Expert Opinion: Federal Student Loans: The Smartest Option Despite Impending Changes

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Expert Opinion: Federal Student Loans Still the Smartest Option Despite Impending Changes

The landscape of student loan repayment is shifting, leaving many prospective students and borrowers wondering: are federal student loans still the best option? With significant changes on the horizon, including the end of the COVID-19 repayment pause and evolving repayment plans, the question is more relevant than ever. Our expert analysis reveals that, despite the uncertainties, federal student loans remain a smarter choice for most borrowers, but informed decision-making is crucial.

Navigating the Changing Landscape of Student Loan Repayment

The recent Supreme Court ruling on President Biden's student loan forgiveness plan has significantly altered the trajectory of student loan repayment. While widespread forgiveness is off the table for now, the impending return to standard repayment schedules and the potential for future legislative changes underscore the need for borrowers to understand their options. This uncertainty, however, shouldn't overshadow the inherent advantages of federal student loans.

Why Federal Student Loans Remain a Superior Choice

Despite the looming changes, several key benefits solidify the position of federal student loans as a preferable option:

-

Flexible Repayment Plans: Federal student loans offer a range of repayment plans, including income-driven repayment (IDR) plans, which adjust monthly payments based on income and family size. This flexibility can be crucial for graduates entering the workforce with varying earning potentials. Understanding these plans is critical; you can explore them in detail on the .

-

Robust Borrower Protections: Federal student loans provide critical protections unavailable with private loans. These include deferment and forbearance options during periods of financial hardship, as well as loan forgiveness programs for specific professions, like teaching or public service. These safeguards are invaluable in mitigating the risks associated with student loan debt.

-

Government Oversight and Transparency: Federal student loans are subject to government oversight, providing a layer of transparency and accountability that private lenders may not always offer. This ensures fair lending practices and protects borrowers from predatory lending.

-

Lower Interest Rates (Generally): While interest rates fluctuate, federal student loans typically offer lower interest rates compared to private student loans. This can significantly reduce the overall cost of borrowing over the life of the loan.

The Impact of Impending Changes

While the benefits of federal student loans are substantial, it's essential to acknowledge the upcoming changes:

-

The End of the Repayment Pause: The pause on federal student loan repayments is ending, requiring borrowers to resume payments. This will undoubtedly impact borrowers' budgets, highlighting the importance of carefully budgeting for repayments.

-

Revised Repayment Plans: The Department of Education is currently working on potential revisions to existing repayment plans. These changes could affect monthly payment amounts and overall repayment timelines, necessitating a close watch on updates from the government.

Making Informed Decisions in a Shifting Market

The key takeaway is that, despite the uncertainties, careful planning and understanding of your options are paramount. Before taking on any student loan debt, thoroughly research your options, compare federal and private loan offers, and consult with a financial advisor to create a personalized repayment strategy.

Call to Action: Stay informed about the latest developments in student loan repayment by regularly checking the . Proactive planning is your best defense against the challenges of student loan debt.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Expert Opinion: Federal Student Loans: The Smartest Option Despite Impending Changes. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

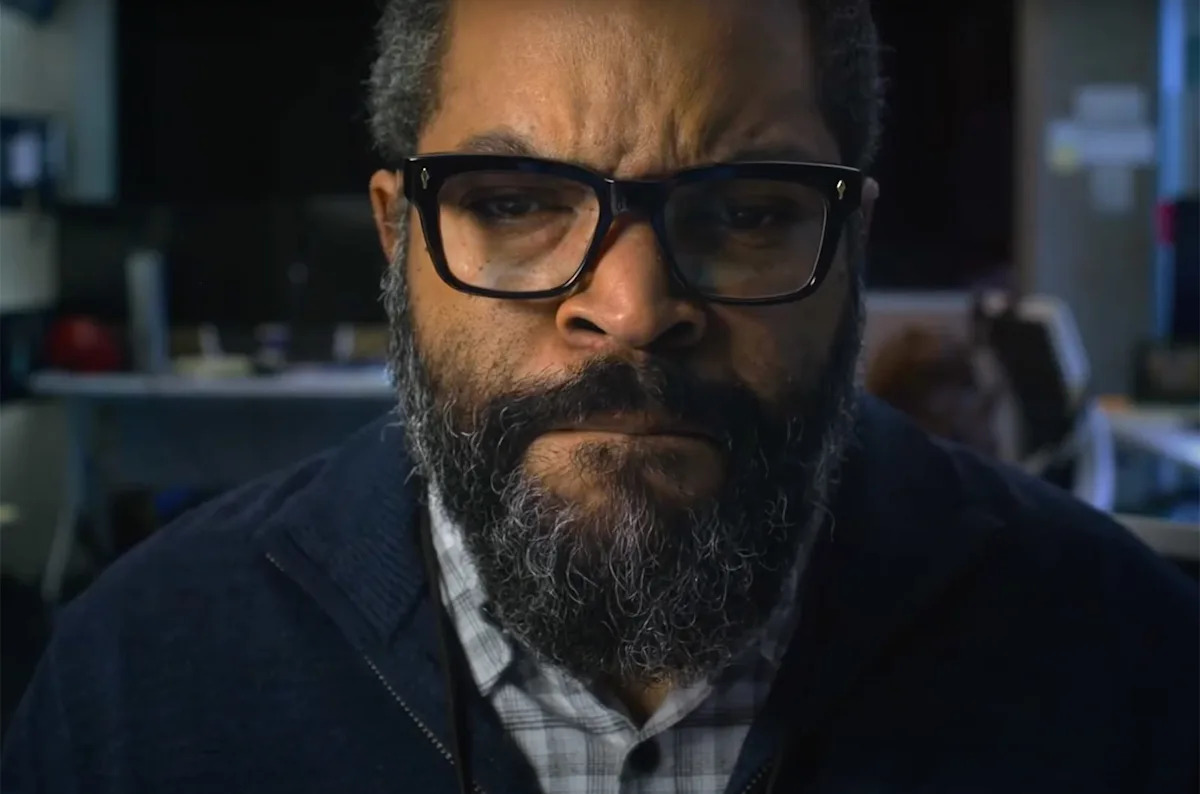

Ominous New Trailer Ice Cubes Take On War Of The Worlds

Jul 31, 2025

Ominous New Trailer Ice Cubes Take On War Of The Worlds

Jul 31, 2025 -

Bitcoin Investor Demand Falls Price Dip On The Horizon

Jul 31, 2025

Bitcoin Investor Demand Falls Price Dip On The Horizon

Jul 31, 2025 -

Transforming Unused Railway Land A 40 000 Home Development

Jul 31, 2025

Transforming Unused Railway Land A 40 000 Home Development

Jul 31, 2025 -

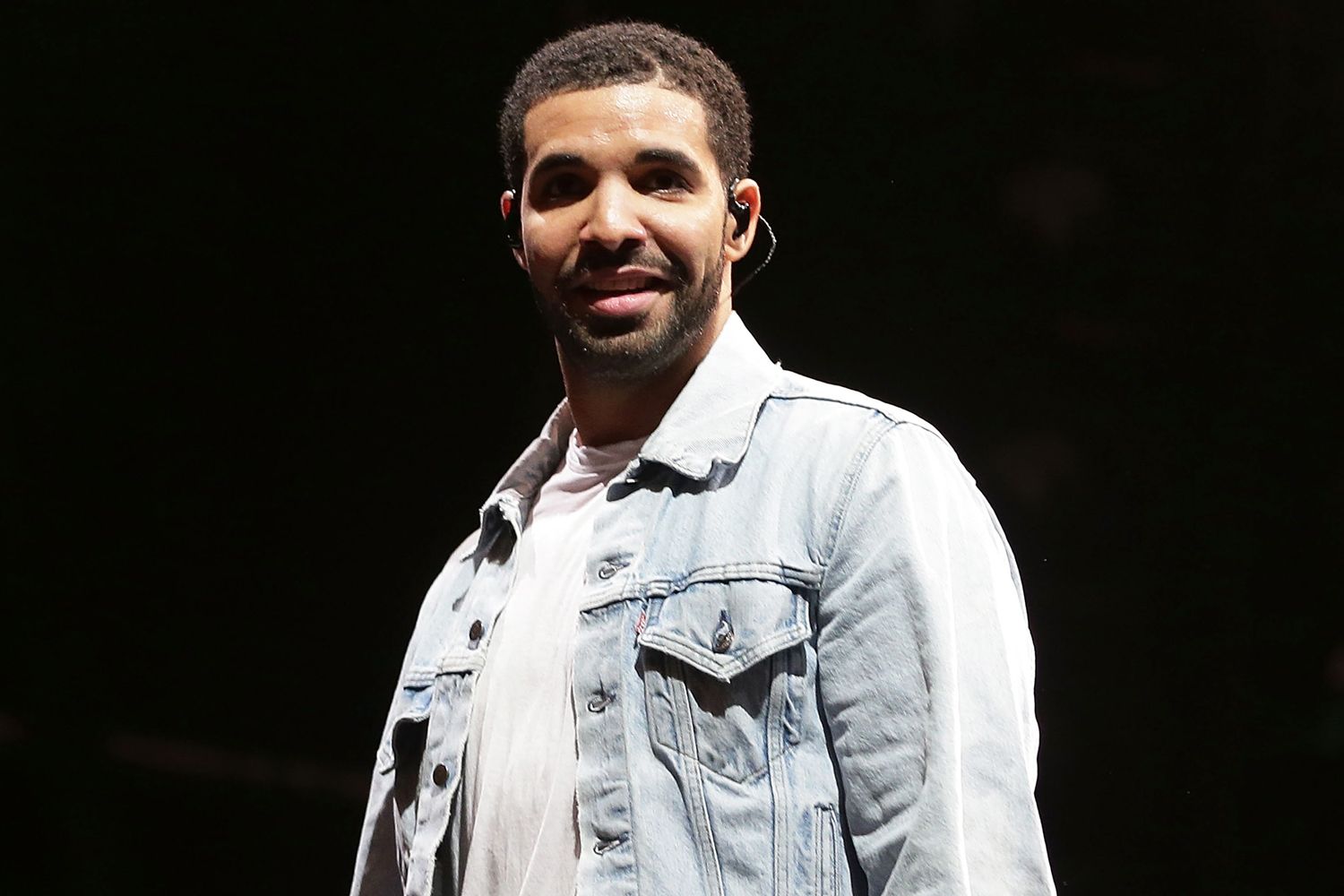

Australia And New Zealand Drakes Tour Cancellation Leaves Fans Disappointed

Jul 31, 2025

Australia And New Zealand Drakes Tour Cancellation Leaves Fans Disappointed

Jul 31, 2025 -

Small Business Manufacturing And Automation To Receive Aid New Sba Advocates Promise

Jul 31, 2025

Small Business Manufacturing And Automation To Receive Aid New Sba Advocates Promise

Jul 31, 2025

Latest Posts

-

Brazilian Government Actions Potential Threats To Us National Interests

Aug 01, 2025

Brazilian Government Actions Potential Threats To Us National Interests

Aug 01, 2025 -

Oyster Bay Womans 30 Million Fraud Scheme A Guilty Plea And Political Connections

Aug 01, 2025

Oyster Bay Womans 30 Million Fraud Scheme A Guilty Plea And Political Connections

Aug 01, 2025 -

Cnn Politics Examining The Maga Medias Rally Around Trump On Epstein Allegations

Aug 01, 2025

Cnn Politics Examining The Maga Medias Rally Around Trump On Epstein Allegations

Aug 01, 2025 -

Market Movers Apples Earnings Surprise Amazons Stock Slip Reddits Rally

Aug 01, 2025

Market Movers Apples Earnings Surprise Amazons Stock Slip Reddits Rally

Aug 01, 2025 -

Pop Cap Reimagines Plants Vs Zombies Replanted As Franchise Cornerstone

Aug 01, 2025

Pop Cap Reimagines Plants Vs Zombies Replanted As Franchise Cornerstone

Aug 01, 2025