Economic Slowdown? Jamie Dimon Issues Urgent Warning

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Slowdown? Jamie Dimon Issues Urgent Warning

JPMorgan Chase CEO's stark prediction sends shockwaves through Wall Street.

The global economy is facing a potential storm, according to JPMorgan Chase CEO Jamie Dimon, who issued a stark warning about an impending economic slowdown. His recent comments, delivered during a quarterly earnings call, have sent shockwaves through Wall Street and fueled anxieties among investors already grappling with persistent inflation and rising interest rates. Dimon's prediction is not just another gloomy forecast; it carries significant weight given his extensive experience and the bank's prominent position in the financial world. This article delves into the details of Dimon's warning, exploring its implications for consumers and businesses alike.

Dimon's Dire Prediction: A "Hurricane" on the Horizon?

Dimon didn't mince words. He characterized the current economic climate as a brewing "hurricane," warning that while businesses currently appear strong, unforeseen economic headwinds could quickly materialize. He cited several factors contributing to his pessimistic outlook, including the ongoing war in Ukraine, stubbornly high inflation, and the Federal Reserve's aggressive interest rate hikes aimed at curbing inflation. These actions, while necessary to combat inflation, also risk triggering a recession.

Key Factors Contributing to Dimon's Concerns:

- Inflation: Persistent high inflation continues to erode purchasing power and dampens consumer spending. This decrease in consumer demand can trigger a domino effect, impacting businesses and ultimately leading to job losses. [Link to article on inflation]

- Interest Rate Hikes: The Federal Reserve's aggressive interest rate increases, while intended to control inflation, also increase borrowing costs for businesses and consumers, potentially stifling economic growth and investment. [Link to article on Federal Reserve policy]

- Geopolitical Instability: The ongoing war in Ukraine presents significant uncertainty, impacting global supply chains and energy prices, further exacerbating inflationary pressures. [Link to article on the Ukraine War]

- Supply Chain Disruptions: Although easing, lingering supply chain disruptions continue to impact businesses' ability to meet consumer demand and contribute to price increases.

What Does This Mean for Consumers and Businesses?

Dimon's warning highlights the need for both consumers and businesses to prepare for potential economic turbulence. Consumers should consider:

- Budgeting Carefully: Creating and sticking to a budget is crucial in times of economic uncertainty. Careful financial planning can help mitigate the impact of potential job losses or reduced income.

- Managing Debt: Paying down high-interest debt should be a priority. Higher interest rates make it more expensive to borrow money.

- Emergency Savings: Building a robust emergency fund can provide a financial cushion during unexpected economic downturns.

Businesses should consider:

- Strategic Planning: Developing contingency plans to navigate potential economic headwinds is essential for business survival and growth.

- Cost Management: Implementing cost-cutting measures and improving efficiency can help mitigate the impact of reduced consumer demand.

- Diversification: Diversifying revenue streams and supply chains can reduce vulnerability to economic shocks.

Looking Ahead: Preparing for the Storm

While Dimon's prediction is undoubtedly alarming, it also underscores the importance of proactive planning and preparation. The potential for an economic slowdown necessitates careful consideration of financial strategies for both individuals and businesses. Staying informed about economic trends and adapting to changing conditions will be crucial in navigating the turbulent waters ahead. The coming months will be critical in determining the severity of the impending economic storm and how effectively individuals and businesses can weather it. Regularly reviewing your financial situation and staying informed are crucial steps in mitigating potential risks.

Call to Action: Stay informed about economic developments by subscribing to our newsletter for regular updates and expert analysis. [Link to newsletter signup]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Slowdown? Jamie Dimon Issues Urgent Warning. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Court Sides With Son Tricked Into Moving To Africa By Parents

Jun 13, 2025

Court Sides With Son Tricked Into Moving To Africa By Parents

Jun 13, 2025 -

Landmark Me Too Retrial Jury Convicts Harvey Weinstein

Jun 13, 2025

Landmark Me Too Retrial Jury Convicts Harvey Weinstein

Jun 13, 2025 -

No Injuries Following Jet Blue Planes Grass Landing At Bostons Logan Airport

Jun 13, 2025

No Injuries Following Jet Blue Planes Grass Landing At Bostons Logan Airport

Jun 13, 2025 -

Rachel Reeves Economic Approach Deliberate And Sustainable

Jun 13, 2025

Rachel Reeves Economic Approach Deliberate And Sustainable

Jun 13, 2025 -

Antonio Senzatelas Performance Key To Rockies Victory In Game 68

Jun 13, 2025

Antonio Senzatelas Performance Key To Rockies Victory In Game 68

Jun 13, 2025

Latest Posts

-

No Injuries In Jet Blue Runway Excursion At Logan International Airport

Jun 14, 2025

No Injuries In Jet Blue Runway Excursion At Logan International Airport

Jun 14, 2025 -

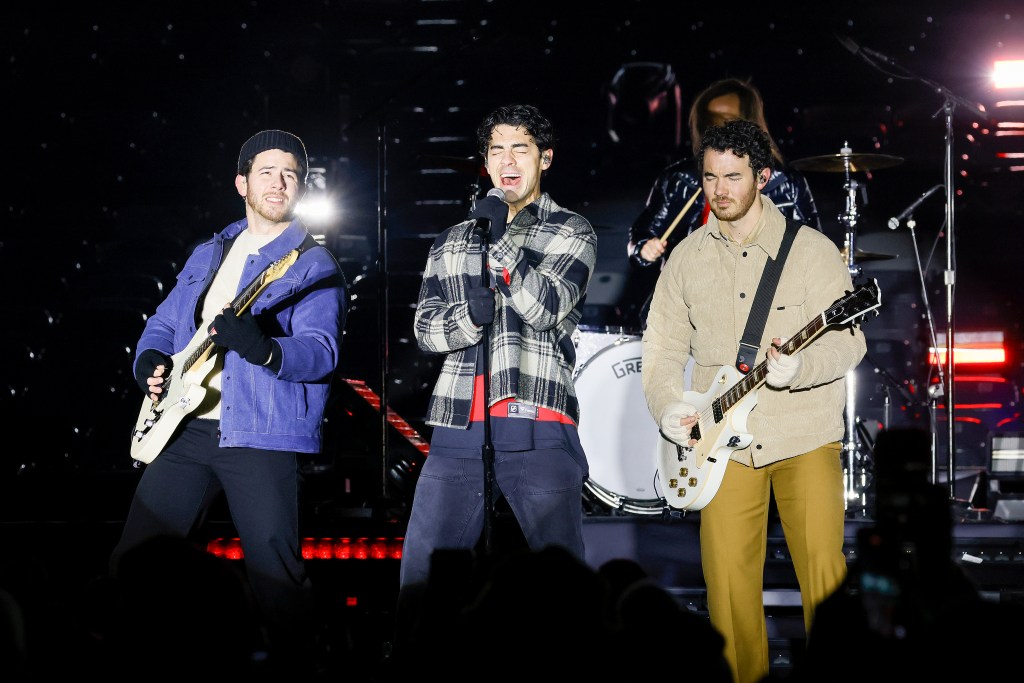

Jonas Brothers Cancel Multiple Concerts Including Chicagos Wrigley Field

Jun 14, 2025

Jonas Brothers Cancel Multiple Concerts Including Chicagos Wrigley Field

Jun 14, 2025 -

Illini Mens Golf A Look At Former Players Professional Careers June 9 2025

Jun 14, 2025

Illini Mens Golf A Look At Former Players Professional Careers June 9 2025

Jun 14, 2025 -

Trump Addresses Rand Pauls White House Picnic Invitation A Dispute Resolved

Jun 14, 2025

Trump Addresses Rand Pauls White House Picnic Invitation A Dispute Resolved

Jun 14, 2025 -

Wall Streets Strange Bets Analyzing Unusual Trading Patterns

Jun 14, 2025

Wall Streets Strange Bets Analyzing Unusual Trading Patterns

Jun 14, 2025