Farm Inheritance Tax: Parliamentarians Seek 12-Month Delay To Implementation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Farm Inheritance Tax Delay Sought: Parliamentarians Push for 12-Month Reprieve

Farmers across the country are breathing a collective sigh of relief as parliamentarians launch a concerted effort to delay the implementation of the controversial new farm inheritance tax. The proposed legislation, slated to come into effect on October 1st, has sparked widespread protests and concerns within the agricultural community, prompting a significant political pushback. Leading figures are now calling for a twelve-month delay to allow for further consultation and revisions to the complex tax regulations.

The proposed tax, designed to address wealth inequality and generate additional government revenue, has been met with fierce opposition. Critics argue the current framework unfairly targets family-run farms, many of which have been passed down through generations. The fear is that the tax will force many farmers to sell their land, leading to a significant loss of agricultural expertise and potentially impacting food security.

H2: The Key Concerns Fueling the Debate

Several key concerns are driving the calls for a delay:

- Complexity of the legislation: The intricacies of the new tax regulations are proving difficult for many farmers to understand, leading to widespread confusion and anxiety. Many feel insufficient support and guidance has been provided to help them navigate the new system.

- Impact on family farms: The existing structure disproportionately affects family-owned farms, threatening the long-term viability of these businesses and potentially leading to land fragmentation.

- Lack of consultation: Farmers argue there hasn’t been adequate consultation with the agricultural community during the drafting of the legislation, leading to a feeling of being ignored and unheard.

- Economic consequences: The potential economic ramifications of the tax are far-reaching, potentially leading to job losses in the rural economy and impacting food production.

H2: Parliamentarians Spearhead the Campaign for Delay

A cross-party group of parliamentarians has united in calling for a twelve-month delay to the implementation of the farm inheritance tax. Their argument centers on the need for further review and amendment of the legislation to ensure fairness and prevent unintended consequences. Leading the charge is MP [Name of MP], who stated: “[Quote from MP highlighting concerns and the need for delay].” Support for the delay is growing, with several influential agricultural organizations lending their weight to the campaign.

H3: Potential Solutions and Next Steps

The proposed twelve-month delay aims to allow time for:

- Improved clarity in the legislation: Simplifying the regulations and making them more accessible to farmers.

- Targeted support for family farms: Developing strategies to mitigate the impact of the tax on smaller, family-run operations.

- Wider consultation: Engaging with the agricultural community to address their concerns and incorporate their feedback into the legislation.

H2: The Future of Farm Inheritance Tax

The fate of the farm inheritance tax now hangs in the balance. The success of the campaign for a twelve-month delay will depend on the government's response to the mounting pressure. While the government has yet to officially respond, the strength of the opposition suggests a potential compromise is on the cards. The coming weeks will be crucial in determining the future of farming and land ownership in the country. Further updates and analysis will be provided as the situation unfolds. Stay informed and follow our coverage for the latest developments.

[Call to action - subtly embedded]: For more in-depth information on the farm inheritance tax and the ongoing political debate, visit [link to relevant government website or agricultural organization].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Farm Inheritance Tax: Parliamentarians Seek 12-Month Delay To Implementation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Proposed Farm Inheritance Tax Year Long Delay Sought By Parliamentarians

May 17, 2025

Proposed Farm Inheritance Tax Year Long Delay Sought By Parliamentarians

May 17, 2025 -

Assisted Dying Bill Debate What Changes Have Been Made

May 17, 2025

Assisted Dying Bill Debate What Changes Have Been Made

May 17, 2025 -

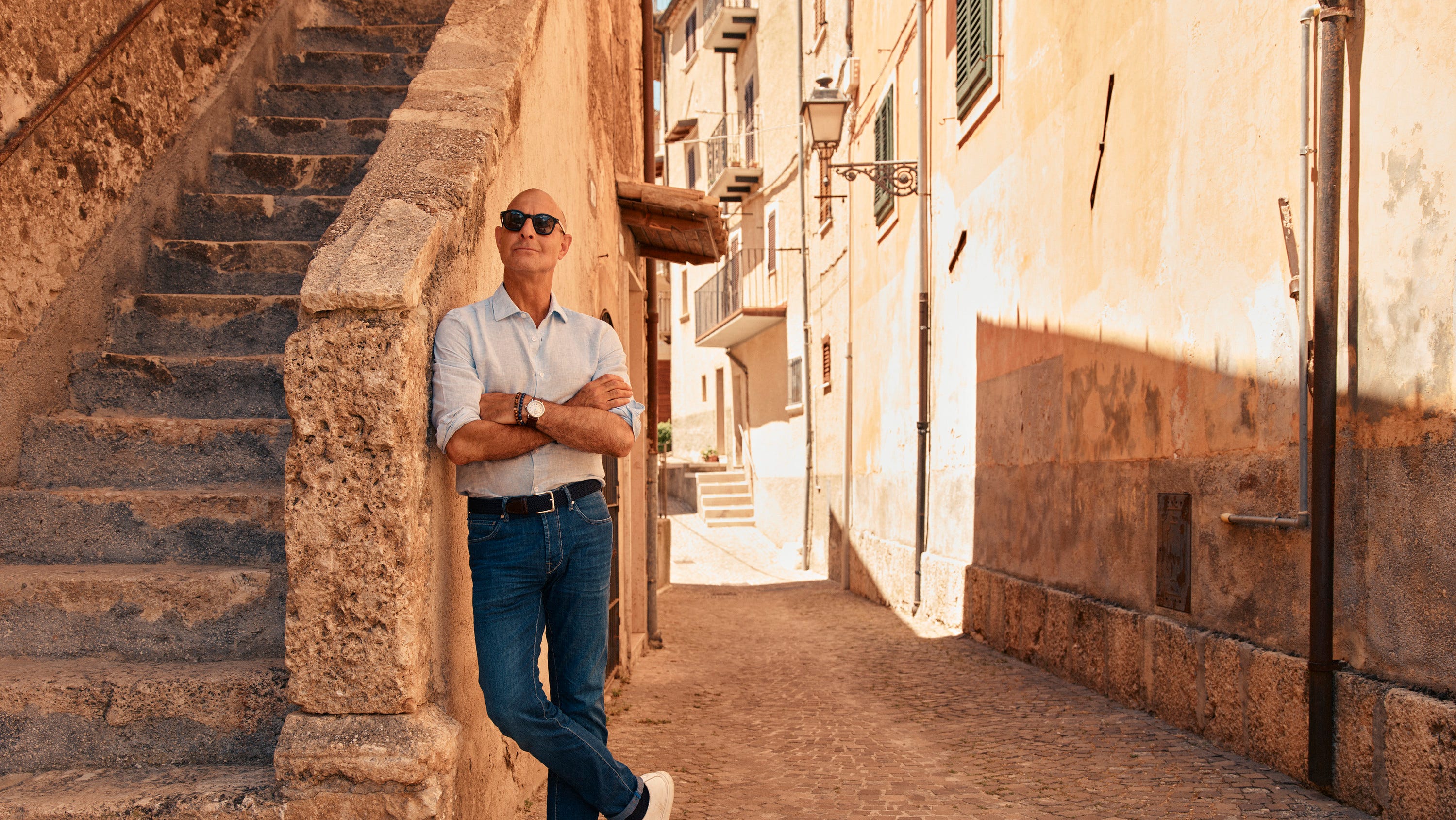

A Dish At A Time Stanley Tuccis Italian Food Exploration

May 17, 2025

A Dish At A Time Stanley Tuccis Italian Food Exploration

May 17, 2025 -

State Farm Rate Hike In California What It Means For You

May 17, 2025

State Farm Rate Hike In California What It Means For You

May 17, 2025 -

Insurance Industry Under Fire Hawley Investigation Grills State Farm Allstate

May 17, 2025

Insurance Industry Under Fire Hawley Investigation Grills State Farm Allstate

May 17, 2025

Latest Posts

-

Ben Roberts Smith Appeal Fails War Crimes Defamation Case Finalized

May 17, 2025

Ben Roberts Smith Appeal Fails War Crimes Defamation Case Finalized

May 17, 2025 -

Consumer Alert Elevated Arsenic And Cadmium Levels Detected In Rice

May 17, 2025

Consumer Alert Elevated Arsenic And Cadmium Levels Detected In Rice

May 17, 2025 -

Can Trump And Putin Help Broker Peace In Ukraine Us Weighs In

May 17, 2025

Can Trump And Putin Help Broker Peace In Ukraine Us Weighs In

May 17, 2025 -

Staffing Crisis And Tech Issues Plague Newark Airport A Controllers Perspective Wsj

May 17, 2025

Staffing Crisis And Tech Issues Plague Newark Airport A Controllers Perspective Wsj

May 17, 2025 -

Shocking Report Dangerous Arsenic And Cadmium In Popular Rice Brands

May 17, 2025

Shocking Report Dangerous Arsenic And Cadmium In Popular Rice Brands

May 17, 2025