Facing A 15% Cut? Understanding Social Security Changes In June 2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Facing a 15% Cut? Understanding Social Security Changes in June 2025

Are you worried about potential Social Security cuts in 2025? You're not alone. The looming possibility of a significant reduction in Social Security benefits has many Americans concerned about their financial future. While a 15% cut isn't guaranteed, understanding the current situation and potential changes is crucial for planning ahead. This article breaks down the key issues and helps you navigate this complex topic.

The Trust Fund's Tightrope Walk:

The Social Security Administration (SSA) relies on a trust fund to pay out benefits. This fund is projected to be depleted by 2034, leading to potential benefit cuts. While the exact percentage of the cut is uncertain and could vary depending on various economic factors, the possibility of a significant reduction, perhaps reaching 15% or more, is a real concern. This impending depletion highlights the urgent need for Congress to address the long-term solvency of the Social Security system. Failure to act could result in substantial reductions in benefits for current and future retirees.

What Could Trigger a 15% Reduction?

The projected depletion of the trust fund is the primary driver behind the potential for benefit cuts. Once the trust fund is exhausted, incoming Social Security taxes would only cover approximately 80% of scheduled benefits. This shortfall would necessitate benefit reductions to maintain solvency. While a 15% cut is a possibility, the actual reduction could be higher or lower depending on future economic conditions and Congressional action.

Understanding the Proposed Solutions:

Several solutions have been proposed to address the looming shortfall:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full Social Security benefits.

- Increasing the Social Security Tax Rate: Slightly increasing the payroll tax rate that funds Social Security.

- Increasing the Taxable Wage Base: Expanding the amount of earnings subject to Social Security taxes.

- Benefit Reductions: As previously mentioned, reducing benefits across the board or through means-testing (reducing benefits for higher earners).

Each of these solutions has potential benefits and drawbacks, and finding a compromise that addresses both short-term and long-term solvency is a complex political challenge.

What Can You Do Now?

While the future of Social Security remains uncertain, you can take proactive steps to prepare:

- Stay Informed: Keep up-to-date on the latest developments and proposed solutions by following reputable news sources and the SSA website.

- Plan for Multiple Scenarios: Consider how a potential benefit reduction could impact your retirement plans and adjust your savings accordingly.

- Diversify Your Retirement Income: Explore other sources of retirement income, such as 401(k)s, IRAs, and pensions.

- Contact Your Representatives: Let your elected officials know your concerns and encourage them to find a sustainable solution for Social Security.

The Bottom Line:

The potential for a significant reduction in Social Security benefits in 2025, even a 15% cut, is a serious concern. While the exact outcome remains uncertain, understanding the challenges facing the system and taking proactive steps to plan for the future is crucial. Stay informed, engage in the conversation, and prepare for various scenarios to ensure a secure retirement. This is a vital issue impacting millions of Americans, and your voice matters.

Keywords: Social Security, Social Security cuts, Social Security changes, Social Security 2025, retirement, retirement planning, Social Security benefits, trust fund, SSA, retirement income, financial planning.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Facing A 15% Cut? Understanding Social Security Changes In June 2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

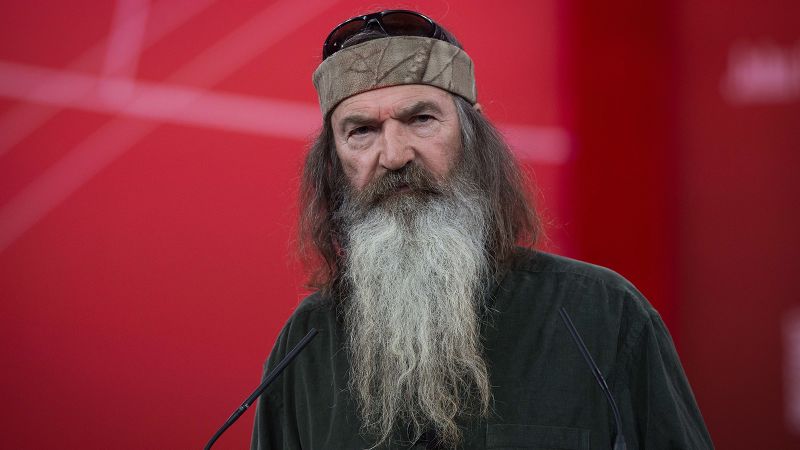

Family Announces Death Of Phil Robertson At Age 79

May 28, 2025

Family Announces Death Of Phil Robertson At Age 79

May 28, 2025 -

One Year High Beefs Role In The Current Food Inflation Crisis

May 28, 2025

One Year High Beefs Role In The Current Food Inflation Crisis

May 28, 2025 -

Gary Linekers Legacy 26 Years Of Match Of The Day At The Bbc Conclude

May 28, 2025

Gary Linekers Legacy 26 Years Of Match Of The Day At The Bbc Conclude

May 28, 2025 -

Mountaineers Conquer Everest In Record Time Raising Ethical Questions

May 28, 2025

Mountaineers Conquer Everest In Record Time Raising Ethical Questions

May 28, 2025 -

Social Security Benefit Increase 5 108 Payments Scheduled This Week

May 28, 2025

Social Security Benefit Increase 5 108 Payments Scheduled This Week

May 28, 2025

Latest Posts

-

Life Sentence For Indian Teacher In Odishas Deadly Wedding Bomb Case

May 29, 2025

Life Sentence For Indian Teacher In Odishas Deadly Wedding Bomb Case

May 29, 2025 -

Investigation Into Forced Meter Fittings Leads To Thousands Seeking Payouts

May 29, 2025

Investigation Into Forced Meter Fittings Leads To Thousands Seeking Payouts

May 29, 2025 -

French Open Schedule Novak Djokovics Matches And Daily Order Of Play

May 29, 2025

French Open Schedule Novak Djokovics Matches And Daily Order Of Play

May 29, 2025 -

2025 French Open Jaume Munar And Arthur Fils Clash In Second Round

May 29, 2025

2025 French Open Jaume Munar And Arthur Fils Clash In Second Round

May 29, 2025 -

Trumps Anger At Putin Fuels Consideration Of Fresh Russia Sanctions

May 29, 2025

Trumps Anger At Putin Fuels Consideration Of Fresh Russia Sanctions

May 29, 2025