Farm Inheritance Tax Delay: MPs Demand One-Year Reprieve

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Farm Inheritance Tax Delay: MPs Demand One-Year Reprieve for Farmers Facing Ruin

Farmers across the country are breathing a collective sigh of relief as MPs from across the political spectrum unite in demanding a one-year delay to the implementation of the controversial new inheritance tax regulations. The proposed changes, slated to come into effect on [Insert Date], threaten to financially cripple many family farms, forcing the sale of land passed down through generations. This urgent call for a reprieve highlights the growing concerns surrounding the impact of these regulations on rural communities and the future of British agriculture.

The current inheritance tax system already presents significant challenges for farmers, often requiring the sale of valuable assets to cover the tax bill. The new regulations, however, are perceived as significantly more stringent, potentially leading to a wave of farm closures and the loss of countless jobs.

Why the Outcry? The Key Issues Fueling the Debate

Several key factors are driving the MPs' demand for a delay:

- Lack of Consultation: Many MPs argue that insufficient consultation took place with the farming community before the new regulations were announced. This lack of engagement has left farmers feeling unheard and unprepared for the significant financial burden imposed upon them.

- Valuation Challenges: Accurately valuing farmland and agricultural assets is notoriously complex. The new regulations' valuation methods are seen as overly complicated and potentially unfair, leading to inaccurate and inflated tax bills.

- Impact on Rural Economies: The potential loss of family farms will have a devastating impact on rural economies, leading to job losses and the decline of vital local businesses. This ripple effect is a major concern for MPs representing rural constituencies.

- Succession Planning: The regulations severely complicate succession planning for family farms, making it increasingly difficult to transfer ownership to the next generation without incurring crippling tax liabilities. This threatens the long-term viability of family farming businesses.

Calls for a One-Year Reprieve Gain Momentum

The campaign for a one-year delay is gaining considerable traction. Leading MPs from both the [Party Name] and [Party Name] parties have publicly voiced their support, highlighting the cross-party consensus on this crucial issue. [Quote from a prominent MP supporting the delay].

Several farming organizations, including the [Name of Farming Organization] and the [Name of another Farming Organization], have also joined the call for a delay, emphasizing the urgent need for a more comprehensive review of the regulations and a fairer system for valuing agricultural assets.

What Happens Next? The Road Ahead for Farmers

The government is currently reviewing the situation. While a formal response is pending, the growing pressure from MPs and farming organizations suggests a significant chance of a temporary reprieve. However, the long-term future of inheritance tax regulations for farmers remains uncertain. A thorough review of the system is necessary to ensure that it supports, rather than undermines, the viability of family farms and the vital role they play in the UK's food security and rural landscape.

Further Reading & Resources:

- [Link to Government Website on Inheritance Tax]

- [Link to relevant Farming Organization Website]

- [Link to a related news article]

Call to Action: Stay informed on the latest developments by following [Name of relevant news source/farming organization] and contacting your local MP to voice your concerns. The future of farming depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Farm Inheritance Tax Delay: MPs Demand One-Year Reprieve. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

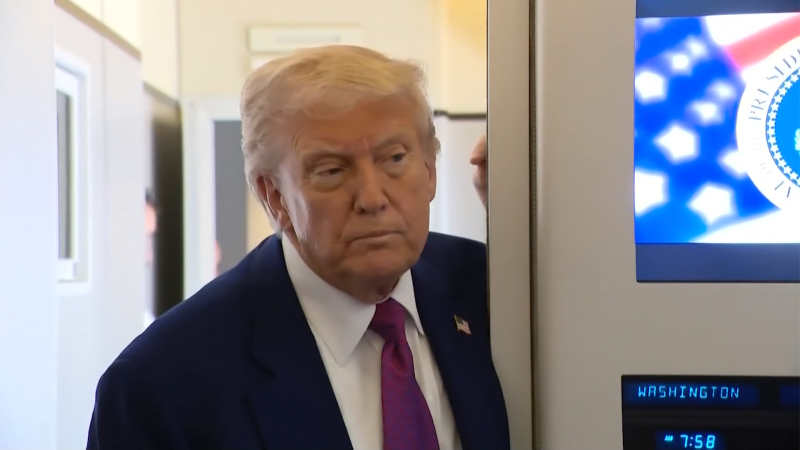

Trump Says Us Russia Relations Hinge On Meeting With Putin

May 17, 2025

Trump Says Us Russia Relations Hinge On Meeting With Putin

May 17, 2025 -

Amidst National Protests Israel Secures Eurovision Final Spot

May 17, 2025

Amidst National Protests Israel Secures Eurovision Final Spot

May 17, 2025 -

Trump Putin Summit The Only Way Forward According To Trump

May 17, 2025

Trump Putin Summit The Only Way Forward According To Trump

May 17, 2025 -

Baby Naming Trends The Popularity Of King In The Us And Its Prohibition In New Zealand

May 17, 2025

Baby Naming Trends The Popularity Of King In The Us And Its Prohibition In New Zealand

May 17, 2025 -

Nj Transit Strike Cripples Commuter Rail Engineers Demand Better Conditions

May 17, 2025

Nj Transit Strike Cripples Commuter Rail Engineers Demand Better Conditions

May 17, 2025

Latest Posts

-

Stanley Tuccis Italian Food Journey Nat Geos New Culinary Series

May 17, 2025

Stanley Tuccis Italian Food Journey Nat Geos New Culinary Series

May 17, 2025 -

The Latest Aoc And Trumps Border Czar Clash Over Immigration Policy

May 17, 2025

The Latest Aoc And Trumps Border Czar Clash Over Immigration Policy

May 17, 2025 -

Stanley Tucci Searching For Italy One Dish At A Time Nat Geo

May 17, 2025

Stanley Tucci Searching For Italy One Dish At A Time Nat Geo

May 17, 2025 -

Seven Startling Mlb Stats Halfway Point Analysis

May 17, 2025

Seven Startling Mlb Stats Halfway Point Analysis

May 17, 2025 -

Wsj Report Veteran Air Traffic Controller Sounds Alarm On Newark Airport Problems

May 17, 2025

Wsj Report Veteran Air Traffic Controller Sounds Alarm On Newark Airport Problems

May 17, 2025