Fed Rate Cut Speculation: Traders Bet On 50 Basis Point Reduction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed Rate Cut Speculation: Traders Bet on 50 Basis Point Reduction

Inflation cools, but is it enough to convince the Fed? Traders are increasingly betting on a significant rate cut by the Federal Reserve, with speculation swirling around a hefty 50 basis point reduction at the upcoming meeting. This bold prediction follows recent data suggesting a cooling inflation rate, but uncertainty remains about whether this is a sustained trend or a temporary blip. The markets are on edge, waiting to see if the Fed will act decisively to stimulate the economy or hold firm in its fight against inflation.

Why the 50 Basis Point Prediction?

The recent Consumer Price Index (CPI) report showed a slower-than-expected increase in inflation, fueling hopes that the Fed might ease its aggressive monetary tightening policy. This follows several months of similar trends, suggesting a potential turning point in the battle against inflation. However, core inflation, which excludes volatile food and energy prices, remains stubbornly high, indicating that underlying inflationary pressures persist.

Several factors contribute to the 50 basis point speculation:

- Easing Inflation: While still elevated, inflation figures are showing signs of deceleration, prompting some analysts to believe the Fed might pivot towards a less hawkish stance.

- Economic Slowdown: Concerns about a potential recession are mounting, adding pressure on the Fed to stimulate economic growth. A significant rate cut could provide a much-needed boost.

- Market Sentiment: Traders' expectations, reflected in futures markets and other financial instruments, strongly suggest a belief in a substantial rate cut. This collective sentiment influences the overall market outlook.

- Previous Fed Actions: While the Fed has historically been reluctant to make large rate cuts, the current economic climate and market pressure could lead to a departure from its usual approach.

The Risks of a 50 Basis Point Cut:

While a 50 basis point cut might seem like a solution to stimulate economic growth, it also carries considerable risk. Such a dramatic move could:

- Reignite Inflation: A significant reduction in interest rates could reignite inflationary pressures if the underlying causes of inflation aren't adequately addressed.

- Undermine Credibility: A drastic shift in policy could undermine the Fed's credibility and its ability to manage inflation effectively in the long term.

- Increase Volatility: A surprising rate cut could lead to significant market volatility, potentially disrupting economic stability.

What Happens Next?

The coming weeks will be crucial as the Fed carefully weighs the economic data and assesses the risks and benefits of various policy options. The upcoming meeting will be closely scrutinized by investors, businesses, and policymakers worldwide. Analysts are eagerly awaiting further economic indicators, including employment data and manufacturing reports, before making definitive predictions. The decision will significantly impact global financial markets and the trajectory of the US economy. Stay tuned for updates as the situation unfolds.

Keywords: Fed rate cut, 50 basis points, interest rates, inflation, CPI, recession, monetary policy, Federal Reserve, economic growth, market volatility, economic indicators.

Related Articles: (Internal links to hypothetical articles on your site)

- [Understanding Inflation: A Beginner's Guide]

- [The Fed's Role in the US Economy]

- [Recession Fears: What You Need to Know]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fed Rate Cut Speculation: Traders Bet On 50 Basis Point Reduction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

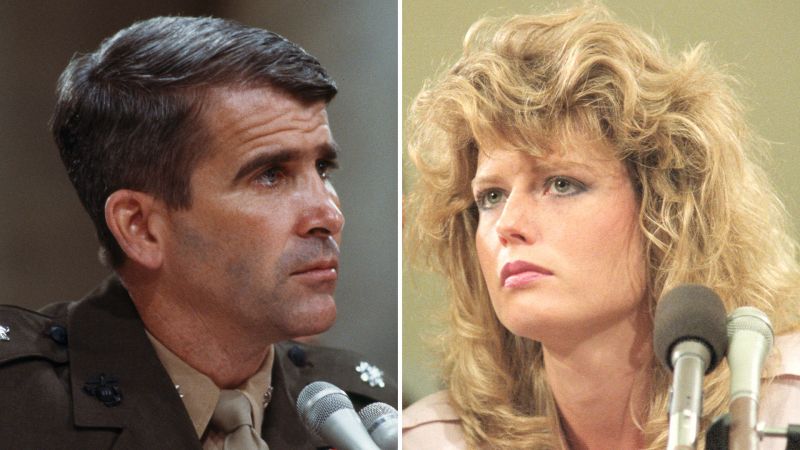

Iran Contra Affair Oliver Norths Marriage To Fawn Hall

Sep 11, 2025

Iran Contra Affair Oliver Norths Marriage To Fawn Hall

Sep 11, 2025 -

Mandelsons Birthday Message Reveals Best Pal Epstein Connection

Sep 11, 2025

Mandelsons Birthday Message Reveals Best Pal Epstein Connection

Sep 11, 2025 -

Parental Rights Under Siege Schools Transgender Policies And The Fight For Parental Voice

Sep 11, 2025

Parental Rights Under Siege Schools Transgender Policies And The Fight For Parental Voice

Sep 11, 2025 -

The Violent Conclusion A Fugitive Fathers Life And His Hidden Children

Sep 11, 2025

The Violent Conclusion A Fugitive Fathers Life And His Hidden Children

Sep 11, 2025 -

Half Point Fed Rate Cut Traders See A Growing Probability

Sep 11, 2025

Half Point Fed Rate Cut Traders See A Growing Probability

Sep 11, 2025

Latest Posts

-

Parental Rights Under Siege Schools Silencing Parents On Transgender Policies

Sep 11, 2025

Parental Rights Under Siege Schools Silencing Parents On Transgender Policies

Sep 11, 2025 -

Us Official Proposed Israeli Action Against Doha Is Detrimental To Security Goals

Sep 11, 2025

Us Official Proposed Israeli Action Against Doha Is Detrimental To Security Goals

Sep 11, 2025 -

Pennsylvania Court Summons Luigi Mangione

Sep 11, 2025

Pennsylvania Court Summons Luigi Mangione

Sep 11, 2025 -

High End Hotel Bills Examining Aocs Campaign Finances Amidst Anti Establishment Messaging

Sep 11, 2025

High End Hotel Bills Examining Aocs Campaign Finances Amidst Anti Establishment Messaging

Sep 11, 2025 -

Luxury Hotel Bills Spark Debate Aocs Spending Under Fire During Sanders Partnership

Sep 11, 2025

Luxury Hotel Bills Spark Debate Aocs Spending Under Fire During Sanders Partnership

Sep 11, 2025