer understanding of PDD Holdings' current standing and future prospects. Stay tuned for further updates as the report is released and analyzed by market experts. [Link to a reputable financial news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on E-commerce Giant PDD Holdings To Report Q1 2025 Earnings: What To Expect. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Daring Style Alexandra Daddarios Revealing Dior Cruise Outfit

May 28, 2025

Daring Style Alexandra Daddarios Revealing Dior Cruise Outfit

May 28, 2025 -

Latest Nba Trade Buzz Dallas Targets Holiday And Ball Bucks Keep Antetokounmpo Nets Draft Strategy

May 28, 2025

Latest Nba Trade Buzz Dallas Targets Holiday And Ball Bucks Keep Antetokounmpo Nets Draft Strategy

May 28, 2025 -

Jerusalem Tensions Rise As Ultra Nationalist March Provokes Outrage

May 28, 2025

Jerusalem Tensions Rise As Ultra Nationalist March Provokes Outrage

May 28, 2025 -

Health Update Bruneis Sultan Undergoes Treatment In Kl Hospital For Fatigue

May 28, 2025

Health Update Bruneis Sultan Undergoes Treatment In Kl Hospital For Fatigue

May 28, 2025 -

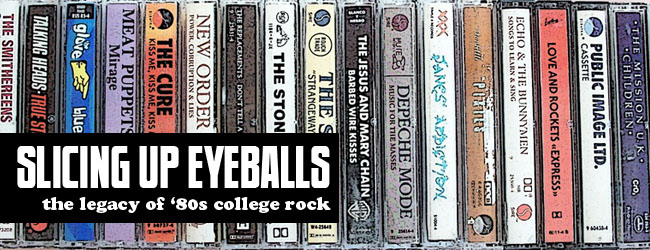

Sirius Xms Dark Wave Playlist Slicing Up Eyeballs May 25th Show

May 28, 2025

Sirius Xms Dark Wave Playlist Slicing Up Eyeballs May 25th Show

May 28, 2025

Latest Posts

-

Predicting The 2025 Memorial Tournament Odds Dark Horse Candidates And Key Players

May 29, 2025

Predicting The 2025 Memorial Tournament Odds Dark Horse Candidates And Key Players

May 29, 2025 -

Nih Director Faces Staff Backlash Town Hall Walkout Underscores Funding Crisis

May 29, 2025

Nih Director Faces Staff Backlash Town Hall Walkout Underscores Funding Crisis

May 29, 2025 -

Alexandra Daddarios Revealing Dior Cruise Look

May 29, 2025

Alexandra Daddarios Revealing Dior Cruise Look

May 29, 2025 -

Milwaukee Bucks Risky Move Banking On Doc Rivers To Retain Giannis Antetokounmpo

May 29, 2025

Milwaukee Bucks Risky Move Banking On Doc Rivers To Retain Giannis Antetokounmpo

May 29, 2025 -

Liverpool Fc Parade Uncovering The Truth Behind The Reported Incidents

May 29, 2025

Liverpool Fc Parade Uncovering The Truth Behind The Reported Incidents

May 29, 2025