Economic Factors Behind The Bank Of England's Interest Rate Reduction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bank of England Cuts Interest Rates: A Deep Dive into the Economic Factors

The Bank of England's (BoE) recent decision to reduce interest rates has sent ripples through the financial markets, prompting questions about the underlying economic forces driving this move. This unexpected shift signals a growing concern about the UK's economic outlook, a concern fueled by a confluence of factors impacting inflation, growth, and global uncertainty. Understanding these factors is crucial for navigating the potential implications for businesses, consumers, and investors alike.

Inflationary Pressures Ease, but Risks Remain:

While inflation has shown signs of cooling down from its peak, it remains stubbornly above the BoE's 2% target. The recent rate cut, however, suggests the central bank believes the risks of a prolonged recession outweigh the dangers of slightly higher inflation in the short term. Factors contributing to this assessment include:

-

Weakening Consumer Demand: Rising living costs, fueled by persistent high energy prices and stubbornly high inflation, have significantly dampened consumer spending. This reduced demand is impacting businesses across various sectors, leading to slower growth and potentially deflationary pressures in certain areas.

-

Global Economic Slowdown: The global economy faces significant headwinds, including geopolitical instability, supply chain disruptions, and tighter monetary policy in major economies. This global slowdown is impacting UK exports and further contributing to the weakening economic outlook.

-

Energy Price Volatility: While energy prices have decreased from their peak, they remain significantly elevated compared to pre-pandemic levels. The volatility in energy markets continues to pose a significant risk to inflation and economic growth, making it challenging to predict the future trajectory of prices.

Growth Concerns Take Center Stage:

The BoE’s decision reflects a growing concern that the UK economy is heading towards a period of prolonged stagnation, or even recession. Recent data has pointed towards slowing growth across key sectors, including manufacturing and services. This slowing growth underscores the need for stimulus measures, with a rate cut being one tool in the BoE's arsenal.

The Impact of Brexit:

The long-term economic impact of Brexit continues to be felt, contributing to uncertainty and hindering investment. Trade frictions with the EU, coupled with skills shortages and labor market disruptions, have added to the economic headwinds facing the UK. While the direct impact of Brexit on the recent interest rate decision is debated, it undoubtedly forms part of the complex economic landscape the BoE is navigating.

What Does This Mean for the Future?

The BoE's decision highlights the delicate balancing act central banks face in managing inflation and supporting economic growth. While the rate cut aims to stimulate the economy, its effectiveness will depend on various factors, including consumer and business confidence, the global economic climate, and the success of other government initiatives.

The coming months will be crucial in assessing the impact of this decision. Further analysis of economic data will be vital in determining whether the rate cut is sufficient to avert a significant economic downturn or whether further action is required. Keep an eye on key economic indicators, such as GDP growth, inflation rates, and unemployment figures, for a clearer picture of the UK’s economic trajectory. This situation warrants careful monitoring by all stakeholders.

Further Reading:

Call to Action: What are your thoughts on the Bank of England's decision? Share your insights in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Factors Behind The Bank Of England's Interest Rate Reduction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Frequently Asked Questions Faq August 5th Edition

Aug 08, 2025

Frequently Asked Questions Faq August 5th Edition

Aug 08, 2025 -

25 Tariff On Indian Russian Oil Imports Trumps Latest Trade Move

Aug 08, 2025

25 Tariff On Indian Russian Oil Imports Trumps Latest Trade Move

Aug 08, 2025 -

Half A Billion Dollars Frozen Federal Government Halts Ucla Research Funding

Aug 08, 2025

Half A Billion Dollars Frozen Federal Government Halts Ucla Research Funding

Aug 08, 2025 -

Cwmbran Airbnb Host Under Fire For Alleged Discrimination Against Welsh Guests

Aug 08, 2025

Cwmbran Airbnb Host Under Fire For Alleged Discrimination Against Welsh Guests

Aug 08, 2025 -

Ucla Faces 500 Million Research Funding Freeze From Federal Government

Aug 08, 2025

Ucla Faces 500 Million Research Funding Freeze From Federal Government

Aug 08, 2025

Latest Posts

-

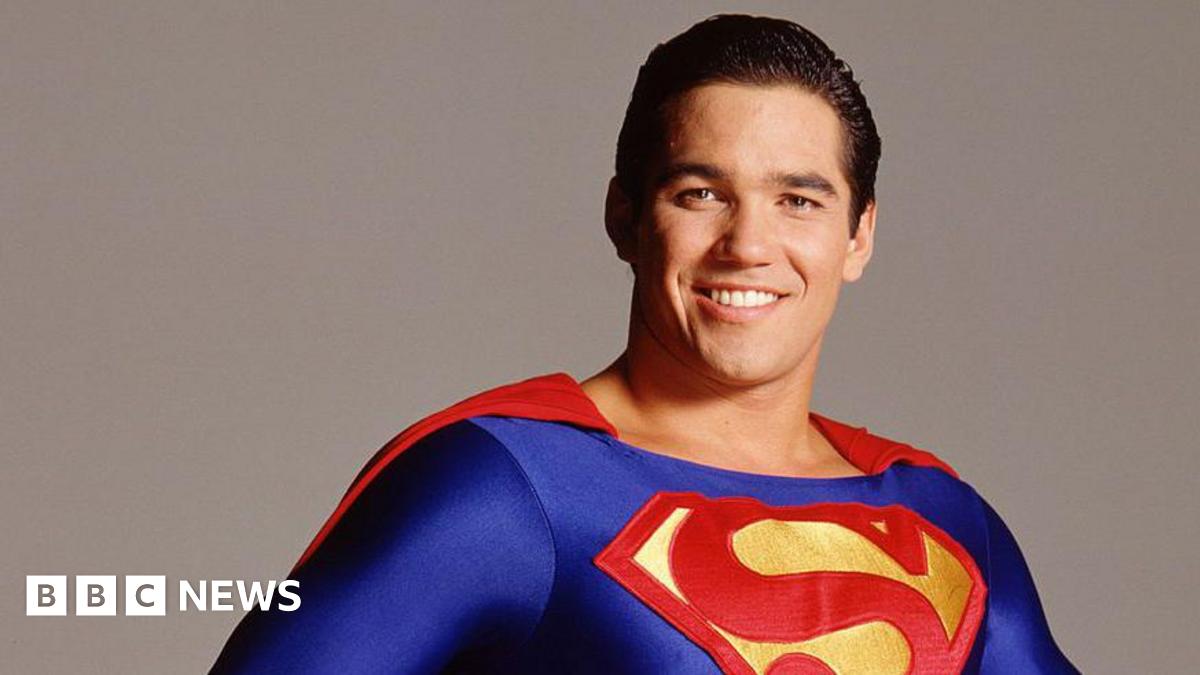

Dean Cains New Role Ex Superman Star Joins Ice

Aug 09, 2025

Dean Cains New Role Ex Superman Star Joins Ice

Aug 09, 2025 -

Nick Balls Cross Fit Success How The British Champion Stays At The Top

Aug 09, 2025

Nick Balls Cross Fit Success How The British Champion Stays At The Top

Aug 09, 2025 -

Is Trumps Threat To Deploy The Military On Us Soil Becoming A Reality

Aug 09, 2025

Is Trumps Threat To Deploy The Military On Us Soil Becoming A Reality

Aug 09, 2025 -

Increasing Reality Trumps Talk Of Using Military Force Within Us Borders

Aug 09, 2025

Increasing Reality Trumps Talk Of Using Military Force Within Us Borders

Aug 09, 2025 -

Political Fallout Trump Administrations Impact On Fbi Leadership Revealed

Aug 09, 2025

Political Fallout Trump Administrations Impact On Fbi Leadership Revealed

Aug 09, 2025