Executive Order Imminent: Trump's Plan To Combat "Debanking"

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Executive Order Imminent: Trump's Plan to Combat "Debanking"

The former President's renewed focus on financial restrictions against conservative voices sparks debate and anticipation.

Donald Trump's potential executive order targeting "debanking," the perceived practice of financial institutions restricting services to politically conservative individuals and organizations, is generating significant buzz. While details remain scarce, the anticipated order promises a major shift in the ongoing battle between financial institutions and those who allege political discrimination. This move comes as conservatives continue to voice concerns about what they see as unfair treatment by major banks and payment processors.

This isn't the first time this issue has garnered attention. Similar accusations have been leveled at financial institutions in the past, sparking investigations and debates about free speech and fair access to financial services. The potential impact of Trump's executive order is far-reaching, potentially affecting everything from campaign finance to everyday banking practices for millions of Americans.

Understanding the "Debanking" Controversy:

The term "debanking," while not a formally recognized legal term, describes the alleged practice of banks and payment processors closing accounts or refusing services to individuals or groups based on their political affiliations or viewpoints. Conservatives argue this constitutes censorship and a violation of their First Amendment rights. Conversely, financial institutions often cite concerns about compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations as justification for their actions. This creates a complex legal and ethical gray area.

What might Trump's Executive Order Include?

While the specifics of the executive order remain shrouded in secrecy, several potential components have been speculated upon:

- Investigations into Financial Institutions: The order might initiate investigations into specific banks and payment processors suspected of discriminatory practices. This could involve subpoenas, audits, and potentially legal action.

- Regulatory Changes: The order could aim to modify existing regulations to better protect individuals and organizations from perceived politically motivated restrictions on financial services. This could involve changes to AML and KYC guidelines.

- Increased Transparency: A focus on greater transparency from financial institutions regarding their account closure policies could be a key element. This would likely require more detailed reporting and justification for account closures.

- Protection for Conservative Groups: The order might specifically address the concerns of conservative organizations that claim to have faced disproportionate restrictions on their access to financial services.

The Potential Fallout:

The proposed executive order faces significant legal challenges. Critics argue that such an order could interfere with the independent operations of financial institutions and potentially violate established legal precedents. The potential for lawsuits and legal battles is considerable. Furthermore, the order could strain the already fraught relationship between the financial sector and the Republican Party.

Looking Ahead:

The unveiling of Trump's executive order is eagerly awaited. Its impact on the financial landscape, the political climate, and the ongoing debate about free speech and financial access will undoubtedly be substantial. Further analysis and legal interpretations will be crucial in assessing its long-term consequences. Stay tuned for updates as this developing story unfolds. We will continue to provide timely and in-depth coverage as more information becomes available. What are your thoughts on this developing situation? Share your opinion in the comments below.

(Note: This article is for informational purposes only and does not constitute legal or financial advice. Consult with relevant professionals for guidance on specific situations.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Executive Order Imminent: Trump's Plan To Combat "Debanking". We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Inside Paramount First Impressions Of David Ellisons Management

Aug 09, 2025

Inside Paramount First Impressions Of David Ellisons Management

Aug 09, 2025 -

2025 Western And Southern Open Collins 61 Vs Townsend 75 Match Preview

Aug 09, 2025

2025 Western And Southern Open Collins 61 Vs Townsend 75 Match Preview

Aug 09, 2025 -

Nerazzurri Summer Friendlies Get Your Tickets Today

Aug 09, 2025

Nerazzurri Summer Friendlies Get Your Tickets Today

Aug 09, 2025 -

Kristi Noem Roasted In Latest South Park Episode Cnn Reports

Aug 09, 2025

Kristi Noem Roasted In Latest South Park Episode Cnn Reports

Aug 09, 2025 -

Ten Year Study Highlights The Connection Between Vitamin B12 And Dementia

Aug 09, 2025

Ten Year Study Highlights The Connection Between Vitamin B12 And Dementia

Aug 09, 2025

Latest Posts

-

From Courtside To Cyberspace How Wnba Sex Toy Tosses Highlight Online Behavior And Womens Sports Issues

Aug 10, 2025

From Courtside To Cyberspace How Wnba Sex Toy Tosses Highlight Online Behavior And Womens Sports Issues

Aug 10, 2025 -

Ufc Fight Night Edwards Vs Cachoeira Betting Odds And Analysis

Aug 10, 2025

Ufc Fight Night Edwards Vs Cachoeira Betting Odds And Analysis

Aug 10, 2025 -

Jaxson Darts Preseason Debut Best Plays And Highlights From Week 1

Aug 10, 2025

Jaxson Darts Preseason Debut Best Plays And Highlights From Week 1

Aug 10, 2025 -

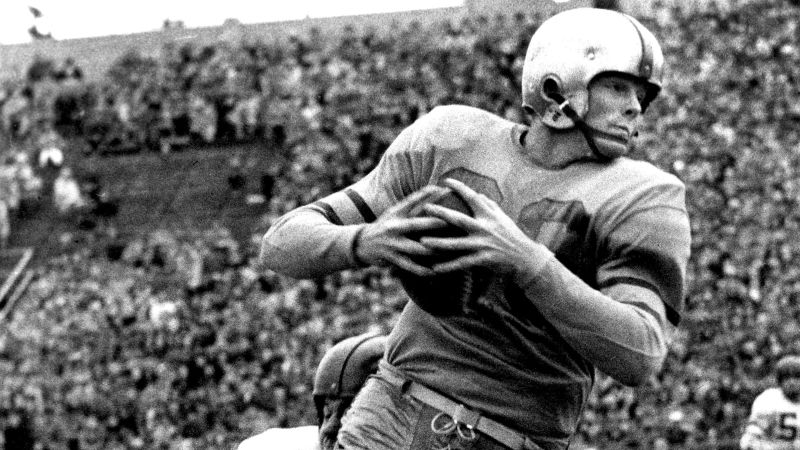

Hall Of Fame Candidate Billy Howton Packers Star And Nflpa Founder Dead At 95

Aug 10, 2025

Hall Of Fame Candidate Billy Howton Packers Star And Nflpa Founder Dead At 95

Aug 10, 2025 -

Apollo 13s Jim Lovell A Life In Space And A Nations Tribute

Aug 10, 2025

Apollo 13s Jim Lovell A Life In Space And A Nations Tribute

Aug 10, 2025