Economic Slowdown Imminent? Jamie Dimon's Sobering Prediction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Slowdown Imminent? Jamie Dimon's Sobering Prediction Sends Shivers Down Wall Street

JPMorgan Chase CEO Jamie Dimon's recent warnings about a potential economic slowdown have sent shockwaves through the financial world. His comments, delivered during a recent earnings call, paint a picture far less rosy than many economists' current predictions. The implications are significant, impacting everything from investment strategies to consumer confidence. Is a recession truly on the horizon, and what should we expect?

Dimon, known for his candid assessments of the economic landscape, expressed concerns about several key factors contributing to this potentially looming downturn. His prediction isn't about a sudden crash, but rather a more gradual, yet potentially painful, slowdown. Let's delve into the specifics of his concerns and what they mean for the average person.

<h3>The Key Factors Driving Dimon's Concerns</h3>

Dimon cited several contributing factors fueling his prediction of an economic slowdown. These include:

- Geopolitical Uncertainty: The ongoing war in Ukraine, coupled with escalating tensions in other global hotspots, continues to disrupt supply chains and fuel inflation. This uncertainty makes long-term economic planning incredibly difficult for businesses and consumers alike.

- Inflationary Pressures: While inflation may be cooling slightly in some sectors, it remains stubbornly high in many others. Persistent inflation erodes purchasing power, dampening consumer spending and impacting overall economic growth. Learn more about the current inflation rate and its impact . (This is a placeholder link; replace with a relevant, authoritative source).

- Federal Reserve Policy: The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, are also impacting borrowing costs for businesses and consumers. Higher interest rates can slow down economic activity as borrowing becomes more expensive.

- Consumer Spending: Consumer spending, a significant driver of economic growth, shows signs of weakening. High inflation and uncertainty are causing many to become more cautious with their spending habits.

<h3>What Does This Mean for the Average Person?</h3>

Dimon's warning doesn't necessarily predict an immediate collapse, but rather a period of slower economic growth. This could translate to several potential scenarios for the average person:

- Higher Interest Rates: Expect to see higher interest rates on loans, mortgages, and credit cards, making borrowing more expensive.

- Increased Job Insecurity: While a full-blown recession isn't guaranteed, slower economic growth could lead to job losses or hiring freezes in some sectors.

- Reduced Spending Power: Inflation continues to eat away at purchasing power, meaning your money may not go as far as it once did.

- Increased Volatility in the Stock Market: Economic uncertainty typically leads to increased volatility in the stock market, potentially impacting investment portfolios.

<h3>Preparing for a Potential Slowdown</h3>

While panic is unwarranted, it’s prudent to take steps to prepare for a potential economic slowdown:

- Review your budget: Identify areas where you can cut expenses and build an emergency fund.

- Pay down debt: Reducing high-interest debt will lessen the impact of rising interest rates.

- Diversify your investments: A diversified investment portfolio can help mitigate risk during periods of market volatility.

- Stay informed: Keep abreast of economic news and developments to make informed financial decisions.

<h3>Conclusion: A Cautious Outlook</h3>

Jamie Dimon's prediction is a serious warning, urging caution and preparedness. While a full-blown recession isn't inevitable, the factors he highlighted paint a picture of a potentially challenging economic landscape in the near future. By understanding the potential risks and taking proactive steps, individuals and businesses can better navigate the challenges that may lie ahead. It’s crucial to remain informed and adapt to the evolving economic situation. What are your thoughts on Dimon's prediction? Share your opinions in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Slowdown Imminent? Jamie Dimon's Sobering Prediction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

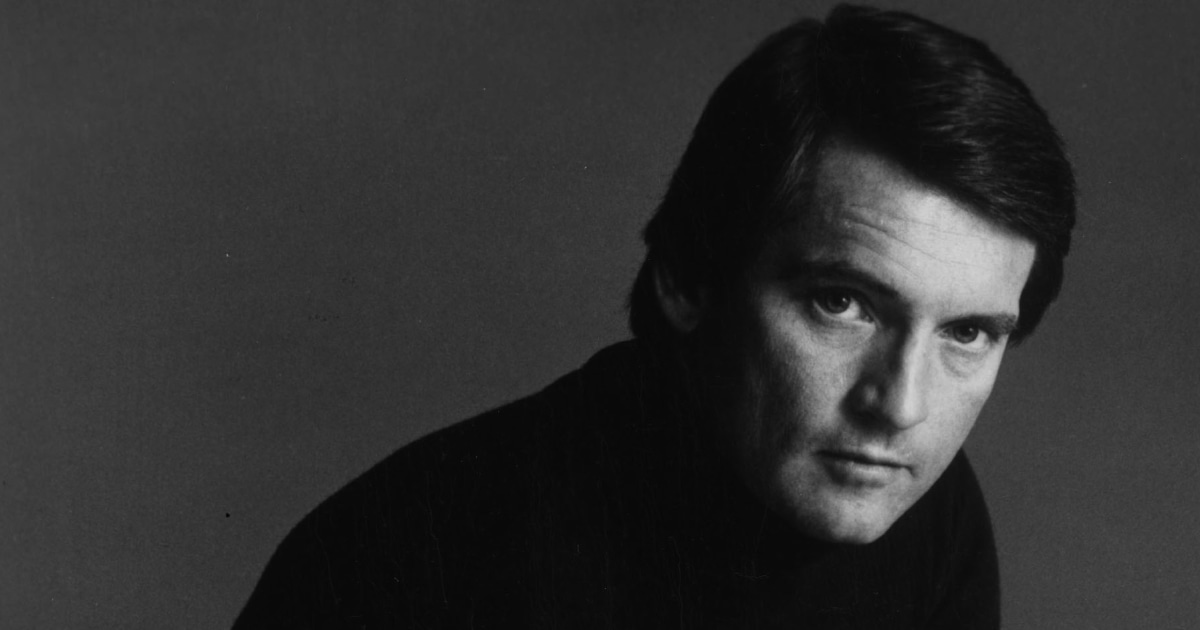

Actor Chris Robinson Known For General Hospital Dies At 86

Jun 13, 2025

Actor Chris Robinson Known For General Hospital Dies At 86

Jun 13, 2025 -

Commuting Costs Understanding The Spending Reviews Effects On Bus Fares

Jun 13, 2025

Commuting Costs Understanding The Spending Reviews Effects On Bus Fares

Jun 13, 2025 -

Turbulent Town Hall Republican Struggles To Sell Trumps Proposed Bill

Jun 13, 2025

Turbulent Town Hall Republican Struggles To Sell Trumps Proposed Bill

Jun 13, 2025 -

Trumps Bill A Republican Lawmakers Town Hall Turns Tumultuous

Jun 13, 2025

Trumps Bill A Republican Lawmakers Town Hall Turns Tumultuous

Jun 13, 2025 -

Weinstein Found Guilty Retrial Delivers Verdict In High Profile Sexual Assault Case

Jun 13, 2025

Weinstein Found Guilty Retrial Delivers Verdict In High Profile Sexual Assault Case

Jun 13, 2025

Latest Posts

-

Illinis Us Open Journey Begins Wins And Losses In The First Round

Jun 14, 2025

Illinis Us Open Journey Begins Wins And Losses In The First Round

Jun 14, 2025 -

Tournament Boat Fire Five Sailors Rescued In Dramatic Offshore Operation

Jun 14, 2025

Tournament Boat Fire Five Sailors Rescued In Dramatic Offshore Operation

Jun 14, 2025 -

Live From The O2 London Jonas Brothers Unveil Live Album Featuring Unreleased Track

Jun 14, 2025

Live From The O2 London Jonas Brothers Unveil Live Album Featuring Unreleased Track

Jun 14, 2025 -

Attics Became Safe Havens As Families Fled Racially Motivated Violence

Jun 14, 2025

Attics Became Safe Havens As Families Fled Racially Motivated Violence

Jun 14, 2025 -

Oregon Highway Closures Wildfire Forces Drivers Off Roads

Jun 14, 2025

Oregon Highway Closures Wildfire Forces Drivers Off Roads

Jun 14, 2025