Evaluating Robinhood Stock: Risks And Rewards For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Evaluating Robinhood Stock: Risks and Rewards for Investors

Robinhood, the once-darling of the investing world, has experienced a turbulent journey since its highly anticipated IPO. While its disruptive commission-free trading platform revolutionized retail investing, the company now faces significant challenges and opportunities that investors must carefully consider. This article will delve into the key risks and rewards associated with investing in Robinhood stock, helping you make an informed decision.

The Rise and Fall (and Potential Rise Again?) of Robinhood

Robinhood’s meteoric rise was fueled by its user-friendly app and its democratization of investing. Millions flocked to the platform, attracted by the promise of commission-free trading and a gamified investing experience. However, this rapid growth was accompanied by regulatory scrutiny, increased competition, and significant operational challenges. The company's stock price, which initially soared, has since experienced considerable volatility.

Key Risks for Robinhood Investors:

-

Increased Competition: The brokerage industry is incredibly competitive. Established players like Fidelity and Charles Schwab, along with newer entrants, constantly challenge Robinhood's market share. This intense competition puts pressure on margins and limits Robinhood's ability to significantly increase its revenue.

-

Regulatory Scrutiny: Robinhood has faced numerous regulatory investigations and fines related to its practices, including allegations of misleading customers and inadequate risk management. Further regulatory actions could significantly impact the company's profitability and reputation.

-

Dependence on Trading Revenue: A significant portion of Robinhood's revenue comes from payment for order flow (PFOF), a practice that has drawn criticism. Changes in regulatory rules or shifts in investor behavior could negatively impact this revenue stream. [Link to article about Payment for Order Flow]

-

Financial Performance: Robinhood's financial performance has been inconsistent, marked by periods of significant losses. While the company is working to diversify its revenue streams, its ability to achieve sustained profitability remains a key concern for investors. [Link to Robinhood's latest financial report]

-

User Acquisition and Retention: Maintaining a strong user base is crucial for Robinhood's success. Attracting and retaining users in a crowded market requires constant innovation and investment, which can strain resources.

Potential Rewards for Robinhood Investors:

-

Large and Growing User Base: Despite challenges, Robinhood maintains a substantial user base, providing a solid foundation for future growth. This large customer base offers significant potential for expanding into new financial products and services.

-

Innovation and Expansion: Robinhood continues to innovate, exploring new products and services to broaden its appeal and revenue streams. Expansion into areas like crypto trading and financial planning could unlock significant growth opportunities.

-

Potential for Market Share Growth: Despite the competition, Robinhood still has the potential to capture further market share, particularly among younger investors. Effective marketing and product development could drive user growth and boost revenue.

-

Long-Term Growth Potential: While the short-term outlook might be uncertain, some analysts believe that Robinhood has long-term growth potential, particularly if it successfully navigates its regulatory challenges and expands its product offerings.

Conclusion: A High-Risk, High-Reward Proposition?

Investing in Robinhood stock presents a high-risk, high-reward proposition. While the company has the potential for significant growth, investors must carefully consider the substantial risks involved. Thorough due diligence, including a review of the company's financial statements and regulatory filings, is crucial before making any investment decision. Remember to consult with a financial advisor before investing in any stock, especially one with the volatility of Robinhood.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Evaluating Robinhood Stock: Risks And Rewards For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

North Pacific Car Carrier Fire 22 Crew Members Saved

Jun 05, 2025

North Pacific Car Carrier Fire 22 Crew Members Saved

Jun 05, 2025 -

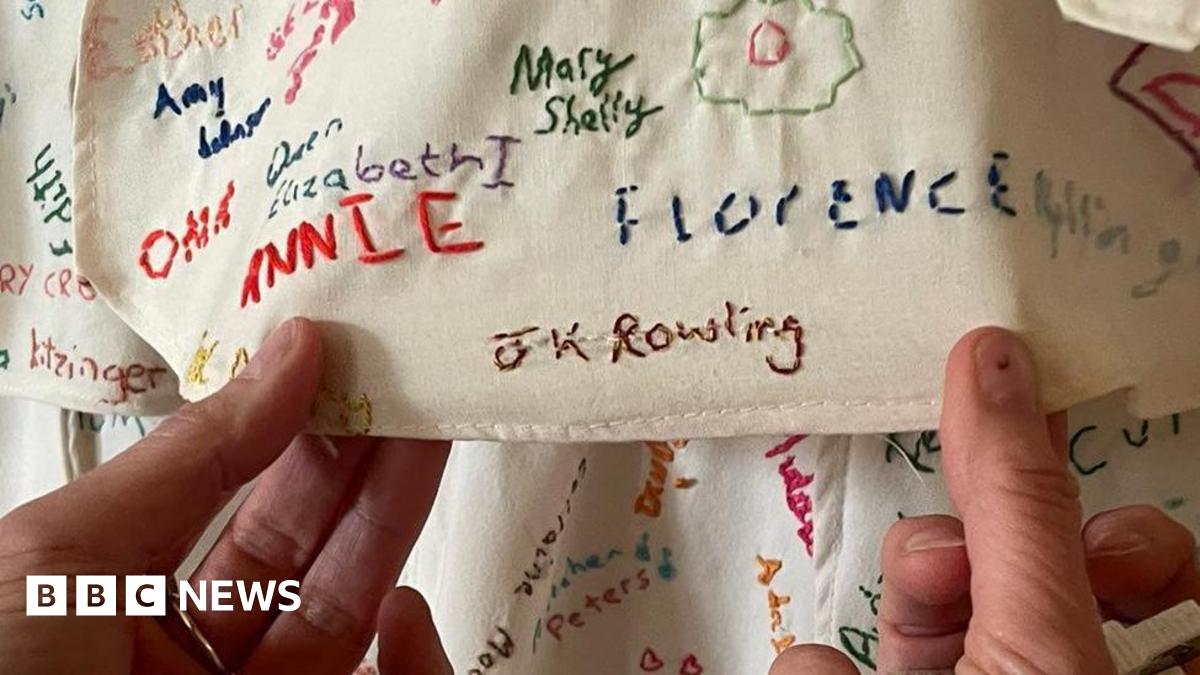

Controversy At Derbyshire National Trust Damaged J K Rowling Artwork Covered

Jun 05, 2025

Controversy At Derbyshire National Trust Damaged J K Rowling Artwork Covered

Jun 05, 2025 -

High Tech Project Disaster What Went Wrong And How To Avoid It

Jun 05, 2025

High Tech Project Disaster What Went Wrong And How To Avoid It

Jun 05, 2025 -

Exploring Grace Potters Musical Archives A Look Inside The Vault

Jun 05, 2025

Exploring Grace Potters Musical Archives A Look Inside The Vault

Jun 05, 2025 -

Core Weaves Potential Could Nvidias Venture Become A Top Us Company

Jun 05, 2025

Core Weaves Potential Could Nvidias Venture Become A Top Us Company

Jun 05, 2025

Latest Posts

-

Travel Smart Understanding Measles Risks And Prevention

Aug 16, 2025

Travel Smart Understanding Measles Risks And Prevention

Aug 16, 2025 -

Court Blocks Trump Administrations Attempt To Limit Dei Initiatives In Higher Education

Aug 16, 2025

Court Blocks Trump Administrations Attempt To Limit Dei Initiatives In Higher Education

Aug 16, 2025 -

Legal Victory For Dei Judge Strikes Down Trump Era Restrictions On Diversity Initiatives

Aug 16, 2025

Legal Victory For Dei Judge Strikes Down Trump Era Restrictions On Diversity Initiatives

Aug 16, 2025 -

Wooler Playgrounds Long Road Back Reopening After Wwii Bomb Discovery

Aug 16, 2025

Wooler Playgrounds Long Road Back Reopening After Wwii Bomb Discovery

Aug 16, 2025 -

Behind The Scenes With Kaitlan Collins National Guard And Trump Putin Summit Coverage

Aug 16, 2025

Behind The Scenes With Kaitlan Collins National Guard And Trump Putin Summit Coverage

Aug 16, 2025