FinFluencer Crackdown: Regulators Make Arrests

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

FinFluencer Crackdown: Regulators Make Arrests in Major Sweep Against Crypto and Investment Fraud

Financial influencers (finfluencers) promoting unregulated investments and cryptocurrencies are facing a significant crackdown. In a coordinated effort across multiple jurisdictions, regulators have announced a series of arrests targeting individuals accused of orchestrating sophisticated schemes to defraud investors through social media platforms. This sweeping action marks a significant escalation in the fight against online financial fraud, sending a clear message that deceptive practices will not be tolerated.

The coordinated effort, involving agencies like the Securities and Exchange Commission (SEC) in the US and equivalent bodies in Europe and Asia, signals a new era of proactive regulation in the online financial space. For years, finfluencers have enjoyed a largely unregulated landscape, using their substantial online followings to promote often-risky investments with little to no disclosure of potential conflicts of interest or the inherent risks involved.

Who is being targeted?

The arrests target a range of individuals, from high-profile finfluencers with millions of followers to those operating smaller, more localized schemes. Charges vary, including:

- Securities fraud: Promoting unregistered securities or engaging in manipulative trading practices.

- Wire fraud: Using electronic communication to defraud investors.

- Money laundering: Concealing the proceeds of illegal activities.

- Market manipulation: Artificially inflating the price of assets.

Many of the arrested individuals allegedly promoted get-rich-quick schemes involving cryptocurrencies, NFTs, and other speculative investments, often employing deceptive marketing tactics and misleading testimonials. The investigations highlight the vulnerability of followers, many of whom lack the financial literacy to assess the risks involved.

The Impact of Social Media:

The ease with which finfluencers can reach large audiences on platforms like TikTok, Instagram, and YouTube has amplified the reach and impact of their fraudulent activities. Regulators are now focusing on these platforms, demanding greater transparency and accountability from both the influencers and the social media companies that host them. This crackdown could lead to increased scrutiny of influencer marketing practices across various sectors.

What this means for investors:

This crackdown serves as a critical reminder for investors to exercise extreme caution when considering investments promoted online. Before investing in anything promoted by a finfluencer, investors should:

- Do their own thorough research: Don't rely solely on the information presented by influencers. Consult reputable financial advisors and conduct independent due diligence.

- Verify the legitimacy of the investment: Ensure the investment is properly registered with the relevant authorities.

- Be wary of unrealistic promises: Be skeptical of any investment promising exceptionally high returns with minimal risk.

- Understand the fees and charges: Be aware of all associated costs and fees.

The Future of FinFluencer Regulation:

This significant crackdown signals a shift towards greater regulatory oversight of online financial promotion. We can expect to see further efforts to increase transparency and accountability within the finfluencer community. Increased collaboration between regulators across international borders is also anticipated, making it harder for fraudulent schemes to operate across jurisdictions. The future of finfluencer activity will likely be shaped by stricter regulations and increased scrutiny, ultimately aiming to protect unsuspecting investors from deceptive practices. This ongoing situation underscores the need for constant vigilance and informed decision-making in the ever-evolving world of online finance.

Related Articles:

- [Link to an article on identifying investment scams]

- [Link to an article on cryptocurrency regulation]

Disclaimer: This article is for informational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on FinFluencer Crackdown: Regulators Make Arrests. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Chris Conleys Nfl Career Concludes After A Decade Of Play

Jun 08, 2025

Chris Conleys Nfl Career Concludes After A Decade Of Play

Jun 08, 2025 -

Shock At Roland Garros Swiateks Defeat And Ranking Drop To No 7

Jun 08, 2025

Shock At Roland Garros Swiateks Defeat And Ranking Drop To No 7

Jun 08, 2025 -

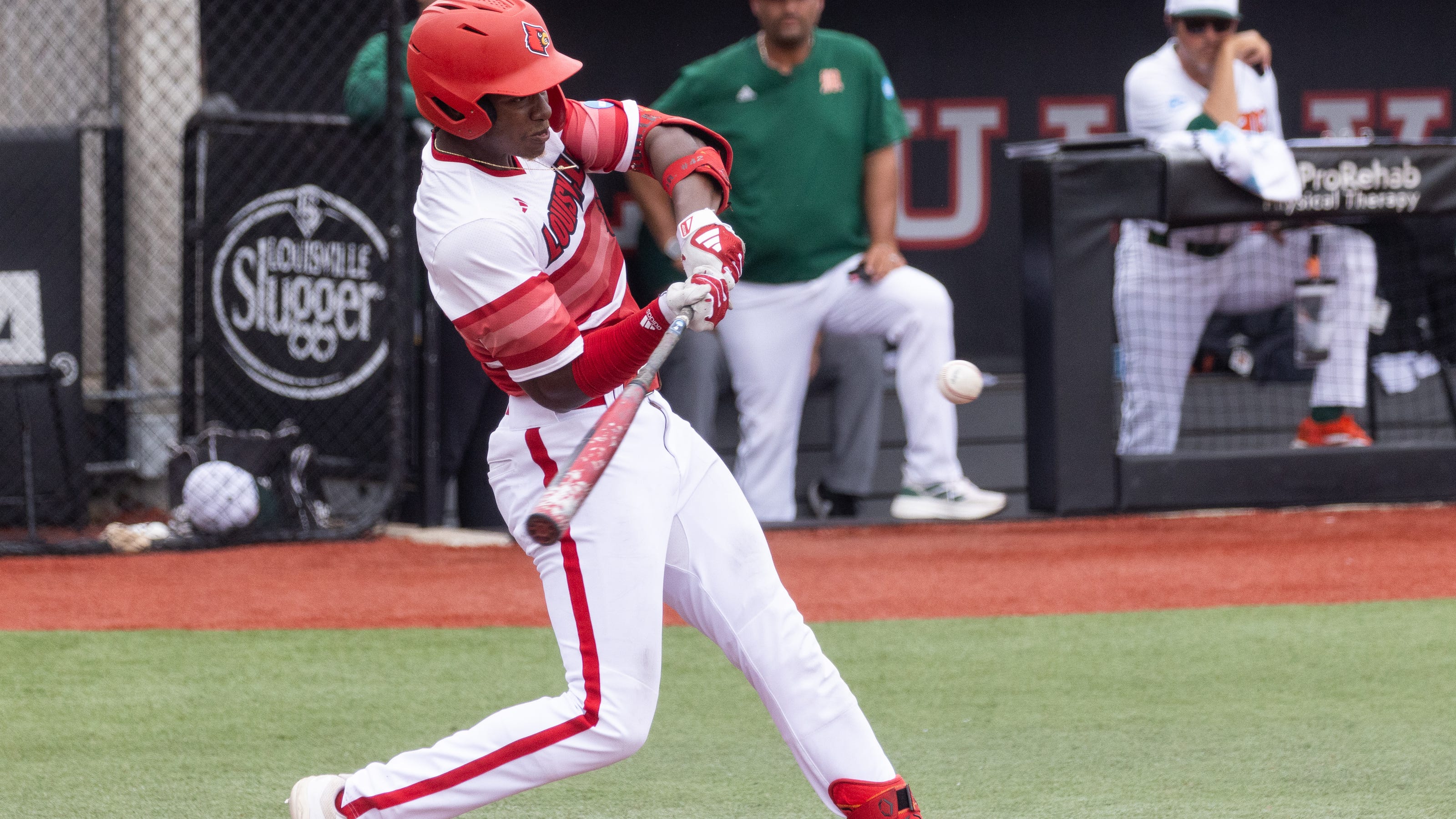

Ncaa Baseball Super Regional Louisville Vs Miami Score Time Tv Channel

Jun 08, 2025

Ncaa Baseball Super Regional Louisville Vs Miami Score Time Tv Channel

Jun 08, 2025 -

Cybercriminals Directly Threaten M And S Ceo With Abuse And Ransom Demands

Jun 08, 2025

Cybercriminals Directly Threaten M And S Ceo With Abuse And Ransom Demands

Jun 08, 2025 -

Swiateks Clay Court Outlook Rankings Are Just Numbers

Jun 08, 2025

Swiateks Clay Court Outlook Rankings Are Just Numbers

Jun 08, 2025

Yankees Shortstop Situation Volpes Performance Under Daily Scrutiny

Yankees Shortstop Situation Volpes Performance Under Daily Scrutiny

Democrats Fail To Block Gop Nominee Push Senate Rules Altered

Democrats Fail To Block Gop Nominee Push Senate Rules Altered

Mealtime Struggles Expert Tips For Dealing With Fussy Eaters

Mealtime Struggles Expert Tips For Dealing With Fussy Eaters