Enhanced Consumer Protections For Buy Now, Pay Later Services

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Enhanced Consumer Protections for Buy Now, Pay Later Services: What You Need to Know

Buy Now, Pay Later (BNPL) services have exploded in popularity, offering consumers a seemingly effortless way to purchase goods and services. But with this convenience comes the risk of spiraling debt if not managed carefully. Recognizing this, regulators are stepping up to enhance consumer protections surrounding BNPL, a crucial development for both consumers and the financial industry. This article explores the key changes and what they mean for you.

The Rise of BNPL and the Need for Regulation

The BNPL market has witnessed phenomenal growth, offering consumers flexible payment options at the point of sale. Services like Klarna, Affirm, and Afterpay have become ubiquitous, integrated into countless online and even brick-and-mortar retailers. However, this rapid expansion has outpaced regulatory frameworks, leaving many consumers vulnerable to unexpected fees, high interest rates, and potential debt traps. The lack of consistent oversight raised concerns about responsible lending practices and the potential for financial harm.

Key Enhancements to Consumer Protections

Several jurisdictions are implementing significant changes to bolster consumer protections in the BNPL space. These include:

-

Increased Transparency: Regulations are pushing for greater transparency regarding fees, interest rates, and repayment schedules. Consumers will have clearer information upfront, making informed decisions easier. This includes readily available information on total repayment costs and potential late payment penalties.

-

Credit Reporting: A major area of reform involves incorporating BNPL activity into credit reports. This allows lenders to assess a consumer's creditworthiness more accurately, preventing over-indebtedness and promoting responsible lending. However, the implementation and specifics of credit reporting vary across regions.

-

Debt Collection Practices: Stricter regulations are being implemented to govern debt collection practices associated with BNPL. This aims to protect consumers from aggressive or unfair collection tactics, ensuring a fairer and more humane process for those struggling with repayments.

-

Affordability Assessments: Some jurisdictions are introducing mandatory affordability checks before approving BNPL applications. This helps prevent consumers from taking on more debt than they can reasonably manage, mitigating the risk of financial hardship.

-

Improved Dispute Resolution: Clearer and more accessible dispute resolution mechanisms are being established, giving consumers a pathway to address complaints and resolve issues with BNPL providers efficiently.

What This Means for Consumers

These enhanced consumer protections aim to:

- Prevent Over-Indebtedness: By providing clearer information and affordability assessments, consumers are better equipped to avoid taking on excessive debt.

- Promote Responsible Borrowing: The increased transparency and credit reporting mechanisms encourage responsible borrowing habits.

- Provide Greater Protection Against Unfair Practices: Stricter regulations on debt collection and dispute resolution offer consumers a safety net against unfair or aggressive practices.

Staying Informed and Making Responsible Choices

While these regulatory changes are positive, consumers still have a crucial role to play. It's vital to:

- Read the terms and conditions carefully: Understand the fees, interest rates, and repayment schedule before committing to a BNPL agreement.

- Only use BNPL for purchases you can afford: Avoid using BNPL for impulsive buys or purchases beyond your budget.

- Track your repayments diligently: Keep a close eye on your repayment schedule to avoid late payment fees and negative impacts on your credit score.

- Seek help if you're struggling: If you are facing difficulties with repayments, contact your BNPL provider immediately to explore options like repayment plans.

The future of BNPL hinges on a balance between convenient payment options and responsible lending practices. The enhanced consumer protections discussed here represent a significant step towards achieving this balance, protecting consumers while ensuring the continued growth of this rapidly evolving financial sector. Stay informed about the specific regulations in your region to fully understand your rights and responsibilities.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Enhanced Consumer Protections For Buy Now, Pay Later Services. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

In Flight Cardiac Arrest Passengers Survival Attributed To Onboard Doctor And Device

May 20, 2025

In Flight Cardiac Arrest Passengers Survival Attributed To Onboard Doctor And Device

May 20, 2025 -

Gary Lineker Exit Fallout And Potential Replacements For Match Of The Day

May 20, 2025

Gary Lineker Exit Fallout And Potential Replacements For Match Of The Day

May 20, 2025 -

Improving Tourist Behavior In Bali A Call For Global Collaboration

May 20, 2025

Improving Tourist Behavior In Bali A Call For Global Collaboration

May 20, 2025 -

Bbc Faces Backlash Following Potential Lineker Exit

May 20, 2025

Bbc Faces Backlash Following Potential Lineker Exit

May 20, 2025 -

The Visionarys Method How One Self Made Billionaire Creates Innovative Concepts

May 20, 2025

The Visionarys Method How One Self Made Billionaire Creates Innovative Concepts

May 20, 2025

Latest Posts

-

Investors Bet Big On Ethereum 200 M Funding Surge After Pectra

May 20, 2025

Investors Bet Big On Ethereum 200 M Funding Surge After Pectra

May 20, 2025 -

Elite Swimmers Harrowing Account Emotional And Physical Abuse By Coach

May 20, 2025

Elite Swimmers Harrowing Account Emotional And Physical Abuse By Coach

May 20, 2025 -

Uk Self Driving Cars Delayed 2027 Target Ubers Claims And Regulatory Hurdles

May 20, 2025

Uk Self Driving Cars Delayed 2027 Target Ubers Claims And Regulatory Hurdles

May 20, 2025 -

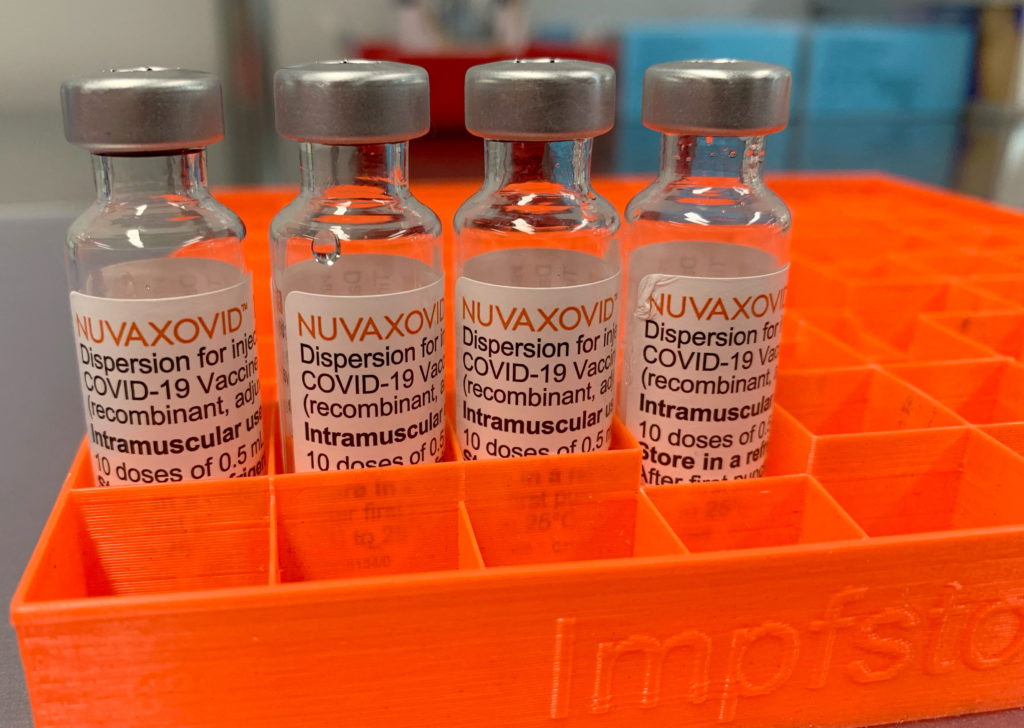

Fda Approval For Novavax Covid 19 Vaccine Strict Usage Restrictions Explained

May 20, 2025

Fda Approval For Novavax Covid 19 Vaccine Strict Usage Restrictions Explained

May 20, 2025 -

Gary Linekers Bbc Departure Is It Imminent

May 20, 2025

Gary Linekers Bbc Departure Is It Imminent

May 20, 2025