Economic Slowdown: Analyzing The Bank Of England's Interest Rate Reduction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Slowdown: Analyzing the Bank of England's Interest Rate Reduction

The UK economy is facing headwinds, prompting the Bank of England (BoE) to take decisive action. In a surprise move last week, the central bank reduced its base interest rate by 0.25%, a move that has sparked significant debate among economists and financial analysts. This article delves into the reasons behind the rate cut, its potential impact on the UK economy, and the ongoing uncertainties facing the nation.

The Rationale Behind the Rate Cut:

The BoE's decision to lower interest rates reflects growing concerns about a potential economic slowdown. Weakening global growth, coupled with persistent Brexit-related uncertainty, has dampened investor confidence and led to a decline in business investment. Inflation, while remaining within the BoE's target range, is also showing signs of softening, indicating a lack of robust economic momentum. The rate cut aims to stimulate lending, boost economic activity, and prevent a deeper recession.

The Governor of the Bank of England, Andrew Bailey, cited the "significant downside risks to the UK economic outlook" as the primary justification for the reduction. This statement highlights the urgency of the situation and the BoE's commitment to proactive monetary policy adjustments.

Potential Impacts of the Interest Rate Reduction:

Lower interest rates are intended to make borrowing cheaper for businesses and consumers. This could lead to:

- Increased Investment: Businesses may be encouraged to invest more in expansion and job creation, fueling economic growth.

- Higher Consumer Spending: Lower borrowing costs could stimulate consumer spending, boosting demand for goods and services.

- Lower Mortgage Rates: Homeowners with variable-rate mortgages could benefit from reduced monthly payments, freeing up disposable income.

However, the effectiveness of the rate cut is subject to several factors, including:

- Consumer Confidence: If consumers remain hesitant to spend due to uncertainty, the stimulative effect of lower rates may be limited.

- Business Investment Sentiment: Businesses might delay investment decisions if they anticipate further economic downturn.

- Global Economic Conditions: The global economic climate significantly impacts the UK economy, and a continued slowdown globally could negate the positive effects of the rate cut.

Criticisms and Alternative Perspectives:

Some economists argue that the rate cut is insufficient to address the underlying structural issues plaguing the UK economy. They contend that focusing solely on monetary policy ignores the need for fiscal stimulus or targeted interventions to address Brexit-related challenges and boost productivity. Others express concern about the potential for increased inflation in the long term, although current inflation figures suggest this is a less pressing concern at present.

Looking Ahead: Uncertainty and Ongoing Challenges:

The effectiveness of the BoE's interest rate reduction remains to be seen. The UK economy faces complex and interconnected challenges, ranging from global trade tensions to the ongoing implications of Brexit. Monitoring key economic indicators, such as GDP growth, inflation, and employment figures, will be crucial in assessing the impact of this policy decision. Further adjustments to monetary policy may be necessary depending on the evolving economic landscape.

Keywords: Bank of England, Interest Rate, Economic Slowdown, Recession, Monetary Policy, UK Economy, Inflation, Brexit, Andrew Bailey, GDP Growth, Economic Outlook, Consumer Spending, Business Investment.

Call to Action: Stay informed about the evolving economic situation by regularly checking reputable financial news sources and the Bank of England's website for updates and analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Slowdown: Analyzing The Bank Of England's Interest Rate Reduction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

12 Weight Loss Achieved With New Daily Pill Study Findings

Aug 09, 2025

12 Weight Loss Achieved With New Daily Pill Study Findings

Aug 09, 2025 -

Tommy Fleetwoods Net Worth Wifes Shocking 3 Word Rejection

Aug 09, 2025

Tommy Fleetwoods Net Worth Wifes Shocking 3 Word Rejection

Aug 09, 2025 -

Economic Slowdown Analyzing The Bank Of Englands Interest Rate Cut

Aug 09, 2025

Economic Slowdown Analyzing The Bank Of Englands Interest Rate Cut

Aug 09, 2025 -

Tennessee Familys Murder Death Penalty On The Table For Suspects

Aug 09, 2025

Tennessee Familys Murder Death Penalty On The Table For Suspects

Aug 09, 2025 -

Inter Milan Pre Season Tickets For Sale Limited Availability

Aug 09, 2025

Inter Milan Pre Season Tickets For Sale Limited Availability

Aug 09, 2025

Latest Posts

-

Cokers One Handed Grab Daltons 34 Yard Pass Secures Victory

Aug 10, 2025

Cokers One Handed Grab Daltons 34 Yard Pass Secures Victory

Aug 10, 2025 -

Shockwaves In Indy Car Officials And Pato O Ward Respond To Ice Controversy

Aug 10, 2025

Shockwaves In Indy Car Officials And Pato O Ward Respond To Ice Controversy

Aug 10, 2025 -

Former Packers Star And Nflpas Inaugural President Billy Howton Dies At 95

Aug 10, 2025

Former Packers Star And Nflpas Inaugural President Billy Howton Dies At 95

Aug 10, 2025 -

Rondale Moore Injury Update Vikings Wide Receiver Hurt In Preseason Game

Aug 10, 2025

Rondale Moore Injury Update Vikings Wide Receiver Hurt In Preseason Game

Aug 10, 2025 -

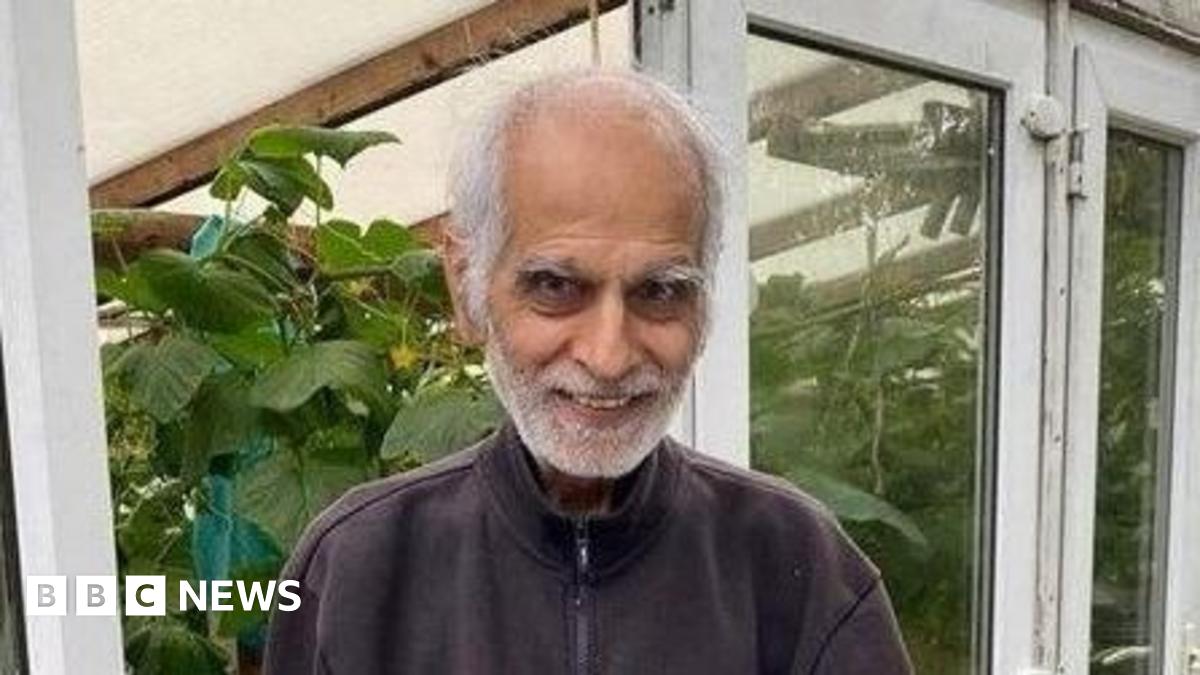

Bhim Kohli Death Investigation Launched Into Police Handling Of Information

Aug 10, 2025

Bhim Kohli Death Investigation Launched Into Police Handling Of Information

Aug 10, 2025