Figma IPO: Your Complete Guide To Trading Figma Shares On The Stock Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Figma IPO: Your Complete Guide to Trading Figma Shares on the Stock Market

The much-anticipated Figma IPO (Initial Public Offering) has finally arrived, marking a significant event for the design and tech worlds. This comprehensive guide will walk you through everything you need to know about trading Figma shares on the stock market, from understanding the company's background to navigating the complexities of stock trading.

Understanding Figma and its Market Position

Figma, the collaborative interface design tool, has rapidly become a dominant player in the software industry. Its cloud-based platform, known for its ease of use and powerful features, has disrupted traditional design workflows and attracted millions of users, ranging from individual designers to large enterprises. This widespread adoption positions Figma for substantial growth in the coming years. However, understanding the competitive landscape, including Adobe XD and Sketch, is crucial before investing. Researching market share and future projections will help inform your investment strategy.

The Figma IPO: Key Details and Considerations

The Figma IPO represents a significant opportunity for investors. However, before diving in, it’s vital to understand the intricacies involved. This includes:

- IPO Pricing: The initial offering price will be a key factor influencing early trading. Analyze pre-IPO valuations and compare them to similar tech company IPOs to gauge potential returns.

- Stock Symbol: Knowing the correct stock symbol (ticker) is crucial for executing trades. This information will be widely publicized leading up to and immediately after the IPO.

- Investment Risks: Like any investment, trading Figma shares carries inherent risks. Market volatility, competition, and economic factors can all impact stock performance. Thorough due diligence is essential.

- Brokerage Account: To buy and sell Figma shares, you'll need a brokerage account. Research different platforms, comparing fees, features, and user-friendliness. [Link to reputable brokerage comparison site - e.g., Investopedia]

How to Buy Figma Shares: A Step-by-Step Guide

Once you've done your research and are ready to invest, follow these steps:

- Open a Brokerage Account: If you don't already have one, open an account with a reputable online broker.

- Fund Your Account: Deposit funds into your brokerage account.

- Search for the Stock Symbol: Locate the Figma stock symbol (ticker) using your brokerage platform's search function.

- Place Your Order: Enter the number of shares you wish to purchase and submit your order. Consider using limit orders to control the price you pay.

- Monitor Your Investment: Regularly track the performance of your Figma shares.

Beyond the Initial Purchase: Strategies for Trading Figma Stock

Buying Figma shares at the IPO is just the beginning. Consider these strategies for managing your investment:

- Long-Term Holding: For long-term growth potential, consider holding your shares for an extended period.

- Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money at regular intervals, regardless of the stock price. This mitigates the risk of investing a lump sum at a peak price.

- Diversification: Don't put all your eggs in one basket. Diversify your investment portfolio across different asset classes to reduce overall risk.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions. The information provided here is based on publicly available data and is subject to change.

Keywords: Figma IPO, Figma stock, Figma shares, buy Figma stock, trade Figma, Figma stock market, IPO investing, stock trading, online brokerage, investment strategies, dollar-cost averaging, diversification, tech stock, design software.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Figma IPO: Your Complete Guide To Trading Figma Shares On The Stock Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

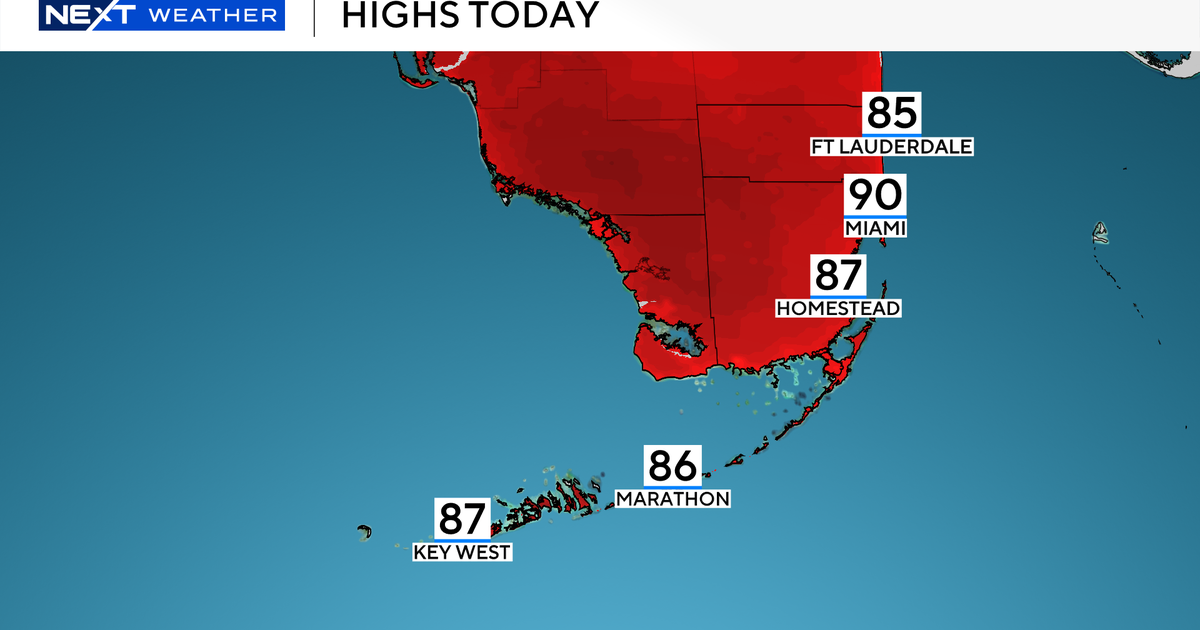

Scattered Showers And Highs In South Florida Today

Jul 02, 2025

Scattered Showers And Highs In South Florida Today

Jul 02, 2025 -

Understanding The Figma Ipo Strategies For Trading Figma Stock

Jul 02, 2025

Understanding The Figma Ipo Strategies For Trading Figma Stock

Jul 02, 2025 -

Record Breaking Heatwave Uk Reaches 33 C

Jul 02, 2025

Record Breaking Heatwave Uk Reaches 33 C

Jul 02, 2025 -

Three Real Madrid Stars Ballon D Or Predictions From Italian Football Icon

Jul 02, 2025

Three Real Madrid Stars Ballon D Or Predictions From Italian Football Icon

Jul 02, 2025 -

Free Agency Move Celtics Sign Ex Timberwolves Forward For 5 Million

Jul 02, 2025

Free Agency Move Celtics Sign Ex Timberwolves Forward For 5 Million

Jul 02, 2025

Latest Posts

-

Major Government Concessions Secure Welfare Bill Passage

Jul 03, 2025

Major Government Concessions Secure Welfare Bill Passage

Jul 03, 2025 -

Understanding The Shifting Landscape Of Glp 1 Drug Coverage For Obesity

Jul 03, 2025

Understanding The Shifting Landscape Of Glp 1 Drug Coverage For Obesity

Jul 03, 2025 -

Pinal County Sheriffs Office Ayers Brothers Missing Person Case Closed

Jul 03, 2025

Pinal County Sheriffs Office Ayers Brothers Missing Person Case Closed

Jul 03, 2025 -

The Lakers Offseason Strategy Analyzing Their Moves And Future Outlook

Jul 03, 2025

The Lakers Offseason Strategy Analyzing Their Moves And Future Outlook

Jul 03, 2025 -

Fbi Scraps Maryland Campus Plan Staying In Dc

Jul 03, 2025

Fbi Scraps Maryland Campus Plan Staying In Dc

Jul 03, 2025