Fed Rate Cut Speculation: Traders Bet On A Half-Point Drop

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed Rate Cut Speculation: Traders Bet on a Half-Point Drop

Is a significant interest rate cut on the horizon? Market speculation is reaching fever pitch as traders increasingly bet on a substantial half-point drop by the Federal Reserve. The possibility of such a drastic move has sent ripples through financial markets, sparking debate among economists and investors alike. But what's driving this sudden surge in anticipation, and what are the potential implications?

The recent banking turmoil, particularly the collapse of Silicon Valley Bank and Signature Bank, has undeniably fueled this speculation. These events highlighted vulnerabilities within the financial system, raising concerns about a potential credit crunch and its impact on economic growth. The rapid escalation of the situation forced the Fed to take swift action, implementing emergency lending facilities to shore up confidence.

<br>

Why a Half-Point Cut? Understanding the Market Sentiment

Traders aren't simply hoping for a rate cut; they're actively pricing in the possibility of a significant 50-basis-point reduction in the federal funds rate. This signifies a belief that the Fed will prioritize financial stability over inflation control, at least in the short term. Several factors contribute to this sentiment:

- Contagion Fears: The fear of further bank failures and a wider contagion effect remains a significant driver. A substantial rate cut is seen as a way to inject liquidity into the system and prevent a broader financial crisis.

- Economic Slowdown Concerns: The banking crisis adds to existing concerns about a potential economic slowdown or even a recession. A rate cut is viewed as a necessary stimulus to prevent a sharp economic contraction.

- Shifting Fed Priorities: While inflation remains a key concern, the recent events have arguably shifted the Fed's priorities towards maintaining financial stability. This could lead them to prioritize a rate cut to mitigate systemic risk.

<br>

The Counterarguments: Inflation Remains a Persistent Threat

Despite the mounting speculation, not everyone agrees that a half-point rate cut is the most likely scenario. Critics point to persistently high inflation as a major obstacle to such a drastic move. A significant rate cut could reignite inflationary pressures, undermining the Fed's long-term goals.

- Inflationary Pressures: While recent data shows some moderation in inflation, it remains stubbornly above the Fed's target. A large rate cut could jeopardize the progress made in bringing inflation under control.

- Credibility Concerns: A sudden and dramatic shift in monetary policy could damage the Fed's credibility, making it harder to manage inflation expectations in the future.

- Market Volatility: A half-point cut could introduce further volatility into already jittery markets, potentially exacerbating uncertainty and investor anxiety.

<br>

What Happens Next? The Fed's Upcoming Decision

The upcoming Federal Open Market Committee (FOMC) meeting will be crucial in determining the Fed's next move. While a half-point cut is certainly a possibility, the ultimate decision will depend on a careful balancing act between mitigating financial risks and managing inflation. Analysts are closely scrutinizing economic data, including inflation figures, employment reports, and consumer confidence indicators, to predict the Fed's likely course of action. The situation remains fluid, and market volatility is likely to persist until the Fed announces its decision.

<br>

Further Reading: For more in-depth analysis on the current economic climate and the Fed's monetary policy, you can explore resources from the Federal Reserve () and reputable financial news outlets. Staying informed is key during periods of market uncertainty.

<br>

Disclaimer: This article provides general information and should not be considered financial advice. Always consult with a qualified financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fed Rate Cut Speculation: Traders Bet On A Half-Point Drop. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Loop Shooting Update Man Injured Near State And Madison Cta Blue Line Delays Expected

Sep 11, 2025

Loop Shooting Update Man Injured Near State And Madison Cta Blue Line Delays Expected

Sep 11, 2025 -

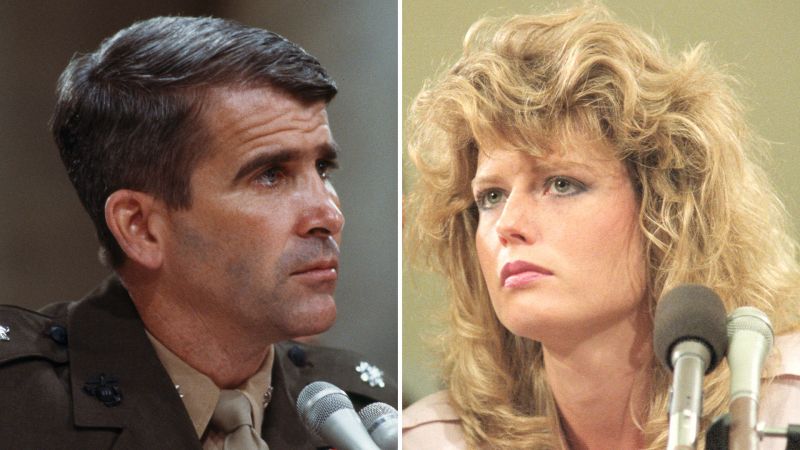

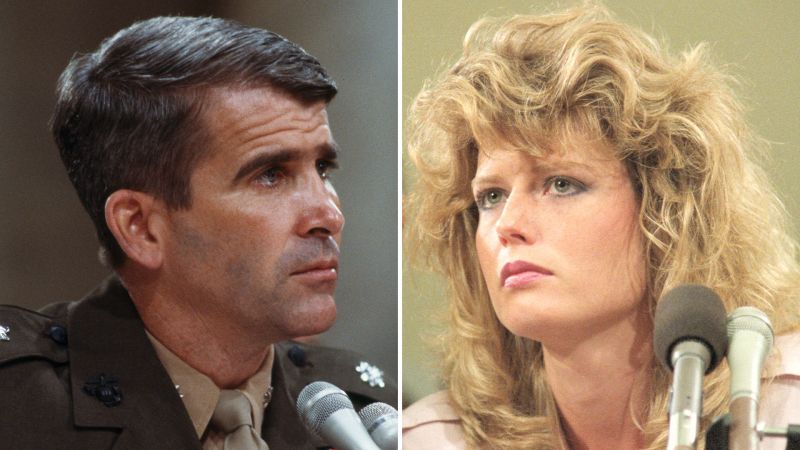

Iran Contra Affair Oliver Norths Marriage To Fawn Hall

Sep 11, 2025

Iran Contra Affair Oliver Norths Marriage To Fawn Hall

Sep 11, 2025 -

Future Of School Transportation Meet The Innovative Bus Drivers Shaping Americas Schools

Sep 11, 2025

Future Of School Transportation Meet The Innovative Bus Drivers Shaping Americas Schools

Sep 11, 2025 -

Fugitive Fathers Violent Death Childrens Hidden Lives Revealed

Sep 11, 2025

Fugitive Fathers Violent Death Childrens Hidden Lives Revealed

Sep 11, 2025 -

Court Order Luigi Mangione To Appear In Pennsylvania

Sep 11, 2025

Court Order Luigi Mangione To Appear In Pennsylvania

Sep 11, 2025

Latest Posts

-

Legal Battle Gregg Wallace And The Bbc Clash

Sep 11, 2025

Legal Battle Gregg Wallace And The Bbc Clash

Sep 11, 2025 -

Transgender Policies In Schools Why Parents Voices Matter

Sep 11, 2025

Transgender Policies In Schools Why Parents Voices Matter

Sep 11, 2025 -

Iran Contra Scandal The Untold Story Of Oliver North And Fawn Halls Marriage

Sep 11, 2025

Iran Contra Scandal The Untold Story Of Oliver North And Fawn Halls Marriage

Sep 11, 2025 -

Us Rejects Potential Israeli Military Action Against Doha Unproductive Strategy

Sep 11, 2025

Us Rejects Potential Israeli Military Action Against Doha Unproductive Strategy

Sep 11, 2025 -

Aocs Luxury Hotel Stays A Discrepancy With Her Anti Oligarchy Stance

Sep 11, 2025

Aocs Luxury Hotel Stays A Discrepancy With Her Anti Oligarchy Stance

Sep 11, 2025