Economic Outlook: Jamie Dimon Predicts Potential Deterioration

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Outlook: Jamie Dimon Predicts Potential Deterioration – A Storm on the Horizon?

JPMorgan Chase CEO Jamie Dimon's recent warnings about a potential economic deterioration have sent shockwaves through financial markets. His pessimistic outlook, shared during the bank's second-quarter earnings call, highlights growing concerns about inflation, rising interest rates, and geopolitical instability. While many economists remain cautiously optimistic, Dimon's considerable experience and influence make his predictions impossible to ignore. This article delves into the key concerns raised by Dimon and analyzes the potential implications for the global economy.

Dimon's Key Concerns: A Brewing Economic Storm

Dimon's concerns aren't based on mere speculation. He cited several key factors contributing to his pessimistic forecast:

-

Stubborn Inflation: Despite recent efforts by central banks to curb inflation, Dimon believes inflation remains stubbornly high and could persist longer than anticipated. This prolonged inflationary period could lead to further interest rate hikes, potentially triggering a recession. Learn more about the current inflation rates in [link to a reputable source on inflation statistics].

-

Geopolitical Uncertainty: The ongoing war in Ukraine, tensions with China, and other global conflicts contribute to significant uncertainty in the global economic landscape. These geopolitical factors disrupt supply chains, fuel inflation, and impact investor confidence.

-

Aggressive Interest Rate Hikes: The Federal Reserve's aggressive approach to raising interest rates, while aimed at combating inflation, carries the risk of triggering a significant economic slowdown or even a recession. The impact of these hikes on different economic sectors is a subject of ongoing debate among economists.

-

Consumer Spending Slowdown: Dimon also noted signs of a potential slowdown in consumer spending, a crucial driver of economic growth. This slowdown could be attributed to high inflation eroding purchasing power and increased uncertainty about the future.

What Does This Mean for the Average Person?

Dimon's predictions are not just abstract economic forecasts; they have real-world implications for everyday people. A potential economic downturn could lead to:

- Higher Unemployment: Recessions often result in job losses across various sectors.

- Increased Costs of Living: Inflationary pressures are likely to persist, potentially increasing the cost of essential goods and services.

- Reduced Investment Returns: A weakening economy can negatively impact investment returns, affecting retirement savings and investment portfolios.

A Cautious Approach, Not Panic:

It's crucial to remember that Dimon's predictions are not a guaranteed forecast of a catastrophic economic collapse. The economy is complex, and many factors can influence its trajectory. However, his warning serves as a valuable reminder to remain cautious and financially prepared for potential economic headwinds.

Strategies for Navigating Economic Uncertainty:

While we cannot predict the future with certainty, proactive steps can help mitigate potential risks:

- Review your budget: Assess your spending habits and identify areas where you can cut back.

- Build an emergency fund: Having a financial safety net can help you weather economic storms.

- Diversify your investments: Reducing risk by spreading your investments across different asset classes can help protect your portfolio.

- Stay informed: Keep up-to-date on economic news and trends to make informed financial decisions.

Conclusion: Preparing for the Possible

Jamie Dimon's warning about a potential economic deterioration isn't a call for panic, but a call for preparedness. By understanding the potential risks and taking proactive steps to manage your finances, you can better navigate the economic landscape, regardless of the path it takes. Remember to consult with a financial advisor for personalized advice tailored to your specific circumstances. Staying informed and adapting to changing economic conditions is key to navigating uncertain times.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Outlook: Jamie Dimon Predicts Potential Deterioration. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Dirty Dozen Report Avoid These Pesticide Heavy Fruits And Vegetables

Jun 13, 2025

New Dirty Dozen Report Avoid These Pesticide Heavy Fruits And Vegetables

Jun 13, 2025 -

Austria Mourns Largest Mass Shooting In Recent History Sparks Investigation

Jun 13, 2025

Austria Mourns Largest Mass Shooting In Recent History Sparks Investigation

Jun 13, 2025 -

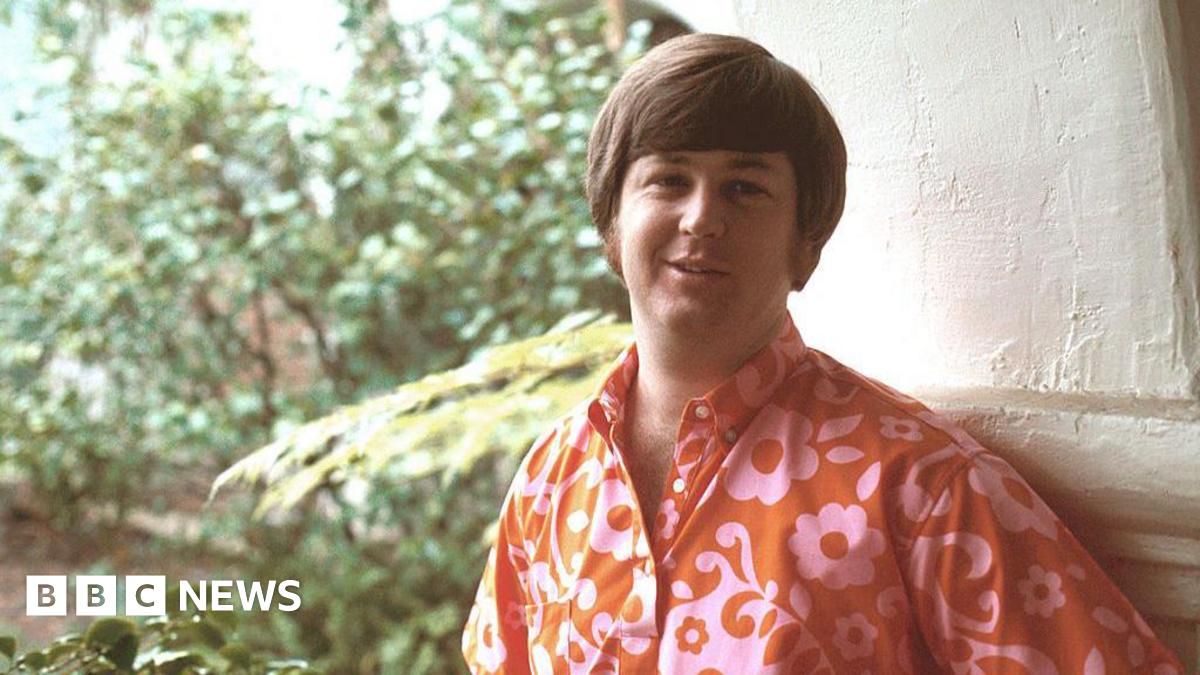

Brian Wilson Remembering The Beach Boys Iconic Co Creator

Jun 13, 2025

Brian Wilson Remembering The Beach Boys Iconic Co Creator

Jun 13, 2025 -

How To Stream Or Watch The San Francisco Giants Vs Colorado Rockies Game Live

Jun 13, 2025

How To Stream Or Watch The San Francisco Giants Vs Colorado Rockies Game Live

Jun 13, 2025 -

Adobe Stock And Ai Opportunities And Risks For Investors Nasdaq Adbe

Jun 13, 2025

Adobe Stock And Ai Opportunities And Risks For Investors Nasdaq Adbe

Jun 13, 2025

Latest Posts

-

Nhl News Marner Matthews Rift Deepens Whats Next For The Leafs

Jun 14, 2025

Nhl News Marner Matthews Rift Deepens Whats Next For The Leafs

Jun 14, 2025 -

Breaking Point Analyzing The Marner Matthews Situation In Toronto

Jun 14, 2025

Breaking Point Analyzing The Marner Matthews Situation In Toronto

Jun 14, 2025 -

Memorial Fight Capitol Police Officers Sue For Recognition Of January 6th Service

Jun 14, 2025

Memorial Fight Capitol Police Officers Sue For Recognition Of January 6th Service

Jun 14, 2025 -

Claro Fire Near Carlsbad Wildfire Contained At 45 Acres

Jun 14, 2025

Claro Fire Near Carlsbad Wildfire Contained At 45 Acres

Jun 14, 2025 -

Watch Love Island Usa Season 7 Episode 9 Tonights Air Time And Streaming Options

Jun 14, 2025

Watch Love Island Usa Season 7 Episode 9 Tonights Air Time And Streaming Options

Jun 14, 2025