Economic Concerns Rise As Private Sector Job Growth Stalls In May

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Concerns Rise as Private Sector Job Growth Stalls in May

Sluggish job growth sparks fears of a potential recession as the US economy shows signs of slowing.

The US economy delivered a concerning signal in May, with private sector job growth essentially stalling, raising significant economic concerns and fueling anxieties about a potential recession. The latest employment report, released by payroll processing firm ADP, revealed a meager gain of only 27,000 jobs, a dramatic slowdown from the revised 149,000 jobs added in April and far below analysts' expectations of around 170,000. This unexpected deceleration has sent ripples through financial markets and prompted renewed scrutiny of the overall health of the American economy.

What does this mean for the average American?

The slowdown in private sector job growth has immediate implications for the average American. Slower job creation translates to less competition for workers, potentially impacting wage growth. This is particularly troubling given the persistent inflation that continues to erode purchasing power. Moreover, a stagnant job market can lead to decreased consumer confidence, further hindering economic growth. For those seeking employment, the weaker-than-expected numbers paint a picture of a more challenging job hunt.

Deeper Dive into the Data: Sectors Showing Weakness

The report revealed significant discrepancies across different sectors. While some industries showed moderate growth, others experienced significant declines. The leisure and hospitality sector, a key driver of job creation in previous months, saw a notable contraction. This suggests that the post-pandemic economic boom might be fading, and consumers are potentially cutting back on discretionary spending.

- Manufacturing: Experienced a slight increase in employment, suggesting continued resilience in this sector despite global economic uncertainty.

- Trade, Transportation, and Utilities: Showed mixed results, with some sub-sectors performing better than others, indicating a complex picture within this broad category.

- Construction: Also experienced sluggish growth, mirroring broader trends in the slowing housing market.

The ADP report's findings don't provide a complete picture of the overall employment situation. The official government jobs report, released by the Bureau of Labor Statistics (BLS), offers a more comprehensive overview, including government jobs and a more refined methodology. However, the ADP report serves as a significant early indicator of potential trends in the broader labor market.

Experts React: Concerns and Predictions

Economists are divided on the implications of the May data. Some attribute the slowdown to temporary factors, such as seasonal adjustments and lingering effects of the banking sector turmoil. Others express more serious concerns, suggesting that it signals a broader economic slowdown that could lead to a recession.

"The weak ADP report underscores the challenges facing the US economy," said [Name of Economist and Title], chief economist at [Institution]. "The combination of high inflation and rising interest rates is putting significant pressure on businesses, leading to reduced hiring."

Looking Ahead: What to Expect

The coming weeks will be crucial in assessing the true impact of this slowdown. The upcoming BLS jobs report will provide a more complete picture, and analysts will be closely watching for any further signs of weakening in the economy. The Federal Reserve's upcoming monetary policy decisions will also play a pivotal role in shaping the economic outlook. Increased interest rates could further dampen economic activity, while a pause or reduction in rates could stimulate growth but also risk exacerbating inflation.

The current economic climate demands careful monitoring and informed decision-making. Stay informed by regularly checking reputable sources for the latest economic news and updates. Understanding these trends can help individuals and businesses make informed choices to navigate the complexities of the current economic landscape.

Keywords: Economic slowdown, job growth, private sector jobs, recession, ADP report, employment report, BLS, US economy, inflation, interest rates, Federal Reserve, economic concerns, labor market, recession risk.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Concerns Rise As Private Sector Job Growth Stalls In May. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Lilibet Mountbatten Windsor Turns Four See The Heartwarming Photos Shared By Meghan

Jun 06, 2025

Lilibet Mountbatten Windsor Turns Four See The Heartwarming Photos Shared By Meghan

Jun 06, 2025 -

3 000 Car Fire 22 Crew Members Rescued From Lifeboat In North Pacific

Jun 06, 2025

3 000 Car Fire 22 Crew Members Rescued From Lifeboat In North Pacific

Jun 06, 2025 -

Roland Garros Decoding The Difficulty Of Clay Courts

Jun 06, 2025

Roland Garros Decoding The Difficulty Of Clay Courts

Jun 06, 2025 -

Maxwell Andersons Trial For The Murder Of Sade Robinson What To Expect

Jun 06, 2025

Maxwell Andersons Trial For The Murder Of Sade Robinson What To Expect

Jun 06, 2025 -

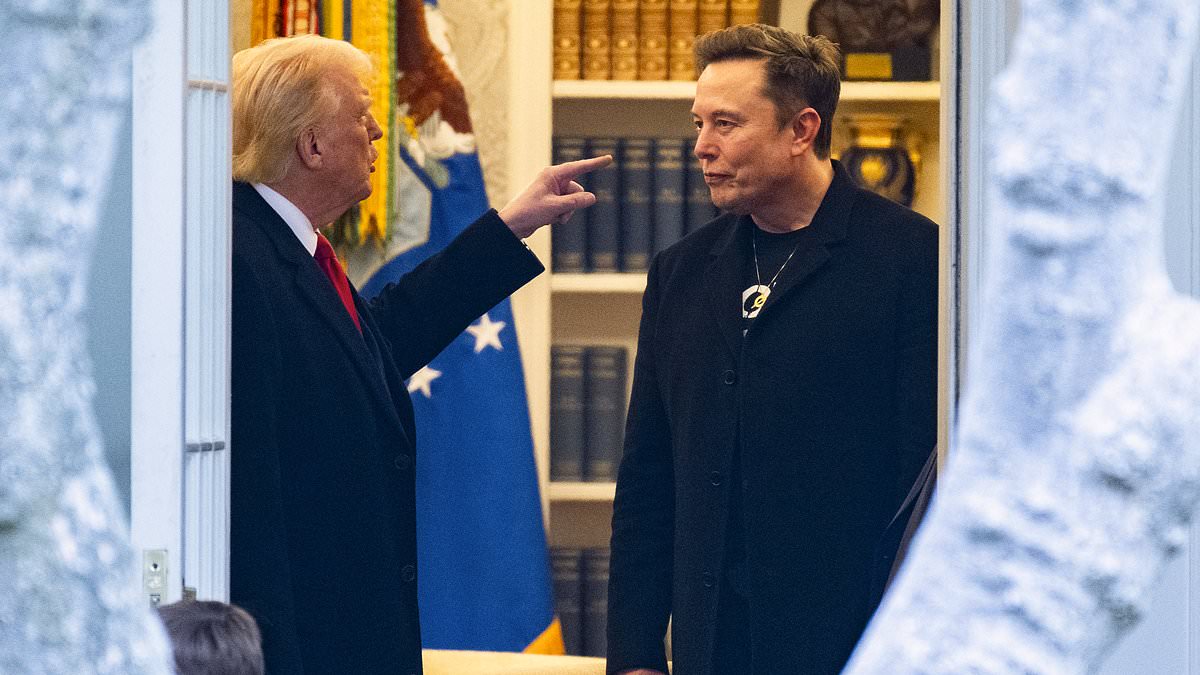

Influential Advisor The Catalyst For Trumps Split With Elon Musk

Jun 06, 2025

Influential Advisor The Catalyst For Trumps Split With Elon Musk

Jun 06, 2025

Latest Posts

-

The Impact Of First Bacteria On Infant Health And Hospital Stays

Jun 07, 2025

The Impact Of First Bacteria On Infant Health And Hospital Stays

Jun 07, 2025 -

Pete De Boer Fired Dallas Stars Coaching Change After Conference Finals

Jun 07, 2025

Pete De Boer Fired Dallas Stars Coaching Change After Conference Finals

Jun 07, 2025 -

Scholz Trump Summit What To Expect From Germanys New Leaders Us Visit

Jun 07, 2025

Scholz Trump Summit What To Expect From Germanys New Leaders Us Visit

Jun 07, 2025 -

Labour Party Chair Condemns Mps Call For Burka Ban As Dumb

Jun 07, 2025

Labour Party Chair Condemns Mps Call For Burka Ban As Dumb

Jun 07, 2025 -

No Feud Walton Goggins And Aimee Lou Wood Discuss White Lotus Deleted Scenes And Instagram

Jun 07, 2025

No Feud Walton Goggins And Aimee Lou Wood Discuss White Lotus Deleted Scenes And Instagram

Jun 07, 2025