Facing 15% Social Security Cuts In June 2025? New Rules Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Facing 15% Social Security Cuts in June 2025? New Rules Explained

Are you worried about potential Social Security cuts in 2025? Millions of Americans rely on Social Security benefits, and the possibility of a 15% reduction is a significant concern. While the situation is complex, understanding the potential changes and the new rules is crucial for planning your financial future. This article breaks down the key issues and helps you navigate this uncertainty.

The looming threat of substantial Social Security benefit cuts stems from the Social Security Trust Fund's projected insolvency. The fund, which pays out benefits to retirees, disabled individuals, and survivors, is facing a shortfall. Current projections indicate that the fund may be unable to pay 100% of scheduled benefits as early as June 2025, potentially leading to a significant reduction – estimated at around 15% – in payments.

What's causing the potential crisis?

Several factors contribute to the Social Security funding crisis:

- Aging Population: The US population is aging, meaning more people are receiving benefits while fewer are contributing through payroll taxes.

- Increased Life Expectancy: People are living longer, drawing benefits for a greater number of years.

- Declining Birth Rates: A lower birth rate means fewer workers are contributing to the system.

These factors create a growing imbalance between incoming payroll taxes and outgoing benefit payments.

Understanding the Proposed Solutions (and their limitations):

While the situation is serious, several potential solutions are being debated:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full retirement benefits. This would delay benefit payments, reducing the immediate financial burden on the trust fund.

- Increasing the Social Security Tax Rate: Raising the payroll tax rate, which would increase contributions from both employers and employees.

- Increasing the Taxable Earnings Base: Expanding the amount of earnings subject to Social Security taxes. Currently, there's a cap on earnings; increasing this cap would bring more high-income earners into the system.

- Benefit Reductions: This is the most drastic measure and the one currently projected to occur if no other changes are made. It involves reducing the amount of benefits paid to retirees, survivors, and the disabled.

What can you do now?

While the future of Social Security remains uncertain, proactive planning is crucial. Consider these steps:

- Monitor the situation closely: Stay informed about legislative developments and potential solutions. Reputable news sources and government websites are your best bet.

- Diversify your retirement income: Don't rely solely on Social Security. Explore other retirement savings options, such as 401(k)s, IRAs, and other investments.

- Plan for potential benefit reductions: Factor potential benefit cuts into your retirement planning. Adjust your spending projections and retirement timeline accordingly.

- Contact your elected officials: Let your voice be heard. Contact your representatives in Congress to express your concerns and encourage them to support solutions that ensure the long-term solvency of Social Security.

Conclusion:

The potential for a 15% cut to Social Security benefits in June 2025 is a serious concern that requires immediate attention. While the situation is complex, understanding the factors contributing to the crisis and the proposed solutions is the first step towards navigating this uncertainty. Proactive planning and engagement with the political process are vital to protecting your financial future and ensuring the long-term viability of Social Security for all Americans.

Disclaimer: This article provides information for educational purposes only and should not be considered financial advice. Consult with a qualified financial advisor for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Facing 15% Social Security Cuts In June 2025? New Rules Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analysis Jeanine Pirro Addresses Deadly Attack On Israeli Embassy

May 27, 2025

Analysis Jeanine Pirro Addresses Deadly Attack On Israeli Embassy

May 27, 2025 -

Fewer Inspectors Laxer Rules The Feds Retreat On Coal Miner Black Lung Prevention

May 27, 2025

Fewer Inspectors Laxer Rules The Feds Retreat On Coal Miner Black Lung Prevention

May 27, 2025 -

Znamy Juz Date I Godzine Pierwszego Meczu Igi Swiatek W Paryzu

May 27, 2025

Znamy Juz Date I Godzine Pierwszego Meczu Igi Swiatek W Paryzu

May 27, 2025 -

Rising Temperatures Fuel The Spread Of A Dangerous Internal Parasitizing Fungus

May 27, 2025

Rising Temperatures Fuel The Spread Of A Dangerous Internal Parasitizing Fungus

May 27, 2025 -

Can A Fungus Spread Through Your Body The Threat Of Global Warming

May 27, 2025

Can A Fungus Spread Through Your Body The Threat Of Global Warming

May 27, 2025

Latest Posts

-

Giannis Future Hangs In The Balance The Bucks Risky Bet On Doc Rivers

May 28, 2025

Giannis Future Hangs In The Balance The Bucks Risky Bet On Doc Rivers

May 28, 2025 -

Trumps 51st State Push A Political Backdrop To King Charles Canadian Visit

May 28, 2025

Trumps 51st State Push A Political Backdrop To King Charles Canadian Visit

May 28, 2025 -

See Alexandra Daddarios Show Stopping Sheer Gown At Dior

May 28, 2025

See Alexandra Daddarios Show Stopping Sheer Gown At Dior

May 28, 2025 -

Ideology And Budget Cuts Fuel Nih Staff Walkout At Directors Meeting

May 28, 2025

Ideology And Budget Cuts Fuel Nih Staff Walkout At Directors Meeting

May 28, 2025 -

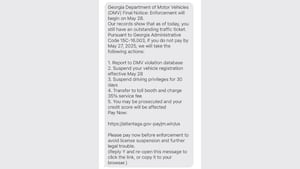

Fake Text Message From Ga Department Of Driver Services Is It A Scam

May 28, 2025

Fake Text Message From Ga Department Of Driver Services Is It A Scam

May 28, 2025