Executive Order On "Debanking": Understanding Trump's Latest Move

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Executive Order on "Debanking": Understanding Trump's Latest Move

Former President Donald Trump's recent executive order targeting "debanking," while lacking the immediate force of law, ignites a firestorm of debate regarding financial regulations and political power. This move, shrouded in accusations of partisan targeting and perceived threats to financial stability, demands a closer look. What exactly is "debanking," and what are the potential implications of this executive order?

What is "Debanking"?

The term "debanking," while not a formally recognized financial term, refers to the practice of banks or financial institutions severing ties with a customer, often citing concerns about risk or compliance. This can range from refusing to open an account to closing existing accounts and halting services. While banks have always had the right to choose their customers, the controversy arises when this practice is perceived as politically motivated. Critics argue that "debanking" is used to silence dissenting voices or target specific political groups, undermining democratic principles.

Trump's Executive Order: A Closer Examination

Trump's executive order, though not legally binding without Congressional approval, aims to investigate and potentially combat what he terms unfair "debanking" practices. The order calls for a review of existing regulations and potentially proposes changes to protect businesses and individuals from discriminatory financial practices. The key argument centers around the assertion that certain banks are unfairly targeting individuals or entities associated with specific political viewpoints.

Key Arguments For and Against the Order

-

Proponents argue the order is necessary to protect businesses and individuals from politically motivated actions by financial institutions, ensuring fair access to financial services regardless of political affiliation. They highlight instances where conservative groups or individuals have allegedly faced disproportionate scrutiny.

-

Opponents, on the other hand, express concerns that the order could undermine the independence of financial institutions and create an environment where banks are hesitant to comply with anti-money laundering and other crucial regulatory requirements. They argue that focusing on political affiliations could expose banks to increased risk and potentially destabilize the financial system.

Legal Challenges and Future Implications

The legal validity and enforceability of the executive order are subject to significant debate. Legal challenges are anticipated, focusing on issues such as overreach of executive power and potential violations of due process. The outcome of these legal battles will significantly impact the future of financial regulations and the extent to which the government can intervene in the relationship between banks and their customers.

The Broader Context: Political Polarization and Financial Regulation

This executive order is a reflection of the increasing political polarization in the United States. The debate surrounding "debanking" exposes a deeper tension between political freedom and the responsibilities of financial institutions to maintain the integrity of the financial system. The outcome will likely influence future discussions about financial regulation and the balance between protecting individual rights and preventing financial risks.

Conclusion: An Ongoing Debate

Trump's executive order on "debanking" presents a complex and multifaceted challenge. The accusations of political targeting, coupled with concerns about financial stability, necessitate a thorough and balanced assessment. The ongoing legal battles and the evolving political landscape will ultimately determine the long-term impact of this controversial move. Further analysis and discussion are crucial to understanding the full implications for the financial sector and the broader political climate. Stay informed and follow the developments as this issue unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Executive Order On "Debanking": Understanding Trump's Latest Move. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ennis Rakestraw Addresses Online Harassment Controversy

Aug 09, 2025

Ennis Rakestraw Addresses Online Harassment Controversy

Aug 09, 2025 -

Inside Ecuadors Ganglands Cnn Reports From The Front Lines Of A Turf War

Aug 09, 2025

Inside Ecuadors Ganglands Cnn Reports From The Front Lines Of A Turf War

Aug 09, 2025 -

Ennis Rakestraw Addresses Online Harassment Calls For An End To Nasty Dms

Aug 09, 2025

Ennis Rakestraw Addresses Online Harassment Calls For An End To Nasty Dms

Aug 09, 2025 -

Rushanara Ali Defends London Property Rent Increase Amidst Criticism

Aug 09, 2025

Rushanara Ali Defends London Property Rent Increase Amidst Criticism

Aug 09, 2025 -

One In One Out First Migrants Returned To France Under New Agreement

Aug 09, 2025

One In One Out First Migrants Returned To France Under New Agreement

Aug 09, 2025

Latest Posts

-

Jaxson Darts Preseason Debut Best Plays And Highlights From Week 1

Aug 10, 2025

Jaxson Darts Preseason Debut Best Plays And Highlights From Week 1

Aug 10, 2025 -

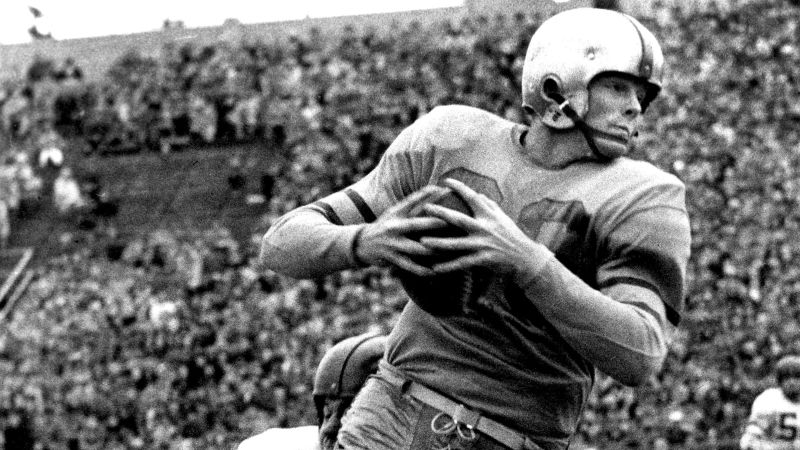

Hall Of Fame Candidate Billy Howton Packers Star And Nflpa Founder Dead At 95

Aug 10, 2025

Hall Of Fame Candidate Billy Howton Packers Star And Nflpa Founder Dead At 95

Aug 10, 2025 -

Apollo 13s Jim Lovell A Life In Space And A Nations Tribute

Aug 10, 2025

Apollo 13s Jim Lovell A Life In Space And A Nations Tribute

Aug 10, 2025 -

Nicola Sturgeons Memoir Arrest Detailed As Worst Day Of My Life

Aug 10, 2025

Nicola Sturgeons Memoir Arrest Detailed As Worst Day Of My Life

Aug 10, 2025 -

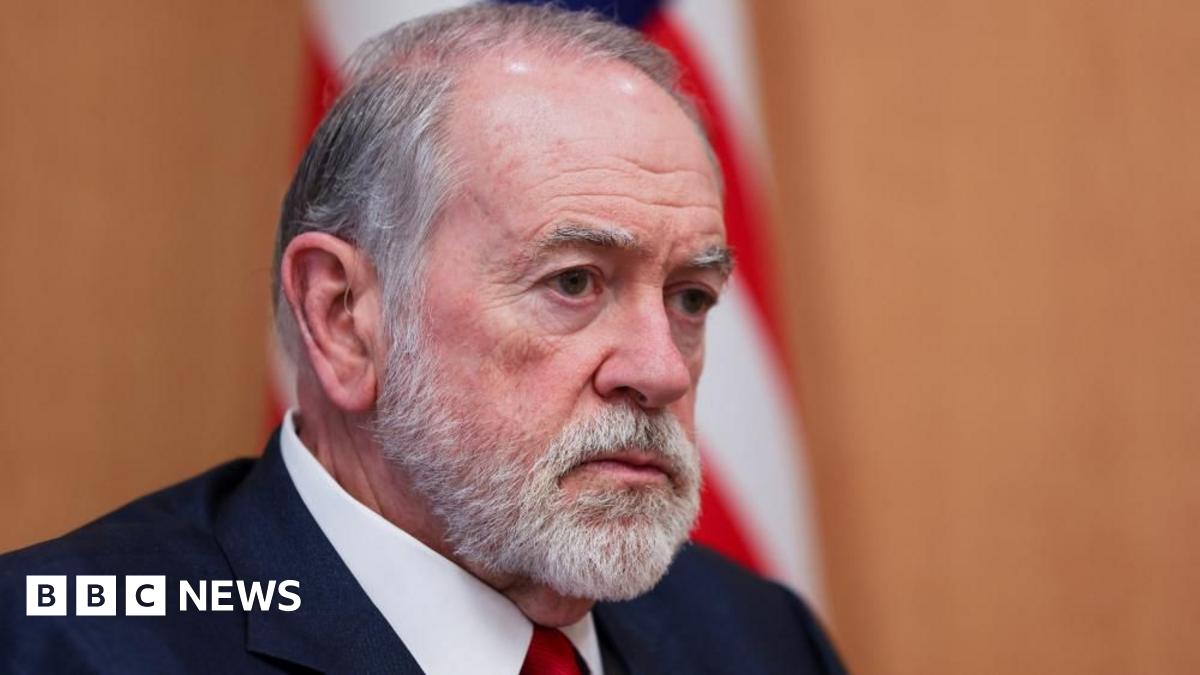

Mike Huckabee Weighs In Starmers Leadership And Wwii Hypothetical

Aug 10, 2025

Mike Huckabee Weighs In Starmers Leadership And Wwii Hypothetical

Aug 10, 2025