Experts Weigh In: Federal Student Loans Remain Superior To Private Options

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Experts Weigh In: Federal Student Loans Remain Superior to Private Options

The looming weight of student loan debt is a significant concern for millions of Americans. Choosing the right loan to finance your education can feel overwhelming, but understanding the key differences between federal and private student loans is crucial. While private loans might seem appealing at first glance, experts overwhelmingly agree: federal student loans remain the superior choice for most borrowers.

This article will delve into the reasons why, examining the key advantages federal loans offer over their private counterparts. We'll explore repayment options, protections for borrowers, and the long-term financial implications of each choice.

Why Federal Student Loans Reign Supreme

Federal student loans offer a range of benefits unavailable with private loans. These benefits are particularly crucial for navigating the complexities and potential hardships of repayment.

1. Flexible Repayment Plans: Federal loans provide a variety of repayment plans tailored to individual circumstances. This includes income-driven repayment plans, which adjust your monthly payments based on your income and family size. These plans are lifesavers for graduates facing unexpected financial challenges. Private loans generally offer fewer options and less flexibility.

2. Robust Borrower Protections: Federal student loans offer significant borrower protections, including deferment and forbearance options. Deferment allows you to temporarily postpone payments without accruing interest (under certain circumstances), while forbearance allows you to temporarily reduce your payments. These options are vital during periods of unemployment or financial hardship. Private lenders rarely provide such comprehensive protections.

3. Loan Forgiveness Programs: Several federal student loan forgiveness programs exist, offering the possibility of having a portion or all of your debt forgiven after meeting specific requirements, such as working in public service. These programs provide a safety net and incentivize careers in vital sectors. Private loan forgiveness is exceedingly rare.

4. Lower Interest Rates: Historically, federal student loans have offered lower interest rates compared to private loans. This difference can significantly impact the total amount you pay over the life of the loan. While interest rates fluctuate, federal loans often provide a more favorable borrowing cost.

5. Government Oversight and Transparency: Federal student loans are subject to government regulations and oversight, ensuring fair lending practices and transparency. This provides an additional layer of protection for borrowers. Private lenders are subject to less stringent regulations.

When Private Loans Might Be Considered

While federal loans are generally recommended, there are limited situations where private loans might be a supplementary option:

- Insufficient Federal Funding: If you've exhausted your federal loan eligibility and still need funding, private loans may be considered. However, this should be approached cautiously and only after thoroughly researching the terms and conditions.

- Specific Educational Needs: Some specialized programs or educational institutions might not accept federal loans. In such cases, private loans may be the only viable option.

However, even in these situations, it is crucial to compare offers carefully and prioritize federal loans to the maximum extent possible.

Conclusion: Prioritize Federal Student Loans

Navigating the student loan landscape can be daunting. However, understanding the significant advantages of federal student loans is key to making informed financial decisions. Their flexibility, borrower protections, and potential for loan forgiveness make them an overwhelmingly superior choice compared to private options. Always prioritize maximizing your federal loan eligibility before considering private loans. Seek professional financial advice if you are unsure about the best course of action for your individual needs. Remember to thoroughly research and compare all loan options before signing any loan agreements.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Experts Weigh In: Federal Student Loans Remain Superior To Private Options. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Remembering A Son Fighting For Change Aviation Safety Advocacy After A Midair Collision

Aug 01, 2025

Remembering A Son Fighting For Change Aviation Safety Advocacy After A Midair Collision

Aug 01, 2025 -

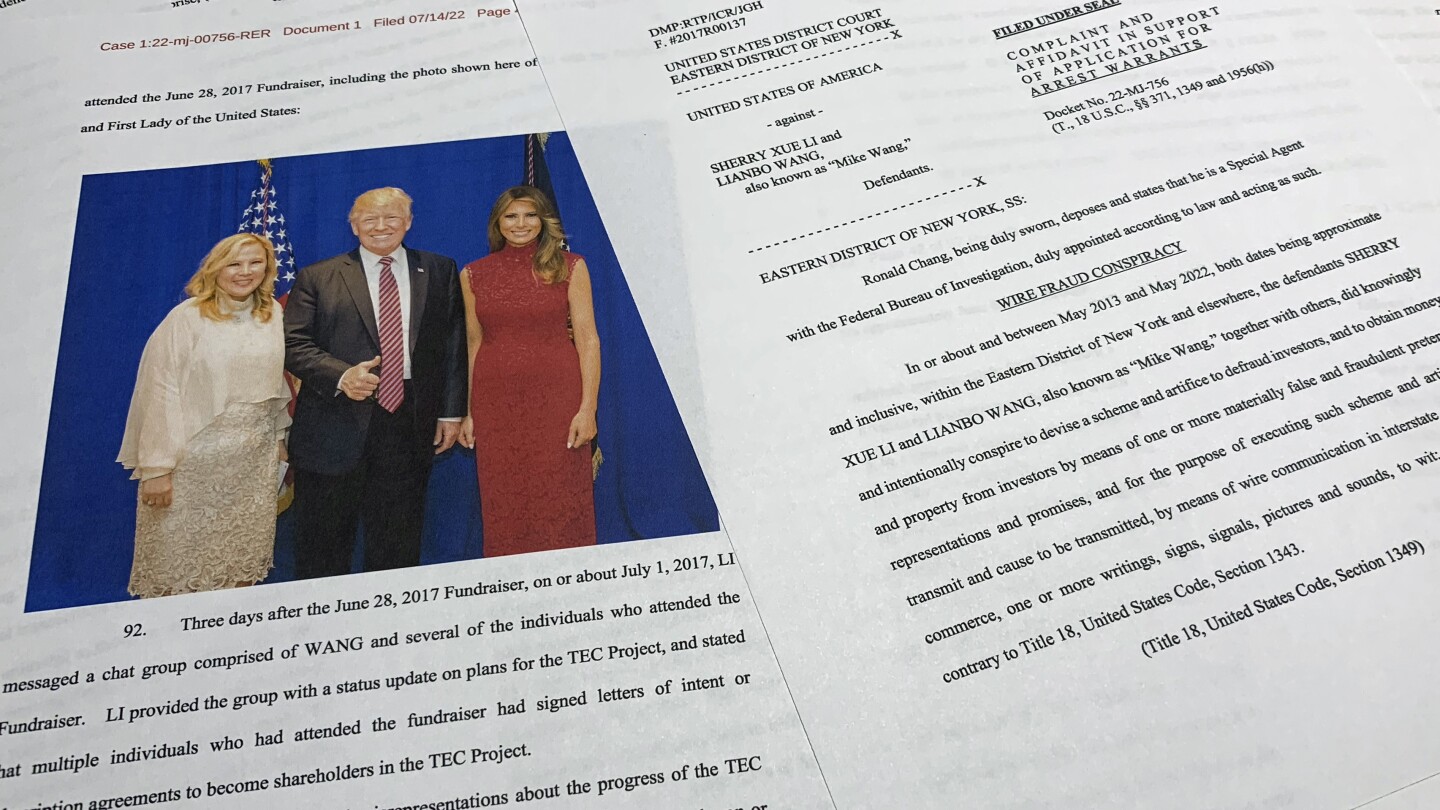

New York Investor Fraud Case Guilty Plea And Trump Fundraiser Link

Aug 01, 2025

New York Investor Fraud Case Guilty Plea And Trump Fundraiser Link

Aug 01, 2025 -

Californias High Speed Rail Project A Funding Plan Mandate

Aug 01, 2025

Californias High Speed Rail Project A Funding Plan Mandate

Aug 01, 2025 -

Manufacturing And Automation To Receive Boost From New Sba Advocate

Aug 01, 2025

Manufacturing And Automation To Receive Boost From New Sba Advocate

Aug 01, 2025 -

Top Events In El Paso This Weekend August 1st 3rd

Aug 01, 2025

Top Events In El Paso This Weekend August 1st 3rd

Aug 01, 2025

Latest Posts

-

Pattinsons Batman And Corenswets Superman A Gunn Sequel

Aug 02, 2025

Pattinsons Batman And Corenswets Superman A Gunn Sequel

Aug 02, 2025 -

Mega Millions Jackpot 8 1 25 Winning Numbers And Results

Aug 02, 2025

Mega Millions Jackpot 8 1 25 Winning Numbers And Results

Aug 02, 2025 -

Mr Beasts Team Trees Successor 40 Million Clean Water Initiative

Aug 02, 2025

Mr Beasts Team Trees Successor 40 Million Clean Water Initiative

Aug 02, 2025 -

No Pattinson As Batman James Gunn Clarifies Dcu Casting Rumors

Aug 02, 2025

No Pattinson As Batman James Gunn Clarifies Dcu Casting Rumors

Aug 02, 2025 -

Quentin Tarantino Breaks Silence On Michael Madsens Passing

Aug 02, 2025

Quentin Tarantino Breaks Silence On Michael Madsens Passing

Aug 02, 2025