Enhanced Consumer Safeguards: The Future Of Buy Now, Pay Later Lending

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Enhanced Consumer Safeguards: The Future of Buy Now, Pay Later Lending

Buy Now, Pay Later (BNPL) services have exploded in popularity, offering consumers a seemingly effortless way to purchase goods and services. However, this rapid growth has also raised concerns about consumer debt and financial well-being. As a result, regulators and industry players are increasingly focusing on enhancing consumer safeguards within the BNPL landscape. This article explores the evolving regulatory environment and the future direction of responsible BNPL lending.

The Rise of BNPL and its Associated Risks

BNPL's convenience is undeniable. Its seamless integration into online checkout processes has made it a preferred payment method for millions. However, the ease of access also presents potential pitfalls. Many consumers, particularly younger generations, may underestimate the total cost, including interest and fees, leading to unforeseen debt burdens. This lack of financial literacy, coupled with the often-low credit score requirements, contributes to the risk of overspending and financial hardship. A recent study by [insert credible source, e.g., a consumer finance watchdog] highlighted a significant increase in BNPL-related debt defaults among younger borrowers.

Emerging Regulatory Scrutiny and Enhanced Safeguards

Recognizing these risks, governments worldwide are stepping up regulatory oversight. The focus is on implementing measures that protect consumers without stifling innovation. Key areas of regulatory focus include:

- Improved Transparency: Clearer disclosure of fees, interest rates, and repayment terms is crucial. Regulations are pushing for simplified language and easily accessible information to ensure consumers understand the full cost before committing.

- Credit Reporting: Integrating BNPL transactions into credit reports is a significant development. This allows lenders to assess a borrower's overall creditworthiness more accurately, potentially preventing over-indebtedness. However, this also raises concerns about the potential for negative impacts on credit scores for missed payments.

- Affordability Assessments: Stricter affordability checks are being introduced to ensure consumers can realistically repay their BNPL loans. This may involve verifying income and assessing existing debt obligations before approving a loan.

- Debt Collection Practices: Regulations are targeting aggressive debt collection practices, promoting fair and responsible methods to handle overdue payments. This includes limits on communication frequency and restrictions on harassing tactics.

The Future of Responsible BNPL Lending

The future of BNPL hinges on responsible lending practices and robust consumer protection. Industry players are responding to regulatory pressure by adopting:

- Built-in Affordability Checks: Many BNPL providers are proactively incorporating advanced affordability assessments into their platforms to minimize the risk of over-indebtedness.

- Financial Literacy Initiatives: Educating consumers about the responsible use of BNPL is crucial. Many providers are investing in financial literacy programs to empower consumers to make informed decisions.

- Proactive Debt Management Tools: Innovative tools like budgeting apps and debt repayment plans are being integrated into BNPL platforms to help consumers manage their repayments effectively.

Conclusion:

The enhanced consumer safeguards being implemented are a crucial step towards ensuring the sustainable growth of the BNPL sector. While the convenience of BNPL is undeniable, a responsible approach that prioritizes consumer protection is essential. The future success of BNPL depends on a balance between innovation and responsible lending practices, ensuring that this convenient payment method benefits consumers without jeopardizing their financial well-being. Further monitoring and adaptation of regulations will be crucial in navigating this evolving landscape. For more information on responsible borrowing, you can visit [link to a reputable financial literacy website].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Enhanced Consumer Safeguards: The Future Of Buy Now, Pay Later Lending. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

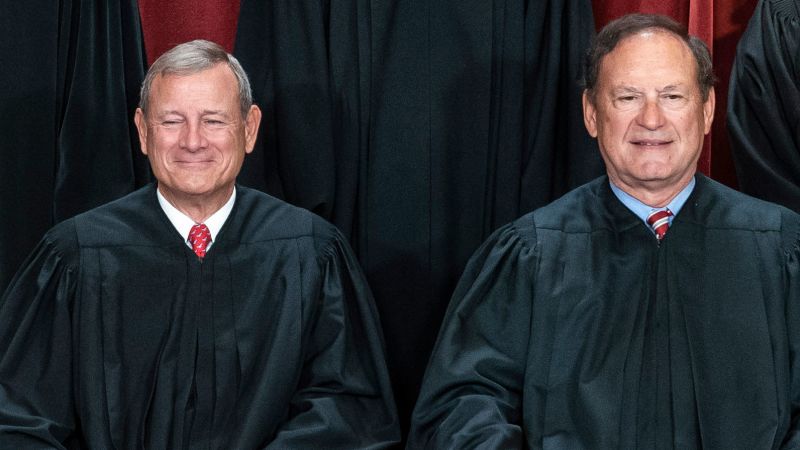

Assessing Two Decades Of Alito And Roberts On The Supreme Court

May 21, 2025

Assessing Two Decades Of Alito And Roberts On The Supreme Court

May 21, 2025 -

Mercedes Benzs Electric G Wagon A Special Gift For League Of Legends Uzi

May 21, 2025

Mercedes Benzs Electric G Wagon A Special Gift For League Of Legends Uzi

May 21, 2025 -

Femicide In The Spotlight Recent Deaths Of A Colombian Model And Mexican Influencer Ignite Public Anger

May 21, 2025

Femicide In The Spotlight Recent Deaths Of A Colombian Model And Mexican Influencer Ignite Public Anger

May 21, 2025 -

Ny Ag James Attacks Doj Probe While Highlighting Trump Legal Battles

May 21, 2025

Ny Ag James Attacks Doj Probe While Highlighting Trump Legal Battles

May 21, 2025 -

Manhunt Intensifies All Four Escaped New Orleans Inmates Now In Custody

May 21, 2025

Manhunt Intensifies All Four Escaped New Orleans Inmates Now In Custody

May 21, 2025

Latest Posts

-

After Trump Cuts Funding Sesame Street Finds New Home On Netflix

May 22, 2025

After Trump Cuts Funding Sesame Street Finds New Home On Netflix

May 22, 2025 -

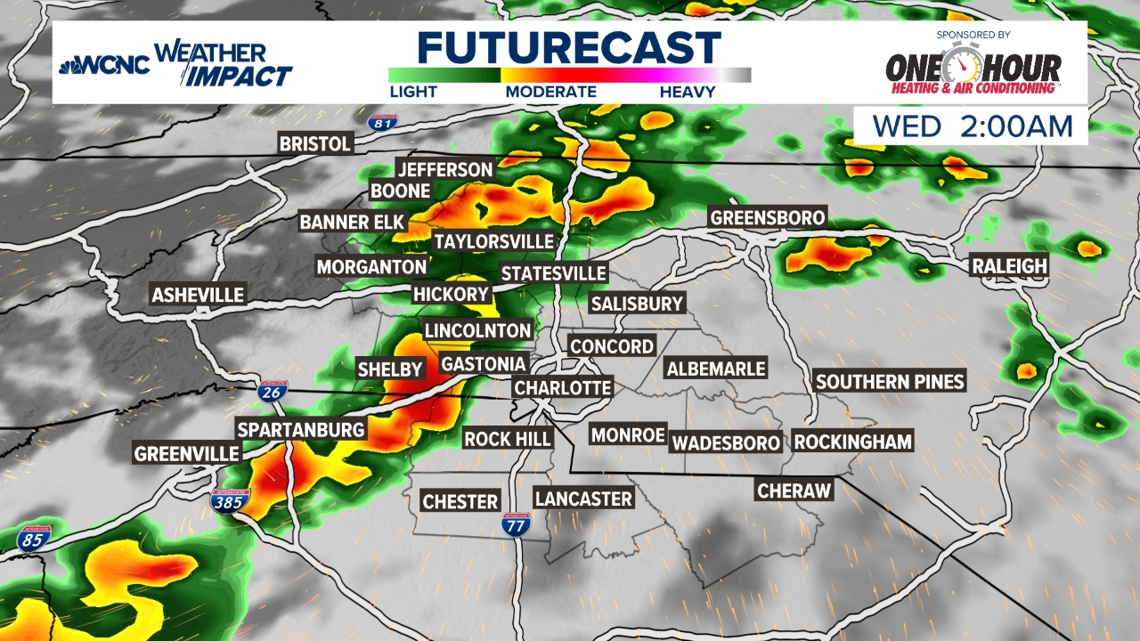

Isolated Severe Storms Possible Tuesday Night Stay Informed

May 22, 2025

Isolated Severe Storms Possible Tuesday Night Stay Informed

May 22, 2025 -

Data Breach At Post Office Compensation For Affected Customers

May 22, 2025

Data Breach At Post Office Compensation For Affected Customers

May 22, 2025 -

Irreplaceable Loss Ellen De Generes Touching Family Obituary

May 22, 2025

Irreplaceable Loss Ellen De Generes Touching Family Obituary

May 22, 2025 -

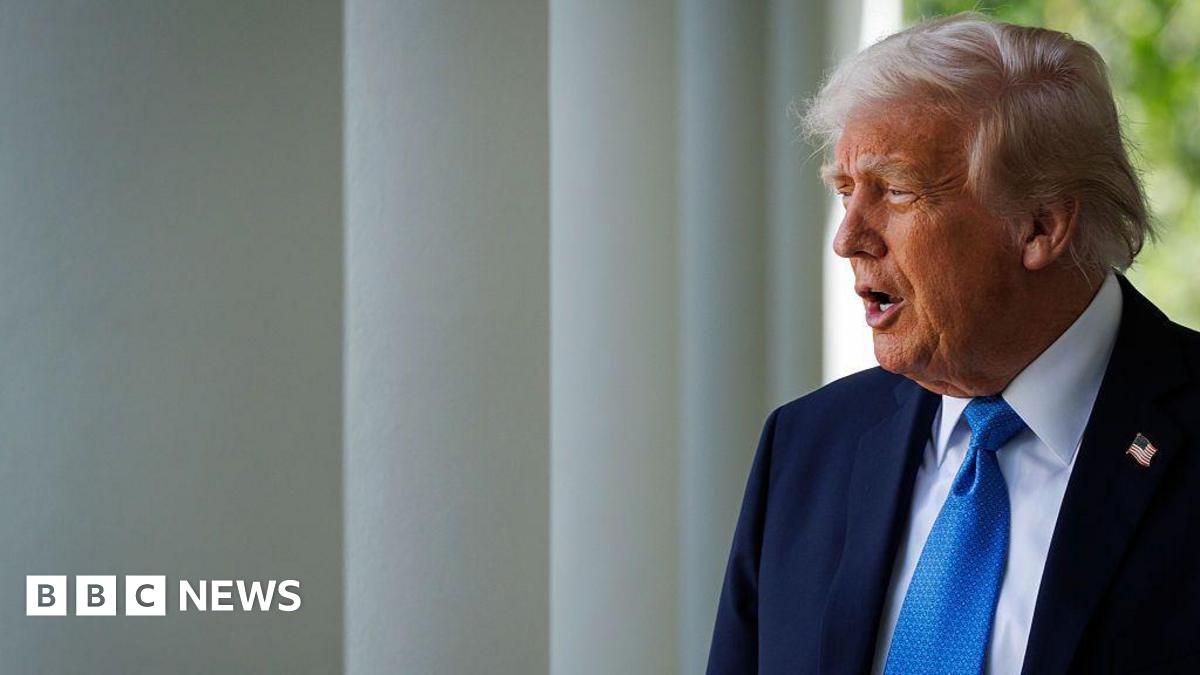

Trump And Putins Call What It Means For The Future Of Ukraine

May 22, 2025

Trump And Putins Call What It Means For The Future Of Ukraine

May 22, 2025