End Of An Era? TSB's Future Uncertain After Santander Deal

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

End of an Era? TSB's Future Uncertain After Santander Deal

The future of TSB Bank hangs in the balance following its turbulent history since being spun off from Santander in 2013. While initially seen as a promising independent challenger bank, a series of IT failures and strategic missteps have left its long-term viability uncertain. The recent lack of significant strategic moves from its parent company, Spain's Banco Santander, has fueled speculation about a potential sale or merger, raising questions about what this means for customers, employees, and the UK banking landscape.

A Rocky Road to Independence:

TSB's journey since its separation from Santander has been far from smooth. The infamous 2018 IT meltdown, which left millions of customers locked out of their accounts for weeks, severely damaged its reputation and eroded customer trust. While the bank has attempted to recover, regaining that lost confidence has proven a significant challenge. Subsequently, a series of profit warnings and leadership changes haven't exactly painted a picture of stability and growth. This instability contrasts sharply with the initial optimism surrounding the bank's independence.

Santander's Silent Strategy:

Banco Santander's relatively quiet approach to TSB's future is fueling much of the current uncertainty. While they've repeatedly affirmed their commitment to the UK market, the lack of concrete plans for TSB's long-term growth has led to market speculation. The absence of significant investment or a clear strategic direction raises questions about whether Santander views TSB as a core part of its future portfolio. This silence has created an environment ripe for rumors of a potential sale or merger with a competitor.

What Does the Future Hold for TSB?

Several scenarios are currently being discussed:

- Acquisition by a Competitor: Several larger UK banks could see TSB as an attractive acquisition target, particularly its branch network and customer base. However, regulatory hurdles and potential antitrust concerns would need to be overcome.

- Merger with Another Bank: A merger with a similarly sized bank could offer synergies and cost savings, creating a stronger, more competitive entity.

- Continued Independent Operation (But Under What Conditions?): Santander could decide to continue operating TSB independently, but this would likely require a significant investment in its technology, infrastructure, and brand image to overcome its past issues. This option seems less likely given the current market conditions and TSB's recent performance.

- Significant Restructuring: A major restructuring focusing on cost-cutting and efficiency improvements could be implemented to improve profitability and attract potential investors. This might involve branch closures and job losses.

Impact on Customers and Employees:

The uncertainty surrounding TSB's future is understandably causing anxiety among both customers and employees. While Santander has pledged to prioritize customer service, the possibility of a sale or merger raises questions about account terms, interest rates, and branch accessibility. Employees also face uncertainty about their job security and future career prospects.

Conclusion: The end of an era for TSB may indeed be approaching. Whether that means acquisition, merger, restructuring, or continued independent operation remains to be seen. The coming months will be crucial in determining the fate of this once-promising challenger bank and its impact on the broader UK financial landscape. The actions of Banco Santander will be closely scrutinized by analysts, investors, and customers alike. Only time will tell what the future holds for TSB.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on End Of An Era? TSB's Future Uncertain After Santander Deal. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Lakers Land Ayton Two Year Contract Finalized After Portland Buyout

Jul 03, 2025

Lakers Land Ayton Two Year Contract Finalized After Portland Buyout

Jul 03, 2025 -

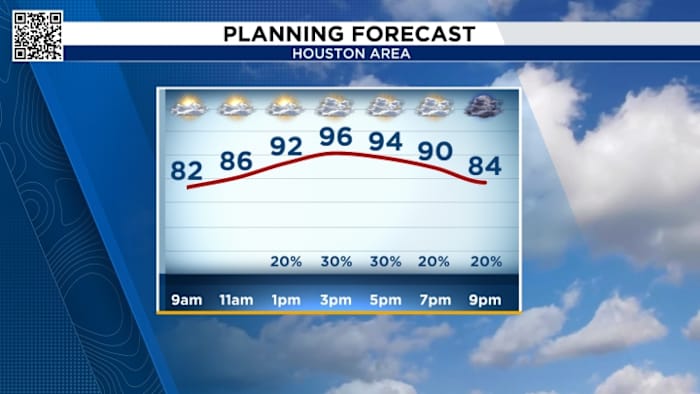

Houston Heatwave Hazy Skies And Dusty Conditions For July 4th Weekend

Jul 03, 2025

Houston Heatwave Hazy Skies And Dusty Conditions For July 4th Weekend

Jul 03, 2025 -

Datadog Ddog Stock Surges Outperforming Market Trends

Jul 03, 2025

Datadog Ddog Stock Surges Outperforming Market Trends

Jul 03, 2025 -

My Mps Voting Record Benefits System Reforms

Jul 03, 2025

My Mps Voting Record Benefits System Reforms

Jul 03, 2025 -

Missing Ayers Brothers Located Safe Return Confirmed In Pinal County

Jul 03, 2025

Missing Ayers Brothers Located Safe Return Confirmed In Pinal County

Jul 03, 2025