Federal Vs. Private Student Loans: Experts Explain Why Federal Loans Still Win

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Federal vs. Private Student Loans: Experts Explain Why Federal Loans Still Win

The rising cost of higher education leaves many students grappling with the daunting task of financing their degrees. Choosing between federal and private student loans is a crucial decision that can significantly impact your financial future. While private loans might seem appealing at first glance, experts overwhelmingly agree that federal student loans still hold a significant advantage. This article breaks down the key differences and explains why federal loans remain the preferred choice for most students.

H2: The Key Advantages of Federal Student Loans

Federal student loans offer a range of benefits that private loans simply can't match. These advantages extend beyond just interest rates, encompassing crucial protections and flexible repayment options.

-

Lower Interest Rates: Generally, federal student loan interest rates are lower than those offered by private lenders. This translates to significant savings over the life of the loan. The current interest rates for federal student loans can be found on the .

-

Income-Driven Repayment Plans: Federal loans offer a variety of income-driven repayment plans (IDR). These plans adjust your monthly payments based on your income and family size, making repayment more manageable, especially during periods of unemployment or low income. Private loans rarely offer such flexibility.

-

Deferment and Forbearance Options: Life throws curveballs. Federal loans provide deferment and forbearance options, allowing you to temporarily postpone or reduce your payments during financial hardship. These protections are significantly less common with private loans.

-

Loan Forgiveness Programs: Certain professions, like teaching and public service, may qualify for federal loan forgiveness programs. These programs can eliminate a portion or even all of your student loan debt after meeting specific requirements. This is a benefit almost exclusively offered through federal loan programs.

-

Stronger Consumer Protections: Federal student loans are subject to robust consumer protections under federal law. This means you have greater recourse if you encounter problems with your loan servicer. Private lenders are subject to state laws, which can vary considerably in their strength.

H2: When Might Private Loans Be Considered?

While federal loans are generally the better option, there are limited circumstances where private loans might be considered:

-

Federal loan limits have been reached: If you've maxed out your federal loan eligibility and still need additional funding, private loans might fill the gap. However, carefully weigh the risks and benefits before taking this route.

-

Specific educational needs: Some private lenders offer specialized loans for specific programs or schools that are not covered by federal loans.

H3: Understanding the Risks of Private Student Loans

Before considering private loans, it's crucial to understand the potential downsides:

-

Higher interest rates: As mentioned, private loan interest rates are typically higher than federal rates, leading to increased long-term costs.

-

Less flexible repayment options: Private loans often lack the flexible repayment and forgiveness options available with federal loans.

-

Fewer consumer protections: Private loans generally offer fewer consumer protections, leaving borrowers more vulnerable to predatory lending practices.

H2: The Bottom Line: Prioritize Federal Loans

In conclusion, for most students, federal student loans remain the superior choice. Their lower interest rates, flexible repayment options, and robust consumer protections significantly outweigh the potential benefits of private loans. Before taking out any student loans, thoroughly research your options, understand the terms and conditions, and prioritize federal loans to protect your financial future. Remember to always check the for the most up-to-date information.

Call to Action: Explore your federal student loan options today. Don't hesitate to seek guidance from a financial advisor if you need help navigating the complexities of student loan financing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Federal Vs. Private Student Loans: Experts Explain Why Federal Loans Still Win. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

108 Million Funding Freeze Trump Administration Targets Duke Health For Alleged Racial Discrimination

Aug 01, 2025

108 Million Funding Freeze Trump Administration Targets Duke Health For Alleged Racial Discrimination

Aug 01, 2025 -

Controversial Fda Official Dr Vinay Prasad Leaves Agency Whats Next

Aug 01, 2025

Controversial Fda Official Dr Vinay Prasad Leaves Agency Whats Next

Aug 01, 2025 -

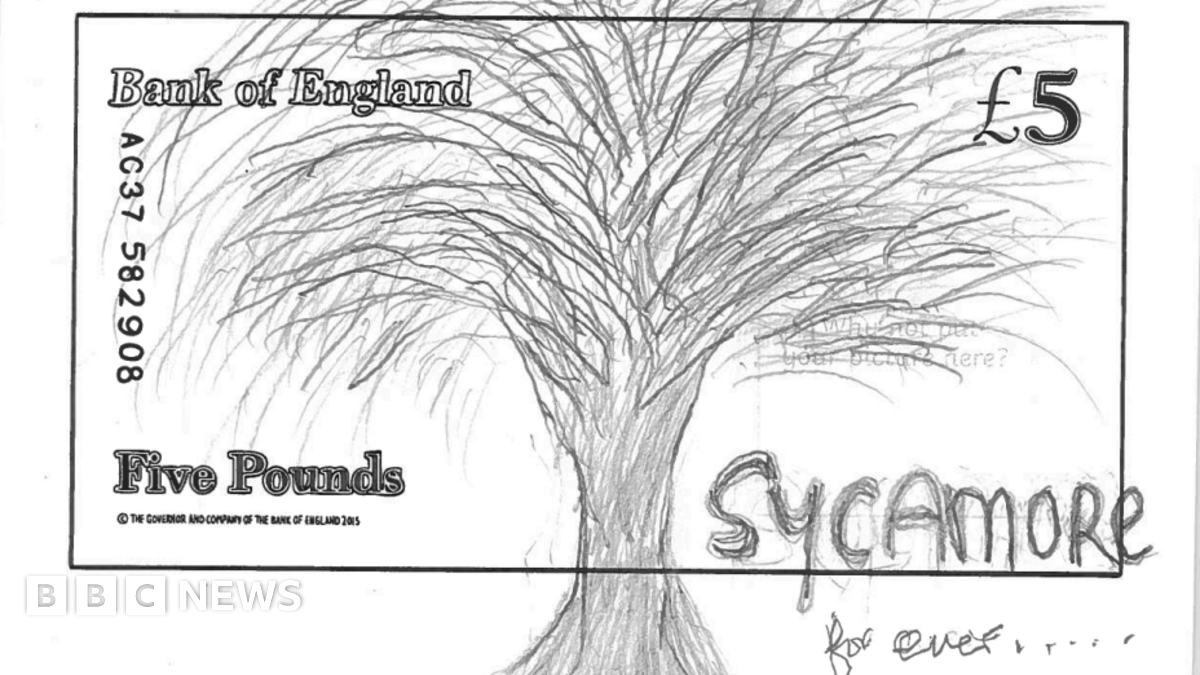

Bank Of Englands Banknote Redesign Thousands Submit Design Ideas

Aug 01, 2025

Bank Of Englands Banknote Redesign Thousands Submit Design Ideas

Aug 01, 2025 -

Greece Denounces Migrant Influx In Crete Tightening Mediterranean Border Controls

Aug 01, 2025

Greece Denounces Migrant Influx In Crete Tightening Mediterranean Border Controls

Aug 01, 2025 -

Departure Of Dr Vinay Prasad Analyzing The Controversy At The Fda

Aug 01, 2025

Departure Of Dr Vinay Prasad Analyzing The Controversy At The Fda

Aug 01, 2025

Latest Posts

-

Analysis Mc Larens Strong Practice Performance At The Hungaroring

Aug 02, 2025

Analysis Mc Larens Strong Practice Performance At The Hungaroring

Aug 02, 2025 -

Mc Laren Dominates Hungarian Gp Practice Unstoppable At The Hungaroring

Aug 02, 2025

Mc Laren Dominates Hungarian Gp Practice Unstoppable At The Hungaroring

Aug 02, 2025 -

Could Robert Pattinson And David Corenswets Heroes Unite In A Dc Sequel

Aug 02, 2025

Could Robert Pattinson And David Corenswets Heroes Unite In A Dc Sequel

Aug 02, 2025 -

New Rules Civil Service Internships Reserved For Working Class Applicants

Aug 02, 2025

New Rules Civil Service Internships Reserved For Working Class Applicants

Aug 02, 2025 -

Kai Cenat Vs X Qc A Net Worth Showdown

Aug 02, 2025

Kai Cenat Vs X Qc A Net Worth Showdown

Aug 02, 2025