Facing A 2034 Social Security Cliff: The Impact Of Congressional Inaction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Facing a 2034 Social Security Cliff: The Impact of Congressional Inaction

The looming Social Security shortfall is no longer a distant threat; it's a rapidly approaching reality. Unless Congress acts decisively, the Social Security Trust Fund is projected to be depleted by 2034, triggering significant benefit cuts for millions of retirees and future beneficiaries. This isn't just a fiscal concern; it's a potential crisis impacting the financial security and well-being of a vast segment of the American population. This article delves into the projected impact of Congressional inaction and explores potential solutions.

The Cliff's Edge: Understanding the 2034 Projection

The Social Security Administration (SSA) consistently projects a shortfall in the Trust Fund. This means that, without legislative intervention, the incoming payroll tax revenue will be insufficient to cover scheduled benefit payments starting in 2034. This doesn't mean Social Security will disappear entirely. However, it does mean a significant reduction in benefits – potentially around 20% – is highly likely. This reduction would affect all beneficiaries, including retirees, disabled individuals, and their dependents.

Who Will Be Affected Most?

While the benefit cuts will impact everyone receiving Social Security, some groups will be disproportionately affected. Low-income retirees, who rely heavily on Social Security for their sustenance, will face the most severe hardship. Similarly, future generations entering retirement after 2034 will receive significantly reduced payments, impacting their financial planning and retirement security.

The Potential Ripple Effects on the Economy

The economic consequences of a 20% benefit cut are far-reaching and potentially devastating. Reduced consumer spending due to lower retirement income could trigger a slowdown in economic growth. The healthcare sector, heavily reliant on Social Security income for a significant portion of its patients, would also be impacted. Furthermore, the reduced purchasing power of millions could strain local communities and businesses.

Potential Solutions: Awaiting Congressional Action

Several options are available to Congress to avert the looming crisis. These include:

- Increasing the Full Retirement Age: Gradually raising the age at which individuals can receive full Social Security benefits.

- Raising the Social Security Tax Cap: Extending the Social Security tax to higher earners, currently capped at a specific income level.

- Increasing Payroll Taxes: Slightly raising the Social Security payroll tax rate for both employers and employees.

- Cutting Benefits for High-Earners: Implementing a benefit reduction for higher-income retirees.

The Urgency of Congressional Action

Delaying action only exacerbates the problem. The longer Congress waits, the more drastic the benefit cuts will need to be to maintain solvency. It's crucial for lawmakers to engage in bipartisan discussions and reach a comprehensive solution that ensures the long-term viability of Social Security.

What You Can Do:

Stay informed about the ongoing debate surrounding Social Security reform. Contact your elected officials and urge them to prioritize finding a sustainable solution. Understanding the potential impact on your own financial future is critical for proactive planning and advocacy. Consider exploring resources like the official Social Security Administration website () for more detailed information.

The future of Social Security hangs in the balance. The time for action is now. The 2034 cliff is not an inevitable fate; it's a preventable crisis demanding immediate and decisive Congressional action.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Facing A 2034 Social Security Cliff: The Impact Of Congressional Inaction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

South Jersey Utility Companies Offer Summer Bill Discounts But Read This First

Jun 20, 2025

South Jersey Utility Companies Offer Summer Bill Discounts But Read This First

Jun 20, 2025 -

Urgent Weather Update Widespread Strong Severe Thunderstorms Today

Jun 20, 2025

Urgent Weather Update Widespread Strong Severe Thunderstorms Today

Jun 20, 2025 -

Why The Tarik Skubal Vs Paul Skenes Pitching Match Failed To Materialize

Jun 20, 2025

Why The Tarik Skubal Vs Paul Skenes Pitching Match Failed To Materialize

Jun 20, 2025 -

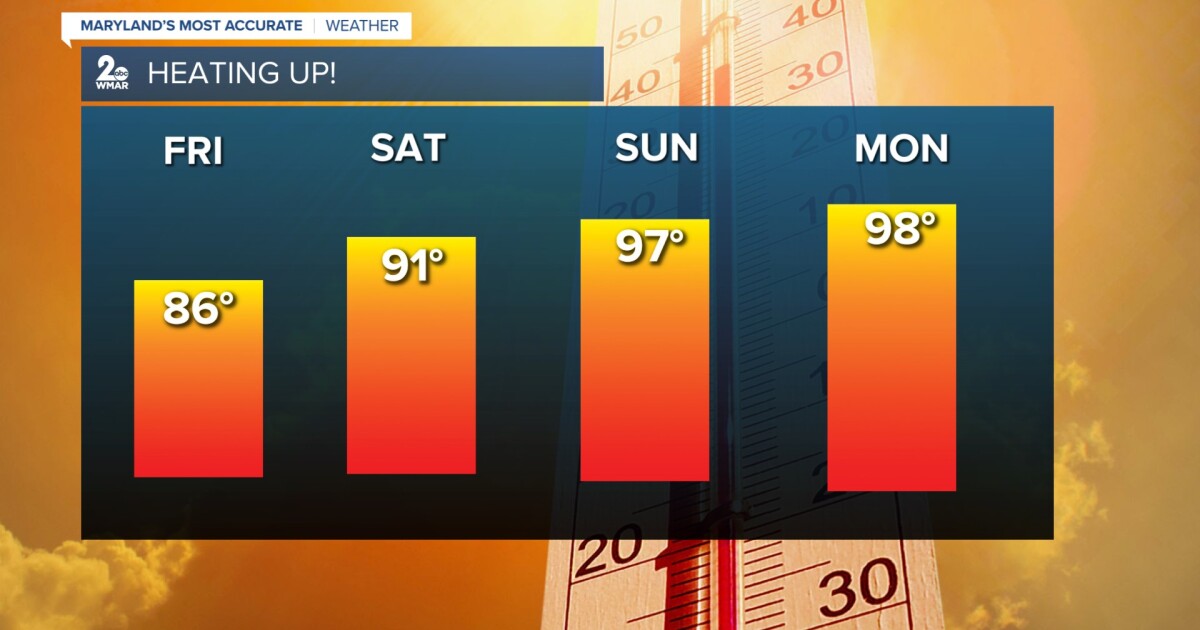

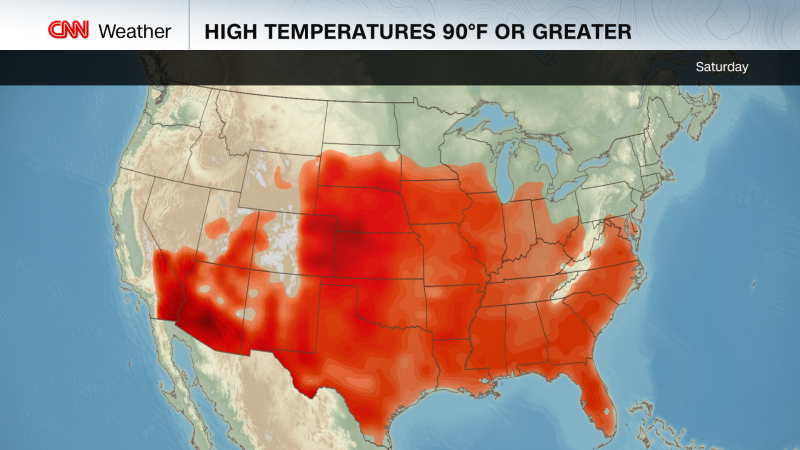

Dangerous Heat Dome To Amplify East Coast Heatwave Next Week

Jun 20, 2025

Dangerous Heat Dome To Amplify East Coast Heatwave Next Week

Jun 20, 2025 -

Indiana Fever Vs Golden State Valkyries Game Day Prediction Tv Schedule And Streaming Info

Jun 20, 2025

Indiana Fever Vs Golden State Valkyries Game Day Prediction Tv Schedule And Streaming Info

Jun 20, 2025

Latest Posts

-

June 19th 2025 Indiana Fever Vs Golden State Valkyries Live Stream And Tv Details

Jun 20, 2025

June 19th 2025 Indiana Fever Vs Golden State Valkyries Live Stream And Tv Details

Jun 20, 2025 -

Fatal Test Drive Cameron And David Walsh Killed In Grimsby Car Accident

Jun 20, 2025

Fatal Test Drive Cameron And David Walsh Killed In Grimsby Car Accident

Jun 20, 2025 -

Death Toll Rises Kyivs Search For Victims Continues After Violent Night

Jun 20, 2025

Death Toll Rises Kyivs Search For Victims Continues After Violent Night

Jun 20, 2025 -

Heatwave Warning Issued East Coast Braces For Intensified Heat Dangerous Heat Dome Incoming

Jun 20, 2025

Heatwave Warning Issued East Coast Braces For Intensified Heat Dangerous Heat Dome Incoming

Jun 20, 2025 -

Is Andrew Mc Cutchens Mlb Knowledge An Advantage Pirates Fans Investigate

Jun 20, 2025

Is Andrew Mc Cutchens Mlb Knowledge An Advantage Pirates Fans Investigate

Jun 20, 2025