Economic Fallout: Dissecting The Gains And Losses From The "Big, Beautiful Bill"

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Fallout: Dissecting the Gains and Losses from the "Big, Beautiful Bill"

The Inflation Reduction Act (IRA), often dubbed the "Big, Beautiful Bill," has been a lightning rod for debate since its passage. While proponents hail it as a landmark achievement in climate action and social justice, critics point to potential economic downsides. This article delves into the complex economic landscape shaped by the IRA, dissecting both its purported gains and potential losses.

The Claimed Gains: A Green Stimulus and Social Safety Net Enhancements

The IRA’s most significant impact is arguably its investment in clean energy. The bill allocates billions towards tax credits for renewable energy technologies like solar panels, wind turbines, and electric vehicles (EVs). Proponents argue this will stimulate green job creation, boost domestic manufacturing, and accelerate the transition to a cleaner energy future. This "green stimulus," they claim, will not only mitigate climate change but also bolster economic growth.

- Job Creation: The IRA is projected to create hundreds of thousands of jobs in the renewable energy sector, from manufacturing and installation to research and development. [Link to relevant government report on job projections]

- Domestic Manufacturing: By incentivizing domestic production of clean energy technologies, the IRA aims to reduce reliance on foreign imports and strengthen the U.S. manufacturing base. This could lead to increased economic activity and a more resilient supply chain.

- Reduced Healthcare Costs: The bill extends Affordable Care Act (ACA) subsidies, potentially lowering healthcare costs for millions of Americans. This could free up disposable income, stimulating consumer spending and boosting the economy.

The Concerns: Inflationary Pressures and Potential Tax Increases

Despite the positive projections, concerns remain about the IRA’s potential economic drawbacks. Critics argue that the massive government spending could exacerbate inflationary pressures, negating any potential economic benefits. Furthermore, some provisions, such as the increased corporate minimum tax, could stifle business investment and hinder economic growth.

- Inflationary Impact: The sheer scale of government spending involved raises concerns about adding fuel to the already-inflamed economy. [Link to article discussing inflation and government spending] Economists are divided on the extent of this impact, with some predicting minimal effect and others warning of significant consequences.

- Tax Increases: While the bill aims to reduce the deficit over the long term, some provisions, such as the 15% minimum tax on large corporations, could lead to higher prices for consumers as businesses pass on increased costs. [Link to analysis of corporate minimum tax impact]

- Unintended Consequences: The complexity of the bill raises concerns about unintended consequences and potential inefficiencies in implementation. Careful monitoring and evaluation will be crucial to assess its long-term effectiveness.

The Verdict: A Complex Economic Equation

The economic impact of the IRA is far from straightforward. While the potential for green job creation, domestic manufacturing growth, and reduced healthcare costs is significant, the risks of increased inflation and potential tax increases cannot be ignored. The ultimate success of the bill will depend on various factors, including its effective implementation, the response of businesses and consumers, and the broader global economic climate. Further research and ongoing analysis are essential to fully understand the long-term consequences of this ambitious legislation.

Call to Action: Stay informed about the economic developments surrounding the IRA by following reputable news sources and economic analysis. Understanding the complexities of this legislation is crucial for informed participation in the ongoing national conversation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Fallout: Dissecting The Gains And Losses From The "Big, Beautiful Bill". We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Leonard Hill A Top Rated Philadelphia Personal Injury Lawyer Tidewater News Announcement

Jul 06, 2025

Leonard Hill A Top Rated Philadelphia Personal Injury Lawyer Tidewater News Announcement

Jul 06, 2025 -

Positive Reviews Pour In For Oasis Highly Anticipated Comeback Tour

Jul 06, 2025

Positive Reviews Pour In For Oasis Highly Anticipated Comeback Tour

Jul 06, 2025 -

Smuggled Cigarettes Unmasking The Uks Organized Crime Links

Jul 06, 2025

Smuggled Cigarettes Unmasking The Uks Organized Crime Links

Jul 06, 2025 -

Divided Gop Lawmakers React To Trumps Sweeping Domestic Policy Bill

Jul 06, 2025

Divided Gop Lawmakers React To Trumps Sweeping Domestic Policy Bill

Jul 06, 2025 -

Montemurro And Micahs Tactical Masterclass Tempo Dictates Matildas Success

Jul 06, 2025

Montemurro And Micahs Tactical Masterclass Tempo Dictates Matildas Success

Jul 06, 2025

Latest Posts

-

Top 100 College Football Players Oregon State Star Included In Ea Sports Roster

Jul 07, 2025

Top 100 College Football Players Oregon State Star Included In Ea Sports Roster

Jul 07, 2025 -

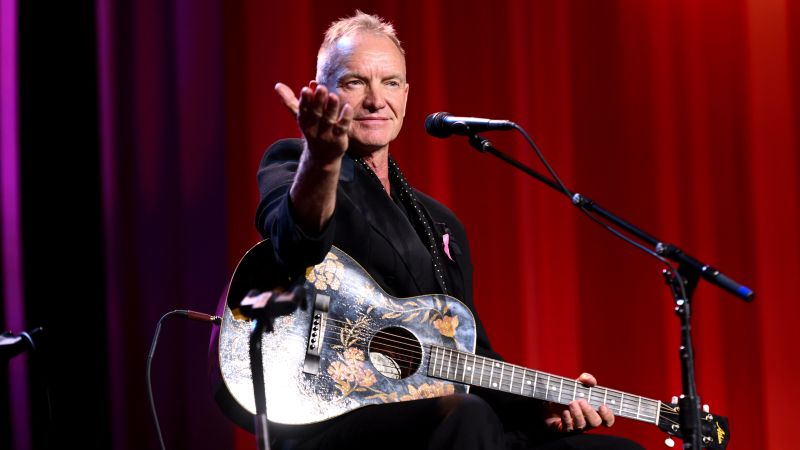

Stings Every Breath You Take A Timeless Classic Revisited

Jul 07, 2025

Stings Every Breath You Take A Timeless Classic Revisited

Jul 07, 2025 -

Ed Sheerans Shape Of You Topping Apple Musics Decade Streaming Chart

Jul 07, 2025

Ed Sheerans Shape Of You Topping Apple Musics Decade Streaming Chart

Jul 07, 2025 -

How Funding Cuts Threaten London Prides Continued Success

Jul 07, 2025

How Funding Cuts Threaten London Prides Continued Success

Jul 07, 2025 -

Experience Montanas Natural Beauty And Culinary Excellence In This Underrated Town

Jul 07, 2025

Experience Montanas Natural Beauty And Culinary Excellence In This Underrated Town

Jul 07, 2025