FCA Report Highlights Worrying Trend: 10% Of Britons Possess No Savings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

FCA Report Highlights Worrying Trend: 10% of Britons Possess No Savings

A new report from the Financial Conduct Authority (FCA) reveals a stark reality for millions in the UK: a concerning 10% of Britons have absolutely no savings. This alarming statistic underscores a growing financial fragility amongst a significant portion of the population, raising serious concerns about their resilience to unexpected economic shocks. The report, released [Insert Date of Report Release], paints a picture of vulnerability and highlights the urgent need for improved financial education and accessible savings schemes.

The FCA's findings are particularly troubling given the current economic climate. Soaring inflation, rising energy costs, and the lingering effects of the pandemic have already placed immense pressure on household budgets. For those with no savings buffer, even a minor unexpected expense – a broken appliance, a medical bill, or job loss – can lead to a devastating financial crisis.

The Impact of Zero Savings:

The lack of savings has profound implications:

- Increased Vulnerability to Debt: Individuals without savings are significantly more likely to rely on high-interest debt, such as payday loans, to cover unexpected expenses. This can lead to a vicious cycle of debt, trapping individuals in a precarious financial situation.

- Difficulty Coping with Emergencies: Unexpected events, such as illness or job loss, can quickly spiral into a major crisis without a financial safety net. This can have devastating consequences for individuals and their families.

- Limited Opportunities for Future Planning: Saving is crucial for long-term financial planning, including retirement, education, and homeownership. The absence of savings severely limits opportunities for future security and prosperity.

Why are so many Britons saving nothing?

The FCA report doesn't pinpoint a single cause, but several factors likely contribute to this worrying trend:

- Stagnant Wages: Many Britons struggle with stagnant wages that fail to keep pace with the rising cost of living. This makes saving a significant portion of income incredibly difficult.

- High Cost of Living: The UK faces a high cost of living, particularly in areas such as housing, transportation, and energy. These essential expenses often leave little room for saving.

- Lack of Financial Literacy: A lack of understanding about personal finance and effective saving strategies prevents many from building a financial safety net.

- Debt Burden: Existing debt can consume a large portion of income, leaving little left for saving.

What can be done?

The FCA report calls for a multi-pronged approach to address this critical issue:

- Improved Financial Education: Increased access to free and accessible financial literacy programs is crucial to empower individuals to make informed financial decisions.

- Government Support Schemes: Government initiatives that encourage saving, such as tax incentives or matched savings programs, can make a significant difference.

- Accessible Savings Products: The availability of savings products tailored to low-income individuals is vital to ensure that everyone has the opportunity to save.

The FCA's findings serve as a wake-up call. Addressing the issue of widespread savings deficiency requires a collective effort from individuals, the government, and financial institutions. It's crucial to prioritize financial education and create an environment that enables more Britons to build a secure financial future. For further information and resources on personal finance, visit the [link to FCA website] and [link to Money Advice Service website].

Keywords: FCA report, savings, UK savings, financial fragility, personal finance, financial literacy, cost of living, debt, economic crisis, financial education, government support, savings schemes.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on FCA Report Highlights Worrying Trend: 10% Of Britons Possess No Savings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

I Was On The Plane But British Airways Says I Wasn T Passengers Ordeal

May 18, 2025

I Was On The Plane But British Airways Says I Wasn T Passengers Ordeal

May 18, 2025 -

Nj Transit Strike Cripples Commuter Rail Impacts Thousands

May 18, 2025

Nj Transit Strike Cripples Commuter Rail Impacts Thousands

May 18, 2025 -

Heavy Metal Contamination In Rice What You Need To Know

May 18, 2025

Heavy Metal Contamination In Rice What You Need To Know

May 18, 2025 -

Stanley Tucci Searching For Italy A Culinary Journey Through Italys Regional Dishes

May 18, 2025

Stanley Tucci Searching For Italy A Culinary Journey Through Italys Regional Dishes

May 18, 2025 -

Australian Citizen Jailed For 13 Years In Russia For Ukraine Involvement

May 18, 2025

Australian Citizen Jailed For 13 Years In Russia For Ukraine Involvement

May 18, 2025

Latest Posts

-

Trumps Peace Efforts A Week Of Intense Negotiations And Unveiled Ambitions

May 18, 2025

Trumps Peace Efforts A Week Of Intense Negotiations And Unveiled Ambitions

May 18, 2025 -

Atlantic Meridional Overturning Circulation Slowdown Implications For The Us

May 18, 2025

Atlantic Meridional Overturning Circulation Slowdown Implications For The Us

May 18, 2025 -

Metrekareye 32 Kg Yagis Istanbul Un Yagmurla Sinanmasi

May 18, 2025

Metrekareye 32 Kg Yagis Istanbul Un Yagmurla Sinanmasi

May 18, 2025 -

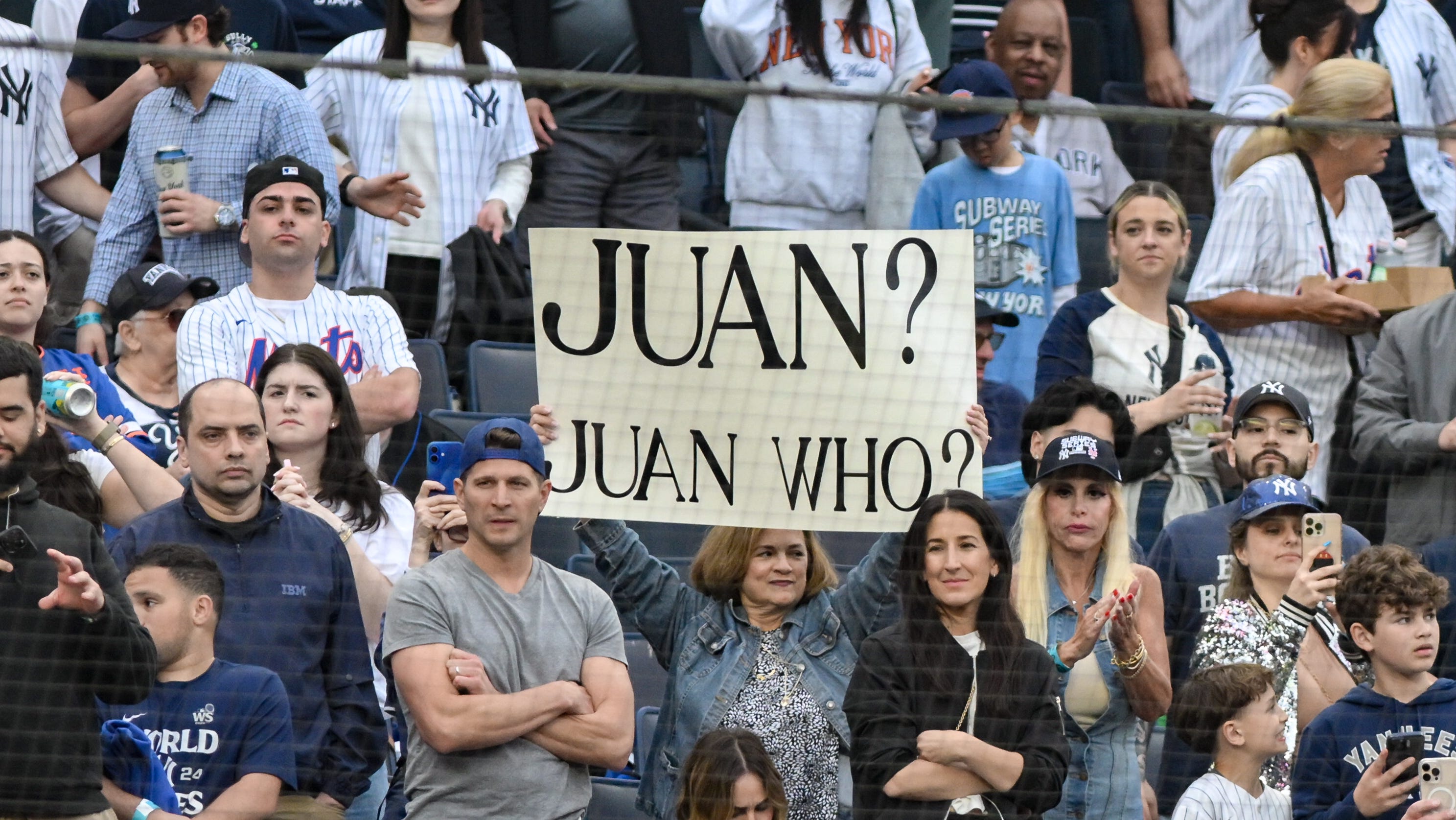

2025 Subway Series Photo Gallery Yankees And Mets Face Off

May 18, 2025

2025 Subway Series Photo Gallery Yankees And Mets Face Off

May 18, 2025 -

Texts Surface Diddys Communication With Cassie Post Assault In L A

May 18, 2025

Texts Surface Diddys Communication With Cassie Post Assault In L A

May 18, 2025