Fed Signals Single 2025 Rate Cut: US Treasury Yields Dip

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed Signals Single 2025 Rate Cut: US Treasury Yields Dip on Doveish Hints

The Federal Reserve's latest pronouncements have sent ripples through the financial markets, with hints of a single interest rate cut in 2025 leading to a dip in US Treasury yields. This cautious optimism, however, is tempered by ongoing concerns about inflation and the resilience of the US economy. The market reaction underscores the delicate balancing act the Fed faces as it navigates a complex economic landscape.

A Shift in Tone: From Hawks to Doves?

The recent shift in the Fed's communication strategy has been noticeable. While previous statements emphasized a commitment to combating inflation, even at the cost of slower economic growth, the latest projections suggest a more dovish approach. This subtle change in tone is what sparked the decline in Treasury yields, a key indicator of investor sentiment. The implied single rate cut for 2025 signals a belief that inflation will continue to moderate, allowing for a loosening of monetary policy. This expectation, however, is not universally shared.

What Drove the Treasury Yield Dip?

The decrease in US Treasury yields can be attributed to several factors:

- Projected Rate Cut: The most significant factor is the market's interpretation of the Fed's projection of a single rate cut in 2025. This suggests a belief that inflation will be under control by then.

- Easing Inflation Concerns: While inflation remains above the Fed's target, recent data points to a gradual decline, further supporting the expectation of a rate cut.

- Economic Uncertainty: The ongoing global economic uncertainty and potential for a recession contribute to investor caution, making lower-yield Treasury bonds more attractive.

Concerns Remain: Inflation and Economic Resilience

Despite the optimistic interpretation by some market participants, significant uncertainties remain. Inflation, while easing, is still stubbornly high. The strength of the US labor market also presents a challenge, as robust employment can fuel wage growth and, consequently, inflation. The Fed's projections are, therefore, subject to considerable revision depending on future economic data.

Impact on Investors and the Broader Economy:

The decreased Treasury yields have implications for various sectors. Lower borrowing costs might stimulate investment and economic activity. However, this positive effect could be counteracted by persistently high inflation. For investors, the situation presents both opportunities and risks. Understanding the nuances of the Fed's policy decisions and their potential impact is crucial for navigating the current market conditions.

Looking Ahead: What to Watch For

The coming months will be crucial in determining the accuracy of the Fed's projections. Investors and economists will be closely monitoring key economic indicators such as inflation data, employment figures, and consumer spending. Any significant deviation from the projected trajectory could lead to a reassessment of the market's current outlook and a subsequent shift in Treasury yields.

Call to Action: Stay informed about economic developments and consult with a financial advisor before making any investment decisions. Understanding the complexities of the current economic climate is crucial for effective financial planning. For further insights into economic forecasting and market analysis, explore resources like [link to a reputable financial news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fed Signals Single 2025 Rate Cut: US Treasury Yields Dip. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Last Of Us Proves Less Is More A Masterclass In Emotional Storytelling

May 20, 2025

The Last Of Us Proves Less Is More A Masterclass In Emotional Storytelling

May 20, 2025 -

Is Bare Beating On Public Transport Getting Out Of Hand

May 20, 2025

Is Bare Beating On Public Transport Getting Out Of Hand

May 20, 2025 -

Jon Joness Explosive Accusation Ufc Covered Up Aspinalls Injury

May 20, 2025

Jon Joness Explosive Accusation Ufc Covered Up Aspinalls Injury

May 20, 2025 -

Brett Favre Controversy A J Perez Discusses Espns Untold And Fallout

May 20, 2025

Brett Favre Controversy A J Perez Discusses Espns Untold And Fallout

May 20, 2025 -

Jon Jones And Tom Aspinall Analyzing The Strip The Duck Controversy And Fan Backlash

May 20, 2025

Jon Jones And Tom Aspinall Analyzing The Strip The Duck Controversy And Fan Backlash

May 20, 2025

Latest Posts

-

Snls 50th Season Ends On A High Note Record Viewership

May 20, 2025

Snls 50th Season Ends On A High Note Record Viewership

May 20, 2025 -

Moodys Downgrade Unfazed Stock Market Gains Continue With S And P 500 Leading The Way

May 20, 2025

Moodys Downgrade Unfazed Stock Market Gains Continue With S And P 500 Leading The Way

May 20, 2025 -

Peaky Blinders Creator Reveals Next Chapter Hints At Key Departure

May 20, 2025

Peaky Blinders Creator Reveals Next Chapter Hints At Key Departure

May 20, 2025 -

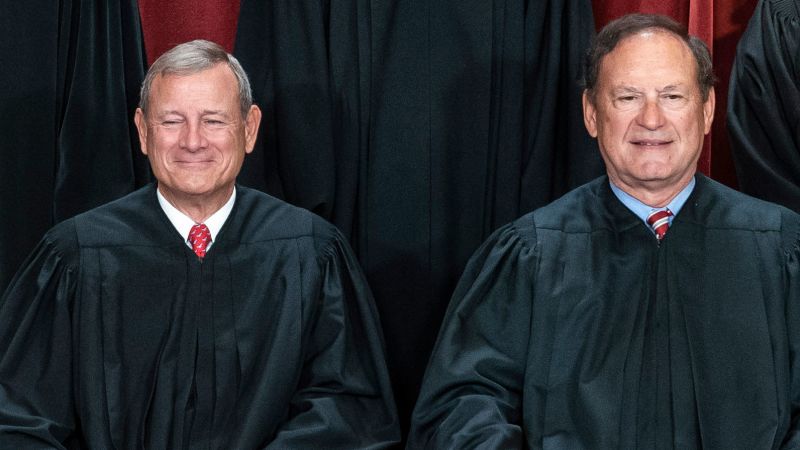

Supreme Court Justices Alito And Roberts A Retrospective On Their Long Tenures

May 20, 2025

Supreme Court Justices Alito And Roberts A Retrospective On Their Long Tenures

May 20, 2025 -

Harsh Training And Weight Criticism An Olympic Gold Medalists Struggle

May 20, 2025

Harsh Training And Weight Criticism An Olympic Gold Medalists Struggle

May 20, 2025