Economic Deterioration: Jamie Dimon's Gloomy Forecast For The Future

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Deterioration: Jamie Dimon's Gloomy Forecast for the Future

JPMorgan Chase CEO Jamie Dimon's recent warnings paint a stark picture of the potential economic downturn ahead. His comments, delivered during the bank's second-quarter earnings call, have sent shockwaves through financial markets, sparking anxieties about inflation, recession, and the overall global economic outlook. Dimon's reputation as a seasoned and often prescient observer of the economic landscape makes his pessimistic forecast particularly noteworthy. This article delves into the specifics of his concerns and analyzes their potential implications.

Dimon's Key Concerns: A Perfect Storm Brewing?

Dimon outlined several key factors contributing to his gloomy outlook. He highlighted the persistent effects of high inflation, citing the ongoing war in Ukraine, persistent supply chain disruptions, and the lingering impact of the COVID-19 pandemic as major contributors. These issues, he argued, are creating a perfect storm that could easily tip the global economy into a recession.

-

Inflationary Pressures: Dimon emphasized that current inflation levels are far from under control. The Federal Reserve's aggressive interest rate hikes, while intended to curb inflation, carry the risk of inadvertently triggering a significant economic slowdown. He warned that the market's current expectations of a "soft landing" might be overly optimistic.

-

Geopolitical Instability: The ongoing war in Ukraine continues to significantly impact global energy markets and supply chains, further fueling inflationary pressures. Dimon stressed the unpredictability of geopolitical events and their potential to exacerbate existing economic fragilities. This uncertainty, he argued, makes accurate economic forecasting extremely challenging.

-

Consumer Spending Slowdown: While consumer spending has remained relatively resilient thus far, Dimon warned of a potential slowdown in the coming months. Rising interest rates, high inflation, and decreasing consumer confidence could all contribute to a significant decline in consumer spending, a key driver of economic growth.

What Does This Mean for Investors and Consumers?

Dimon's forecast naturally raises concerns for both investors and consumers. For investors, this means a potential period of market volatility and uncertainty. The possibility of a recession could lead to decreased corporate earnings and lower stock prices. Diversification and a long-term investment strategy are crucial during such periods. .

For consumers, the forecast suggests the need for careful financial planning. Rising interest rates will likely increase borrowing costs, impacting everything from mortgages and auto loans to credit card debt. Consumers may need to adjust their spending habits and prioritize essential expenses. .

Looking Ahead: Navigating the Uncertain Future

While Dimon's forecast is undeniably pessimistic, it's not entirely without hope. The resilience of the US consumer and the strength of the US labor market could help mitigate the impact of an economic downturn. However, navigating this uncertain economic landscape requires careful planning and proactive adjustments. Businesses need to adapt to changing consumer behavior, while consumers need to be mindful of their spending habits and financial preparedness.

Dimon's warnings serve as a critical reminder of the fragility of the global economy and the importance of remaining vigilant in the face of significant economic challenges. While the future remains uncertain, proactive planning and informed decision-making are crucial for navigating the potentially turbulent waters ahead. Staying informed about economic developments and seeking professional financial advice are key steps in mitigating potential risks.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Deterioration: Jamie Dimon's Gloomy Forecast For The Future. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Selena Gomezs Casual Style Oversized Shirt And Heartfelt Note For Benny Blanco

Jun 13, 2025

Selena Gomezs Casual Style Oversized Shirt And Heartfelt Note For Benny Blanco

Jun 13, 2025 -

Konami Officially Announces Silent Hill Remake A Return To Psychological Horror

Jun 13, 2025

Konami Officially Announces Silent Hill Remake A Return To Psychological Horror

Jun 13, 2025 -

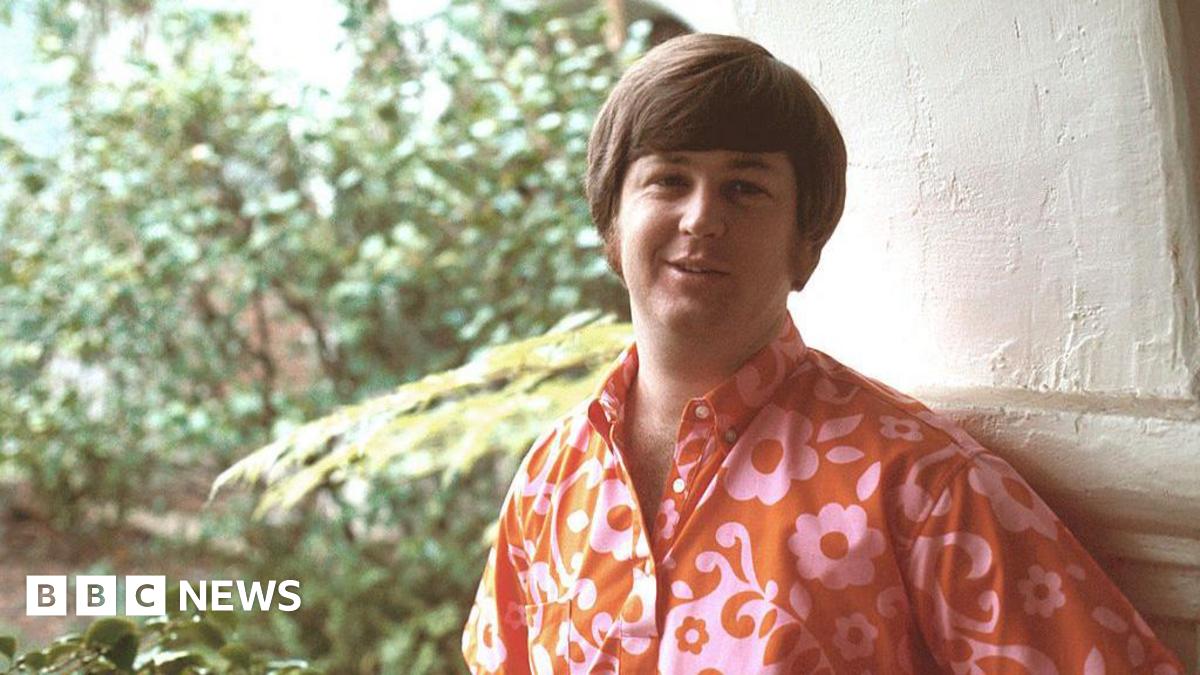

The Beach Boys Brian Wilson A Legacy Celebrated After His Death At 82

Jun 13, 2025

The Beach Boys Brian Wilson A Legacy Celebrated After His Death At 82

Jun 13, 2025 -

Silent Hill Remake What We Know So Far From Konamis Teaser

Jun 13, 2025

Silent Hill Remake What We Know So Far From Konamis Teaser

Jun 13, 2025 -

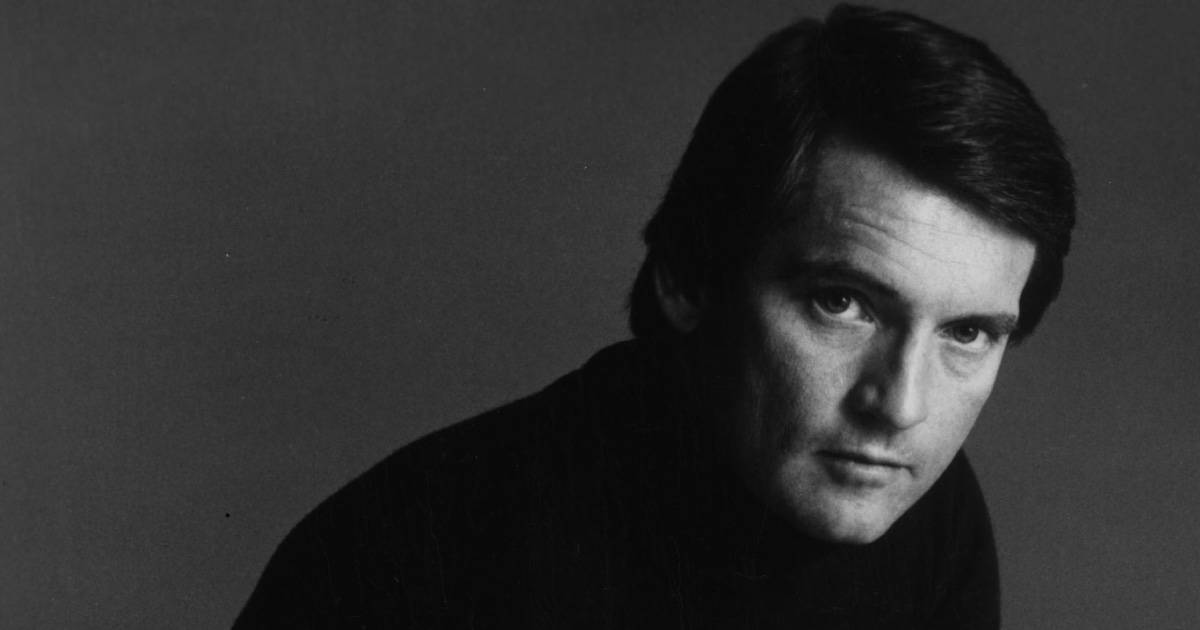

Remembering Chris Robinson General Hospital Star Dies At 86

Jun 13, 2025

Remembering Chris Robinson General Hospital Star Dies At 86

Jun 13, 2025

Latest Posts

-

Love Island Usa June 11th New Episode Time And Where To Watch

Jun 13, 2025

Love Island Usa June 11th New Episode Time And Where To Watch

Jun 13, 2025 -

The Illini Impact Mens Golf Alumnis Performance In Professional Golf June 9 2025

Jun 13, 2025

The Illini Impact Mens Golf Alumnis Performance In Professional Golf June 9 2025

Jun 13, 2025 -

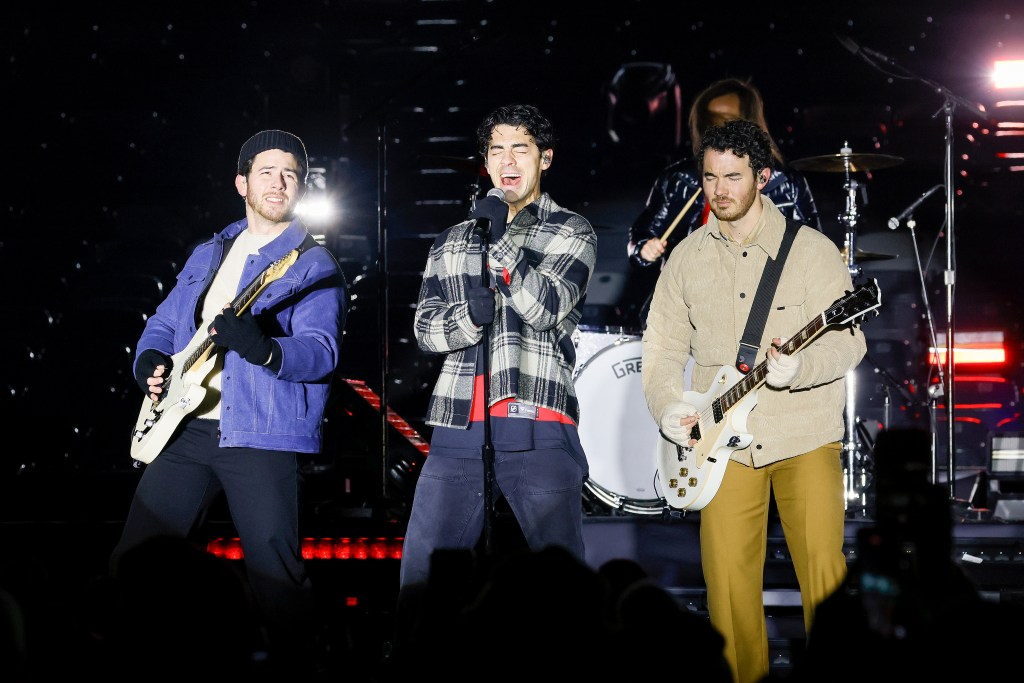

Jonas Brothers Cancel Chicagos Wrigley Field Show

Jun 13, 2025

Jonas Brothers Cancel Chicagos Wrigley Field Show

Jun 13, 2025 -

Dua Lipa And Callum Turner Engaged Confirmation And Details

Jun 13, 2025

Dua Lipa And Callum Turner Engaged Confirmation And Details

Jun 13, 2025 -

Japans 7 Eleven Dominance A Look At Their Unique Snack Production

Jun 13, 2025

Japans 7 Eleven Dominance A Look At Their Unique Snack Production

Jun 13, 2025