Fewer Students Can Afford Law Or Medical School Due To New Federal Loan Restrictions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

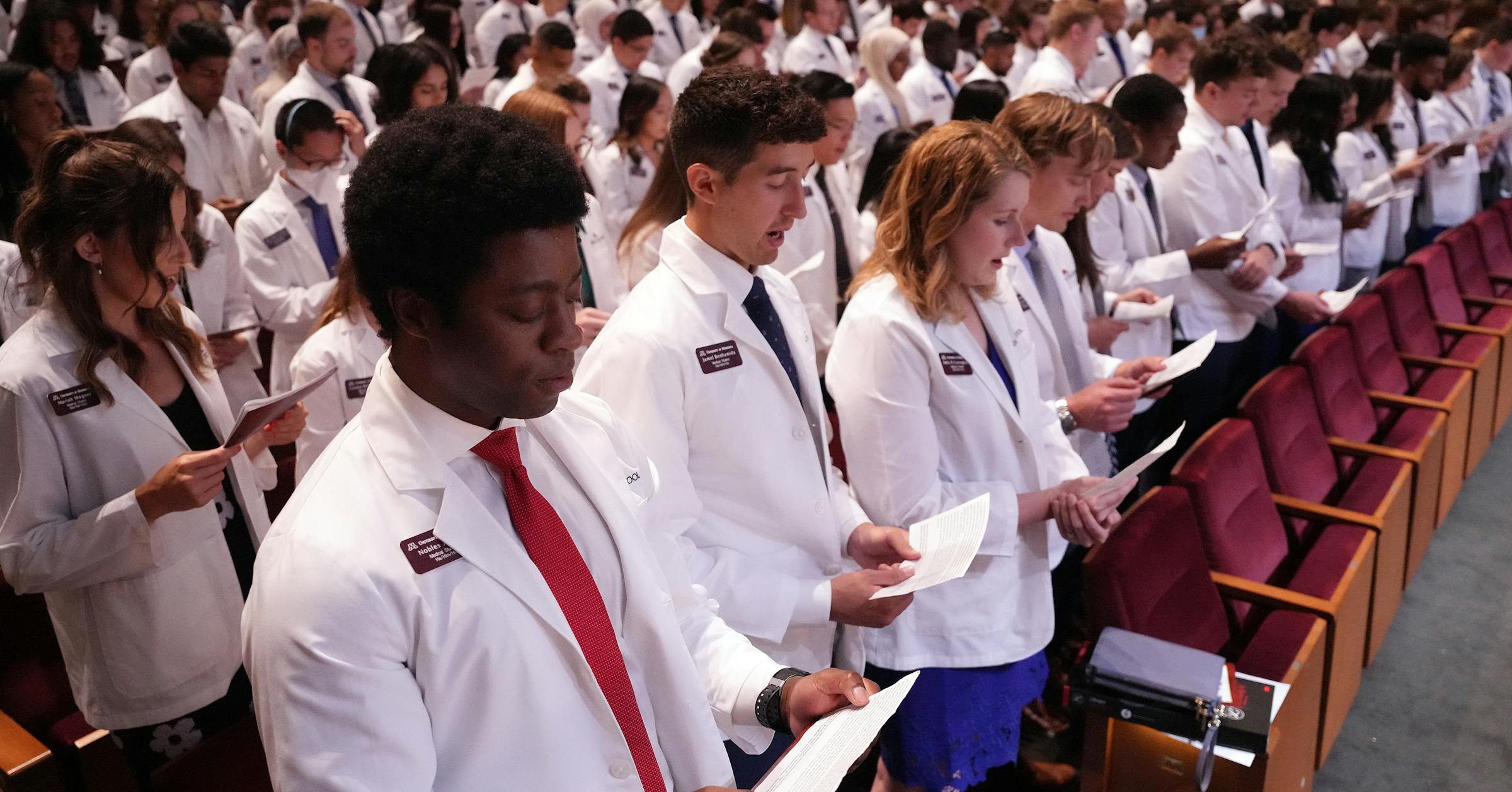

Fewer Students Can Afford Law or Medical School Due to New Federal Loan Restrictions

The rising cost of higher education is nothing new, but recent changes to federal student loan programs are slamming the door on aspiring doctors and lawyers, particularly those from lower-income backgrounds. The new restrictions, implemented [insert date or timeframe if available], significantly limit the amount students can borrow, creating a major hurdle for those pursuing already expensive professional degrees. This is sparking concerns about decreased diversity within these crucial professions and a potential shortage of qualified professionals in the future.

The Impact of Loan Restrictions on Aspiring Professionals

The changes to federal student loan programs have directly impacted prospective law and medical students in several key ways:

- Increased reliance on private loans: With reduced access to federal loans, many students are now forced to rely on private lenders, who often charge significantly higher interest rates and less favorable repayment terms. This can lead to crippling debt burdens even before graduation.

- Reduced applicant pool: The higher cost barrier is discouraging many qualified students, especially those from disadvantaged backgrounds who may lack family support for tuition, from even applying to these prestigious programs. This creates a less diverse student body and potentially limits the pool of future professionals.

- Shifting career choices: Facing insurmountable debt, some prospective students are opting for less expensive career paths altogether, potentially leading to shortages in critical fields like medicine and law.

The Financial Burden of Professional Degrees

The cost of attending law and medical school has skyrocketed in recent years. Tuition, fees, living expenses, and other associated costs can easily reach hundreds of thousands of dollars over the course of a degree. This financial burden was already significant, but the new loan restrictions have exacerbated the problem, making it practically unattainable for many.

For instance, the average annual tuition at private medical schools can exceed $60,000, while top law schools often charge similar amounts. Even with federal loans, many students would graduate with substantial debt. Now, with reduced borrowing limits, the situation is significantly worse.

Long-Term Consequences and Potential Solutions

The long-term consequences of these changes could be far-reaching. A less diverse and potentially smaller pool of future doctors and lawyers could have significant impacts on healthcare access and the legal system, particularly for underserved communities.

What can be done? Experts suggest several potential solutions:

- Increased federal funding for student loans: A larger allocation of funds could help alleviate the financial burden on students and expand access to these critical professions.

- Targeted scholarships and grants: Expanding scholarship and grant programs, especially those aimed at students from underrepresented groups, could help level the playing field.

- Greater transparency in tuition costs: More transparent pricing policies from educational institutions could help students make informed decisions and better plan for their financial future.

- Re-evaluation of loan repayment plans: More flexible and affordable repayment plans could make the burden of student loan debt more manageable for graduates.

The current situation underscores the urgent need for policymakers to address the rising cost of higher education and ensure that talented individuals from all backgrounds have access to opportunities in critical professions. Failure to do so risks creating a system that disadvantages qualified students and ultimately harms society as a whole. This is a challenge that demands immediate attention and innovative solutions.

(CTA: Learn more about student loan options and financial aid resources by visiting [link to relevant government website or educational resource].)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fewer Students Can Afford Law Or Medical School Due To New Federal Loan Restrictions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Shopping Addiction A Serious Problem Experts Weigh In

Aug 01, 2025

Is Shopping Addiction A Serious Problem Experts Weigh In

Aug 01, 2025 -

Trumps Trade Fury Palestine Recognition Fuels Canada Dispute

Aug 01, 2025

Trumps Trade Fury Palestine Recognition Fuels Canada Dispute

Aug 01, 2025 -

Rape Charity Creates Separate Service For Biological Women Following Controversy

Aug 01, 2025

Rape Charity Creates Separate Service For Biological Women Following Controversy

Aug 01, 2025 -

108 Million Funding Freeze Duke University Faces Trump Administrations Racial Discrimination Claims

Aug 01, 2025

108 Million Funding Freeze Duke University Faces Trump Administrations Racial Discrimination Claims

Aug 01, 2025 -

Powell Dap Tat Hy Vong Giam Lai Suat Gia Vang Gap Kho

Aug 01, 2025

Powell Dap Tat Hy Vong Giam Lai Suat Gia Vang Gap Kho

Aug 01, 2025

Latest Posts

-

Michael Madsen Defends Tarantinos Firing Of Lawrence Tierney

Aug 02, 2025

Michael Madsen Defends Tarantinos Firing Of Lawrence Tierney

Aug 02, 2025 -

Reggiana Training Center Preparing For The Future Of Italian Football

Aug 02, 2025

Reggiana Training Center Preparing For The Future Of Italian Football

Aug 02, 2025 -

Gym And Tactical Training Center Build Strength Agility And Skill

Aug 02, 2025

Gym And Tactical Training Center Build Strength Agility And Skill

Aug 02, 2025 -

49 Billion Heathrow Expansion Impact And Implications

Aug 02, 2025

49 Billion Heathrow Expansion Impact And Implications

Aug 02, 2025 -

Tuesday July 29 2025 Mega Millions Results Check Your Tickets

Aug 02, 2025

Tuesday July 29 2025 Mega Millions Results Check Your Tickets

Aug 02, 2025