Economic Downturn Looms? Jamie Dimon Sounds The Alarm

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Downturn Looms? Jamie Dimon Sounds the Alarm

JPMorgan Chase CEO's stark warning sends shockwaves through Wall Street and beyond.

The financial world is buzzing after JPMorgan Chase CEO Jamie Dimon issued a stark warning about the potential for an economic downturn. His comments, delivered during a recent earnings call, have reignited concerns about inflation, rising interest rates, and the overall health of the global economy. Dimon, known for his candid assessments of the market, painted a picture far from rosy, leaving investors and everyday Americans wondering what the future holds.

Dimon's Dire Predictions: More Than Just Market Jitters

Dimon's concerns aren't just about typical market fluctuations. He's predicting a significant economic storm brewing on the horizon. He cited several key factors contributing to this potential downturn:

-

Inflationary Pressures: Persistently high inflation continues to erode purchasing power and squeeze consumer spending. Dimon emphasized the challenges businesses face in managing rising costs, potentially leading to job losses and reduced economic activity. This is further exacerbated by supply chain disruptions, a lingering issue affecting global trade and manufacturing.

-

Aggressive Interest Rate Hikes: The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, could inadvertently trigger a recession. Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing down economic growth and potentially leading to a credit crunch. Dimon's comments highlight the delicate balancing act the Fed faces – controlling inflation without causing a significant economic contraction.

-

Geopolitical Uncertainty: The ongoing war in Ukraine, coupled with escalating geopolitical tensions, adds another layer of complexity to the economic outlook. These uncertainties disrupt global supply chains, increase energy prices, and fuel overall market volatility. Dimon alluded to these factors as significant headwinds for the global economy.

What Does This Mean for the Average Person?

Dimon's warning isn't just relevant to Wall Street investors. The potential for an economic downturn carries significant implications for everyday Americans:

-

Job Security: A recession often leads to job losses and increased unemployment. The potential for layoffs and reduced hiring could significantly impact household incomes and financial stability.

-

Rising Costs: Even without a full-blown recession, the current inflationary environment is already putting a strain on household budgets. Rising prices for essential goods and services, such as groceries and energy, are eroding purchasing power and forcing consumers to make difficult choices.

-

Investment Risk: Market volatility increases during periods of economic uncertainty. Investors may experience losses in their portfolios, further impacting financial security.

Looking Ahead: Preparing for Potential Economic Headwinds

While Dimon's predictions are certainly concerning, it's important to remember that economic forecasts are not set in stone. However, his warning serves as a crucial reminder to prepare for potential economic headwinds. This includes:

-

Reviewing your budget: Assess your spending habits and identify areas where you can cut back. Building an emergency fund is crucial to withstand potential financial shocks.

-

Diversifying investments: Spreading your investments across different asset classes can help mitigate risk during periods of market volatility. Consult with a financial advisor for personalized guidance.

-

Staying informed: Keep up-to-date on economic news and developments. Understanding the factors impacting the economy can help you make informed financial decisions.

While the future remains uncertain, Jamie Dimon's alarm bell serves as a call to action. Staying informed, planning carefully, and adapting to changing economic conditions are crucial steps in navigating the potential challenges ahead. What are your thoughts on Dimon's prediction? Share your opinions in the comments below.

(Note: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Downturn Looms? Jamie Dimon Sounds The Alarm. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Wta London Day 3 Expert Predictions And Match Analysis

Jun 12, 2025

Wta London Day 3 Expert Predictions And Match Analysis

Jun 12, 2025 -

Watch San Francisco Giants Vs Colorado Rockies Your Guide To Live Streaming And Tv

Jun 12, 2025

Watch San Francisco Giants Vs Colorado Rockies Your Guide To Live Streaming And Tv

Jun 12, 2025 -

Extend Your Healthspan A Physicians Perspective On Successful Aging

Jun 12, 2025

Extend Your Healthspan A Physicians Perspective On Successful Aging

Jun 12, 2025 -

England Alters Cervical Screening Invitations For Younger Women

Jun 12, 2025

England Alters Cervical Screening Invitations For Younger Women

Jun 12, 2025 -

Major Vote On Abortion Decriminalisation Looms For English And Welsh Mps

Jun 12, 2025

Major Vote On Abortion Decriminalisation Looms For English And Welsh Mps

Jun 12, 2025

Latest Posts

-

First Round Us Open Highlights Spaun Koepka Set The Pace

Jun 14, 2025

First Round Us Open Highlights Spaun Koepka Set The Pace

Jun 14, 2025 -

Boeing 737 Max Grounded How The Air India Crash Impacts Boeings Future

Jun 14, 2025

Boeing 737 Max Grounded How The Air India Crash Impacts Boeings Future

Jun 14, 2025 -

Elon Musk Teases Teslas Game Changing New Product

Jun 14, 2025

Elon Musk Teases Teslas Game Changing New Product

Jun 14, 2025 -

Mc Ilroy And Scheffler Falter Spaun Seizes Us Open 2025 Lead

Jun 14, 2025

Mc Ilroy And Scheffler Falter Spaun Seizes Us Open 2025 Lead

Jun 14, 2025 -

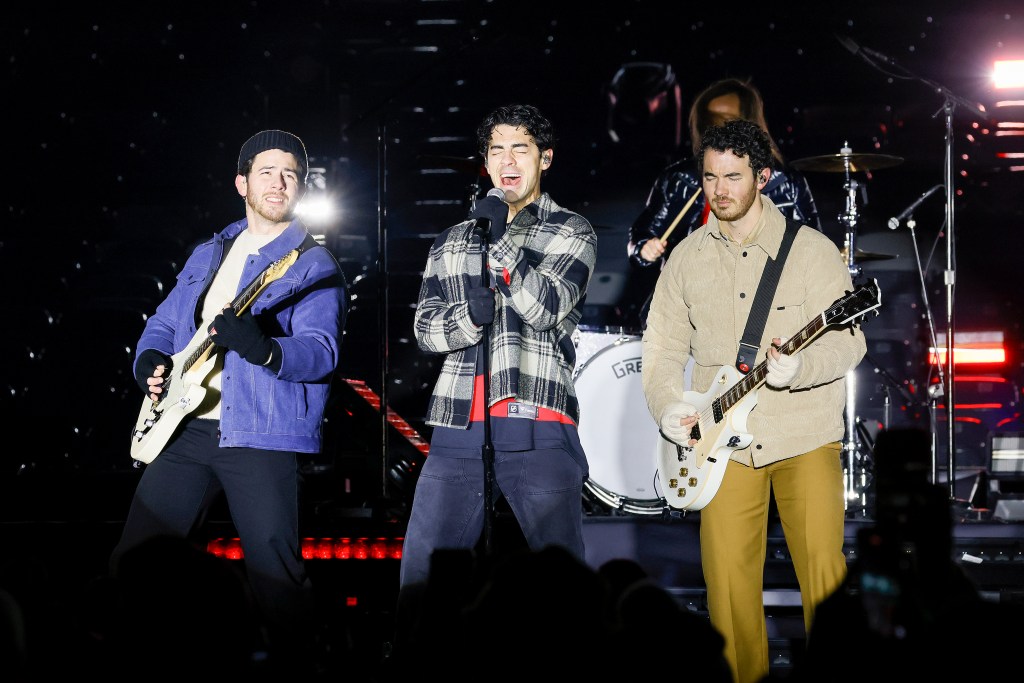

Update Jonas Brothers Postpone Multiple Concerts Including Wrigley Field

Jun 14, 2025

Update Jonas Brothers Postpone Multiple Concerts Including Wrigley Field

Jun 14, 2025