Federal Student Loans Remain A Better Choice Than Private Loans, Experts Explain

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Federal Student Loans Remain a Better Choice Than Private Loans, Experts Explain

The rising cost of higher education leaves many students grappling with the daunting task of financing their degrees. Choosing between federal and private student loans is a crucial decision that can significantly impact a student's financial future. While private loans may seem appealing at first glance, experts overwhelmingly agree that federal student loans remain the superior option for most borrowers. Let's delve into why.

Why Federal Student Loans Reign Supreme:

Federal student loans offer a range of benefits that private loans simply can't match. These advantages stem from government backing and robust consumer protections.

-

Flexible Repayment Plans: Federal loans provide various repayment options, including income-driven repayment plans (IDR) that tie monthly payments to your income. Struggling to make payments? IDR plans can significantly reduce your monthly burden, preventing default. Private lenders typically don't offer this flexibility.

-

Forbearance and Deferment Options: Life throws curveballs. Federal loans allow for forbearance or deferment, temporarily suspending or reducing your payments during periods of financial hardship, such as unemployment or illness. These options are less readily available, if available at all, with private loans.

-

Loan Forgiveness Programs: Certain professions, like teaching and public service, may qualify for federal loan forgiveness programs, potentially eliminating a significant portion or even all of your student loan debt. This is a benefit exclusive to federal loans.

-

Lower Interest Rates: Generally, federal student loans offer lower interest rates compared to private loans. This translates to significant savings over the life of the loan. Shop around for the best federal loan rates, but remember to prioritize the benefits over a tiny interest rate difference.

-

Robust Consumer Protections: The federal government enforces strong consumer protections for federal student loan borrowers, ensuring fair lending practices and preventing predatory lending. Private lenders are less heavily regulated.

The Downsides of Private Student Loans:

While private loans might seem tempting with potentially lower initial interest rates (in some rare cases), the lack of borrower protections and repayment flexibility can quickly turn a seemingly good deal into a financial nightmare.

-

Higher Interest Rates (Often): While sometimes lower initially, private loan interest rates can fluctuate and often end up higher than federal loan rates, especially for borrowers with less-than-perfect credit.

-

Limited Repayment Options: Private loans typically offer fewer repayment options, leaving borrowers with less flexibility to manage their debt during challenging financial times.

-

Lack of Forgiveness Programs: Private loans don't qualify for federal loan forgiveness programs.

-

Potential for Predatory Lending: The lack of stringent regulation in the private loan market increases the risk of predatory lending practices targeting vulnerable students.

Choosing the Right Path: Prioritize Federal Loans First:

Before considering private student loans, exhaust all options for federal aid. Complete the FAFSA (Free Application for Federal Student Aid) to determine your eligibility for grants, scholarships, and federal loans. Only after maximizing federal aid should you explore private loan options – and even then, proceed with extreme caution. Consult with a financial advisor to thoroughly understand the implications of both federal and private student loans before making a decision.

Conclusion:

Federal student loans provide a crucial safety net for students navigating the complexities of higher education financing. Their flexibility, consumer protections, and potential for loan forgiveness make them a far superior choice compared to private loans for the vast majority of borrowers. Always prioritize federal student loan options before exploring private alternatives. Understanding these differences can save you thousands of dollars and prevent potential financial distress in the future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Federal Student Loans Remain A Better Choice Than Private Loans, Experts Explain. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Summer I Turned Pretty Episode Release Times And Streaming Options

Jul 31, 2025

The Summer I Turned Pretty Episode Release Times And Streaming Options

Jul 31, 2025 -

Top 5 Goblin Party Decks For Clash Royales July August 2025 Event

Jul 31, 2025

Top 5 Goblin Party Decks For Clash Royales July August 2025 Event

Jul 31, 2025 -

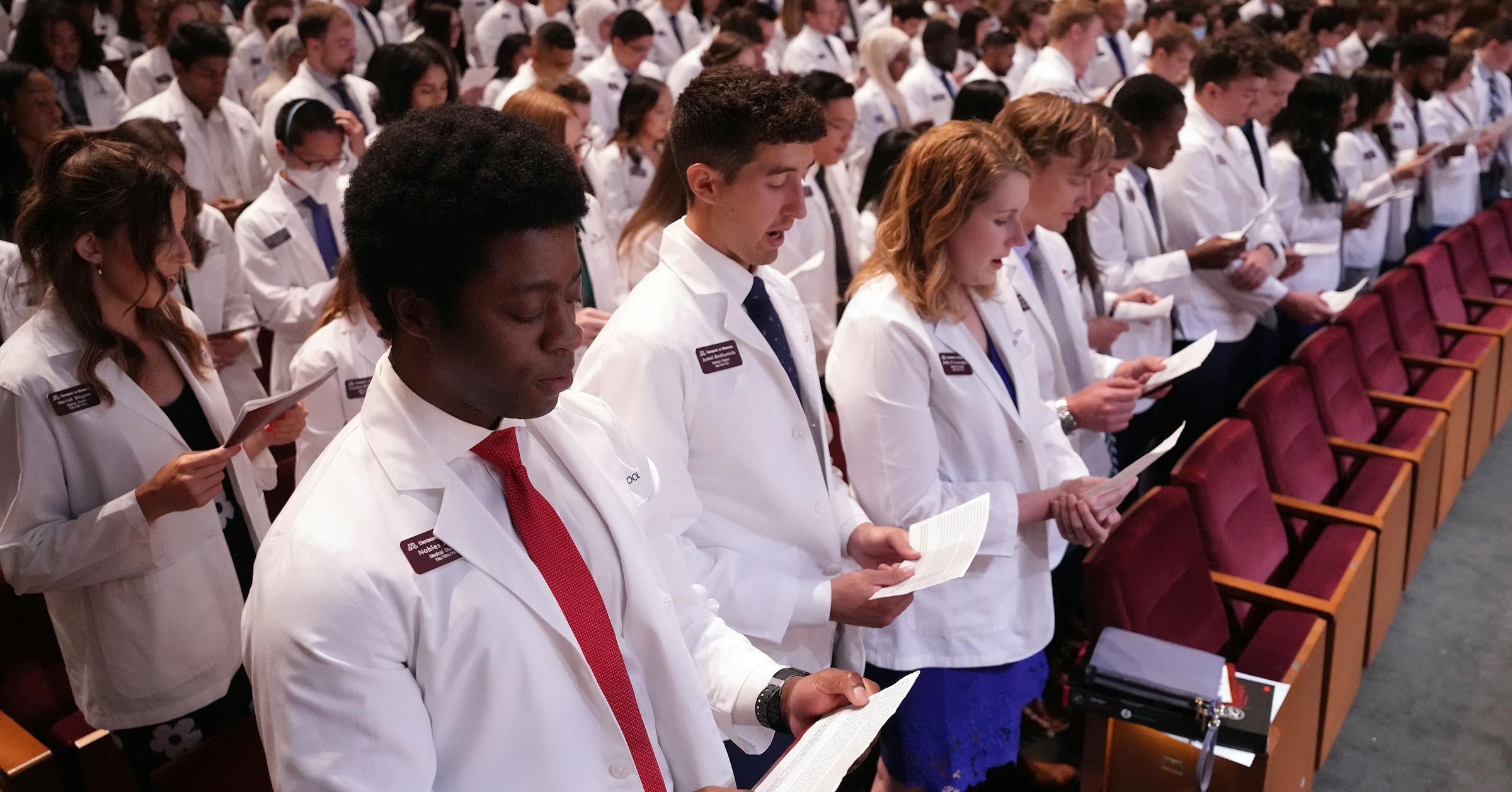

Are Law And Medical School Unaffordable New Federal Loan Caps Explained

Jul 31, 2025

Are Law And Medical School Unaffordable New Federal Loan Caps Explained

Jul 31, 2025 -

Banknote Redesign A Flood Of Ideas Received By The Bank Of England

Jul 31, 2025

Banknote Redesign A Flood Of Ideas Received By The Bank Of England

Jul 31, 2025 -

Fighting For Safer Skies A Familys Legacy After A Fatal Midair Collision

Jul 31, 2025

Fighting For Safer Skies A Familys Legacy After A Fatal Midair Collision

Jul 31, 2025