Fed Signals Single 2025 Rate Cut, U.S. Treasury Yields Dip

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed Signals Single 2025 Rate Cut, Sending U.S. Treasury Yields Lower

The Federal Reserve's latest projections have sent ripples through the financial markets, signaling a potential single interest rate cut in 2025. This announcement, delivered amidst ongoing economic uncertainty, has led to a noticeable dip in U.S. Treasury yields. The implications for investors and the broader economy are significant and warrant careful consideration.

A Subtle Shift in Fed Policy

The Fed's revised forecasts, released following their September meeting, suggest a more nuanced approach to monetary policy than previously anticipated. While inflation remains a concern, the central bank now projects a slightly less aggressive path to bringing it down to its 2% target. This shift reflects a growing awareness of the potential for economic slowdown, even as the labor market remains relatively strong. The projected single rate cut in 2025 marks a departure from previous expectations of a potentially more prolonged period of high interest rates.

Impact on U.S. Treasury Yields

The prospect of a future rate cut has immediately impacted U.S. Treasury yields. These yields, which represent the return an investor receives on government bonds, have seen a decline across the maturity spectrum. This is a direct consequence of investors anticipating lower future interest rates, making existing bonds comparatively more attractive. The dip in yields is particularly noticeable in longer-term Treasuries, reflecting the market's expectation of a more accommodative monetary policy further down the line.

What Does This Mean for Investors?

The implications for investors are multifaceted:

-

Bond Market: The decreased yields suggest potential opportunities for bond investors seeking higher returns in the current environment. However, it's crucial to remember that bond prices and yields move inversely. Lower yields mean higher bond prices, but the potential for future price fluctuations remains. Diversification within a fixed-income portfolio is always advisable.

-

Stock Market: The shift in Fed policy could have positive implications for the stock market. Lower interest rates generally stimulate economic activity and boost corporate profits, potentially leading to higher stock valuations. However, the impact on the stock market will depend on various other economic factors.

-

Housing Market: While the immediate impact on the housing market is less direct, lower interest rates in the future could lead to a gradual easing of mortgage rates, potentially influencing housing demand and prices.

Economic Uncertainty Remains

It's crucial to acknowledge that the economic outlook remains uncertain. While the Fed's projections suggest a less aggressive path, several factors could influence the actual trajectory of interest rates. These include inflation developments, the robustness of the labor market, and global economic conditions.

Looking Ahead:

The Fed's signal of a single rate cut in 2025 represents a significant shift in its monetary policy stance. While this suggests a more optimistic view of the economy's future trajectory, investors should remain cautious and monitor economic data closely. The future remains subject to unforeseen circumstances. Seeking professional financial advice is recommended for making informed investment decisions based on individual risk tolerance and financial goals.

Keywords: Fed, Federal Reserve, interest rates, rate cut, 2025, U.S. Treasury yields, bonds, stock market, housing market, inflation, monetary policy, economic outlook, investment strategy, financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fed Signals Single 2025 Rate Cut, U.S. Treasury Yields Dip. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

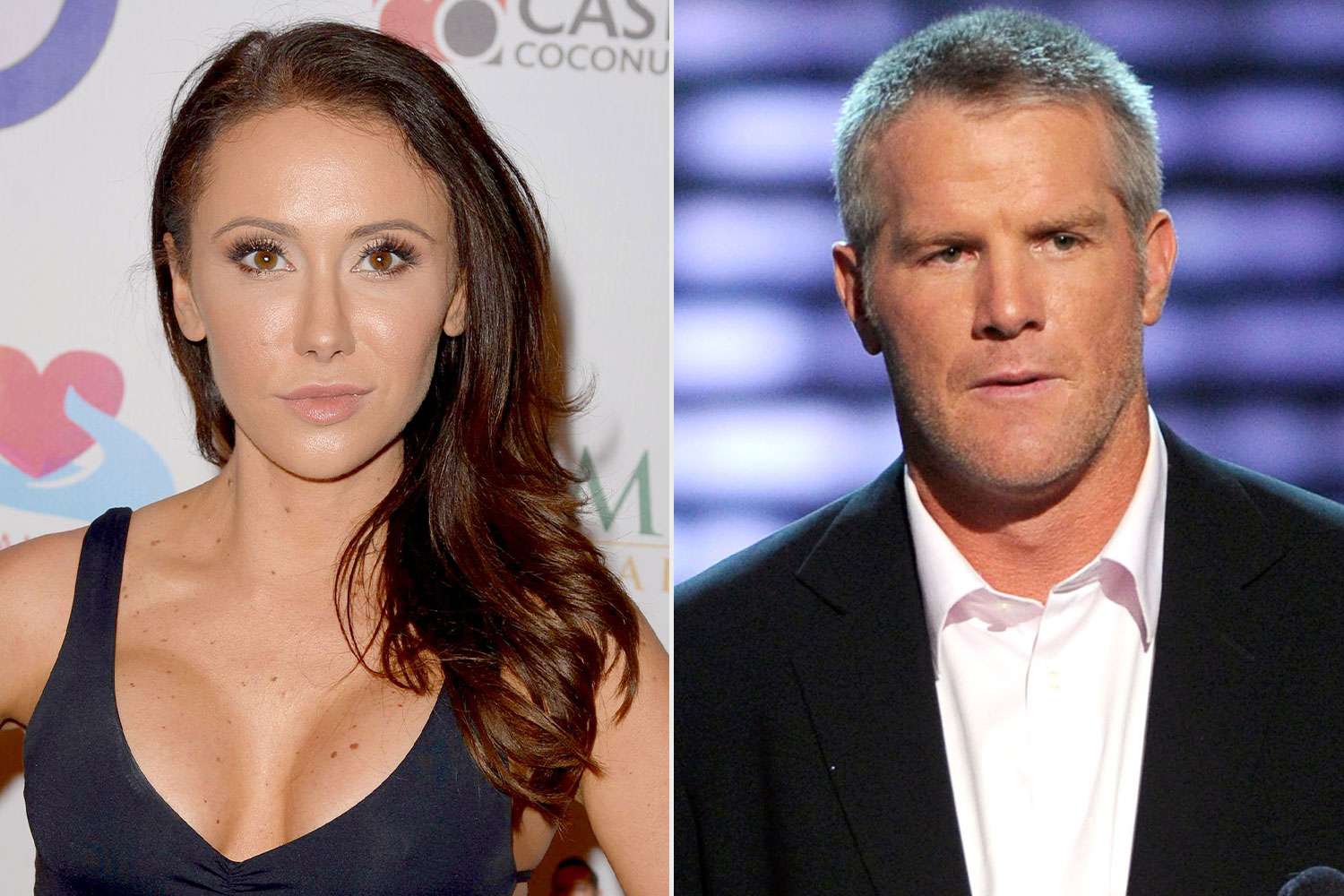

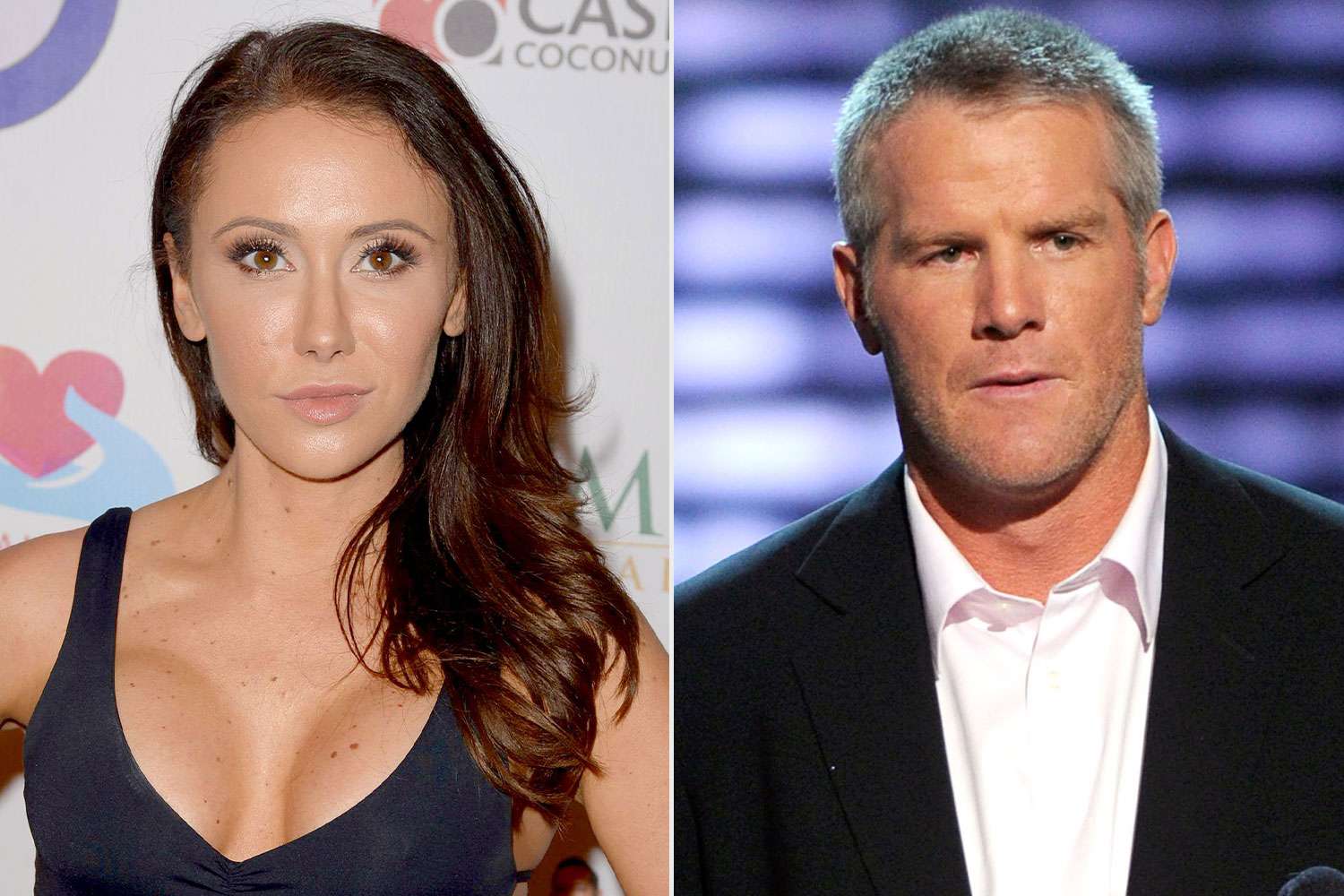

Jenn Sterger Details Emotional Toll Of Brett Favre Scandal

May 20, 2025

Jenn Sterger Details Emotional Toll Of Brett Favre Scandal

May 20, 2025 -

Close Call Nicusor Dan Secures Presidential Win In Romania

May 20, 2025

Close Call Nicusor Dan Secures Presidential Win In Romania

May 20, 2025 -

Lineker Exit Match Of The Day Future Uncertain

May 20, 2025

Lineker Exit Match Of The Day Future Uncertain

May 20, 2025 -

Jamie Lee Curtis Shares Insights On Her Bond With Lindsay Lohan Years After Freaky Friday

May 20, 2025

Jamie Lee Curtis Shares Insights On Her Bond With Lindsay Lohan Years After Freaky Friday

May 20, 2025 -

Los Angeles High Speed Chase Motorcyclist Elude Police

May 20, 2025

Los Angeles High Speed Chase Motorcyclist Elude Police

May 20, 2025

Latest Posts

-

200 Million Invested In Ethereum Funds Following Pectra Upgrade

May 20, 2025

200 Million Invested In Ethereum Funds Following Pectra Upgrade

May 20, 2025 -

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On Dehumanizing Treatment

May 20, 2025

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On Dehumanizing Treatment

May 20, 2025 -

Prostate Cancer Diagnosis For President Joe Biden Official Confirmation

May 20, 2025

Prostate Cancer Diagnosis For President Joe Biden Official Confirmation

May 20, 2025 -

Did The Ufc Withhold Information About Tom Aspinall Jon Jones Says Yes

May 20, 2025

Did The Ufc Withhold Information About Tom Aspinall Jon Jones Says Yes

May 20, 2025 -

Match Of The Day Future Uncertain After Lineker Controversy

May 20, 2025

Match Of The Day Future Uncertain After Lineker Controversy

May 20, 2025