Financial Avengers Inc. Portfolio Analysis: Bank Of America's Significant Role

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Financial Avengers Inc. Portfolio Analysis: Bank of America's Significant Role

Bank of America's substantial presence in Financial Avengers Inc.'s portfolio sparks investor interest and raises questions about diversification.

The financial world is abuzz with discussion surrounding Financial Avengers Inc. (FAI) and the significant weighting of Bank of America (BAC) within its investment portfolio. This strategic allocation has piqued the interest of analysts and investors alike, prompting a closer examination of FAI's overall investment strategy and risk profile. This article delves into the details, analyzing Bank of America's role within FAI's holdings and exploring the potential implications for investors.

Bank of America: A Cornerstone of FAI's Portfolio

FAI's recent portfolio disclosures reveal a considerable stake in Bank of America, representing a substantial percentage of their total assets under management (AUM). This concentration raises questions about FAI's diversification strategy and its potential vulnerability to fluctuations in BAC's stock price. While a large position in a blue-chip company like Bank of America can offer stability, it also increases exposure to sector-specific risks within the financial industry.

The decision to heavily invest in Bank of America reflects FAI's belief in the long-term prospects of the institution. However, the lack of significant diversification across other major financial institutions or sectors could be a cause for concern for some investors. This concentration might be a calculated risk, based on FAI's in-depth analysis of Bank of America's fundamentals, future growth potential, and its position within the broader financial landscape.

Assessing the Risk and Reward

The significant Bank of America holding presents both opportunities and challenges for FAI. On the one hand, a strong performance by BAC could significantly boost FAI's overall returns. Bank of America's robust earnings reports and steady dividend payouts could prove beneficial for FAI's investors in the long run. On the other hand, any negative news or economic downturn affecting Bank of America could severely impact FAI's portfolio performance.

Key considerations include:

- Market Volatility: The current market climate is characterized by uncertainty, and the financial sector is particularly susceptible to volatility.

- Regulatory Changes: Changes in financial regulations could impact Bank of America's profitability and, consequently, FAI's returns.

- Competitive Landscape: The banking sector is highly competitive, and Bank of America faces challenges from other major players.

FAI's Investment Philosophy and Future Outlook

Understanding FAI's overall investment philosophy is crucial to evaluating the significance of its Bank of America investment. Does FAI primarily focus on value investing, growth stocks, or a blend of both? A detailed analysis of FAI's investment strategy and risk management practices is needed to fully assess the implications of this concentrated position.

Further research into FAI’s portfolio beyond Bank of America is also necessary. Examining the diversification across other sectors and asset classes will provide a more comprehensive understanding of their risk profile and potential future performance.

Investors should consider:

- Diversification of their own portfolios: Don't rely solely on FAI's performance; maintain a diversified investment strategy.

- Regular portfolio review: Keep a close eye on FAI's holdings and performance.

- Seeking professional financial advice: Consult a financial advisor before making any significant investment decisions.

This analysis highlights the importance of understanding the intricacies of FAI's portfolio allocation and the significant role Bank of America plays within it. Investors should conduct thorough due diligence and consider their individual risk tolerance before making any investment decisions. The future performance of both FAI and Bank of America remains subject to market forces and unforeseen events. Stay tuned for further updates and analyses.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Financial Avengers Inc. Portfolio Analysis: Bank Of America's Significant Role. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

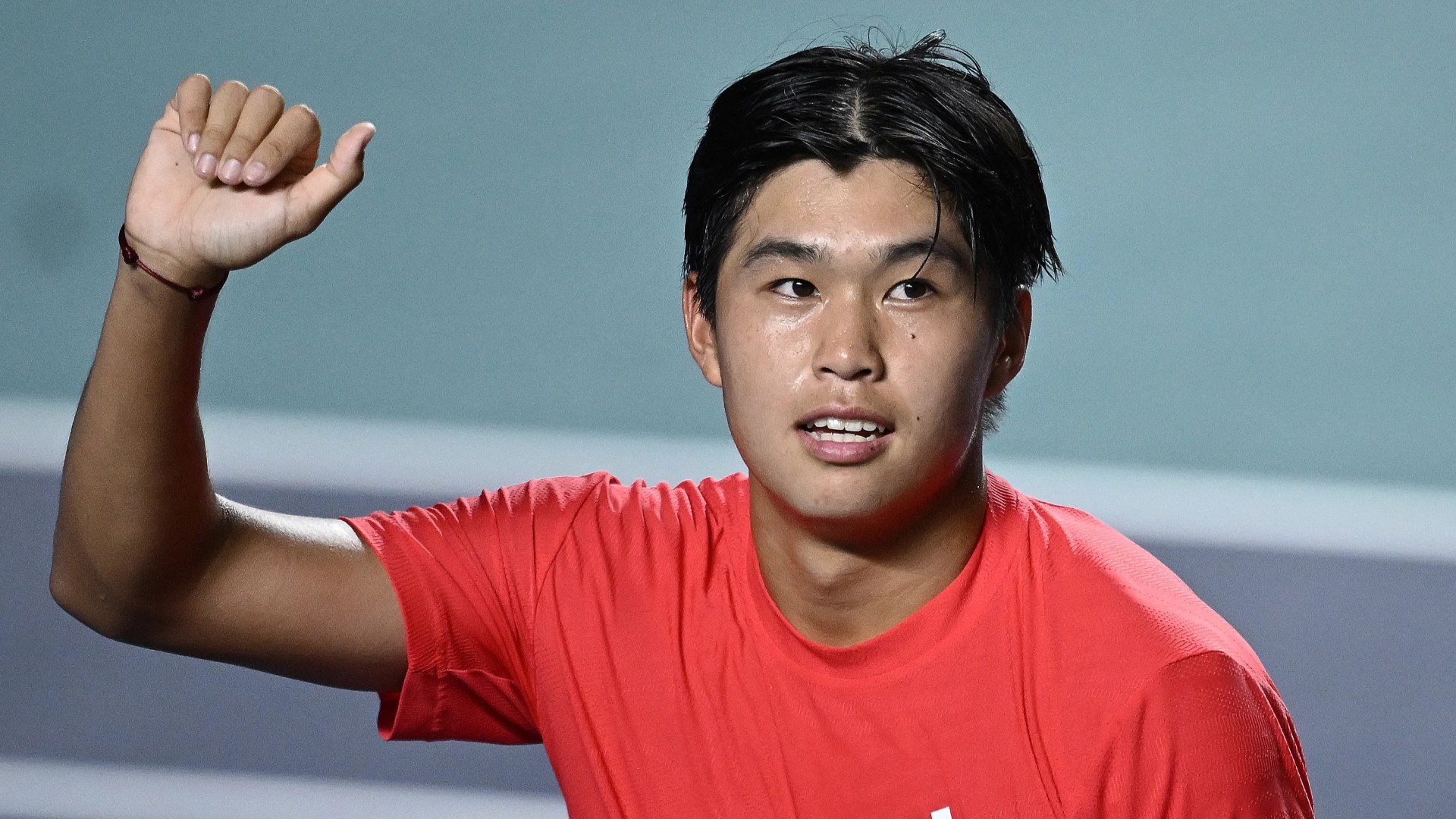

The Unlikely Path A Us Tennis Players Journey From Occupational Naming To World No 3 Showdown

May 28, 2025

The Unlikely Path A Us Tennis Players Journey From Occupational Naming To World No 3 Showdown

May 28, 2025 -

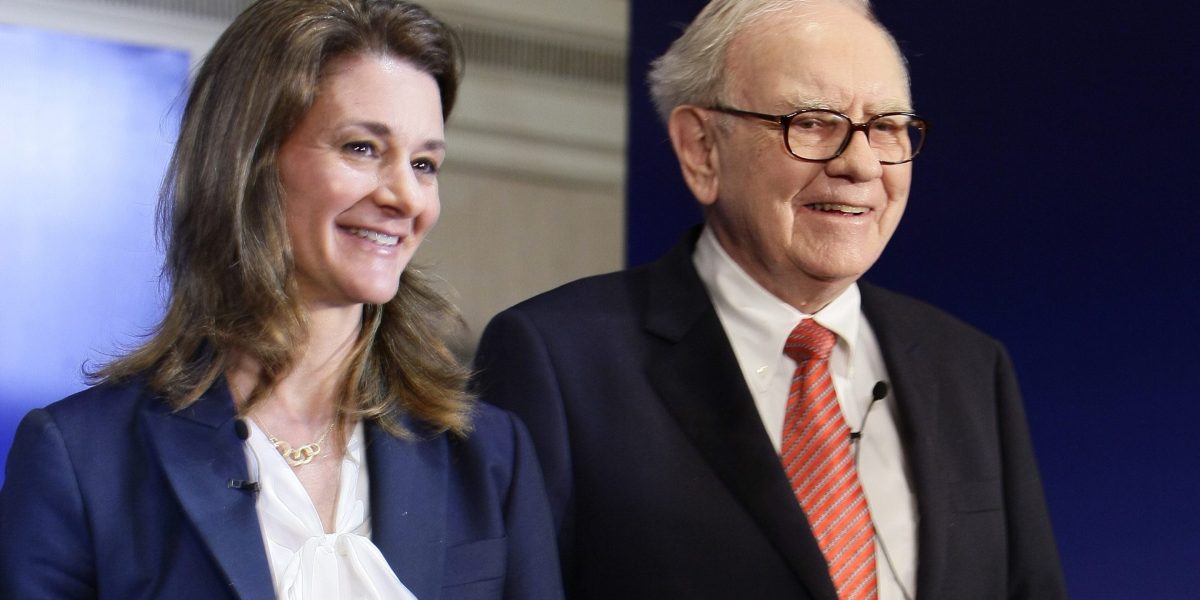

600 Billion Pledge A New Era For Charitable Giving

May 28, 2025

600 Billion Pledge A New Era For Charitable Giving

May 28, 2025 -

Bruneis Sultan In Kuala Lumpur Hospital Fatigue Prompts Medical Care

May 28, 2025

Bruneis Sultan In Kuala Lumpur Hospital Fatigue Prompts Medical Care

May 28, 2025 -

Alcohol And Brain Damage A Growing Public Health Crisis

May 28, 2025

Alcohol And Brain Damage A Growing Public Health Crisis

May 28, 2025 -

Black Lung Crisis Worsens Federal Enforcement Staff And Regulations Reduced

May 28, 2025

Black Lung Crisis Worsens Federal Enforcement Staff And Regulations Reduced

May 28, 2025

Latest Posts

-

Road Construction In Wilkes Barre Water Main Replacement Project Updates

Jun 01, 2025

Road Construction In Wilkes Barre Water Main Replacement Project Updates

Jun 01, 2025 -

Live F1 Qualifying 2025 Spanish Grand Prix In Barcelona Times And Results

Jun 01, 2025

Live F1 Qualifying 2025 Spanish Grand Prix In Barcelona Times And Results

Jun 01, 2025 -

The Underrepresented Women Farmers A Conversation With Clarksons Sidekick

Jun 01, 2025

The Underrepresented Women Farmers A Conversation With Clarksons Sidekick

Jun 01, 2025 -

Betting On Cobolli Zverev And Draper Fonseca At The 2025 French Open A Guide

Jun 01, 2025

Betting On Cobolli Zverev And Draper Fonseca At The 2025 French Open A Guide

Jun 01, 2025 -

Historic Nancy Astor Diamond Tiara Headed To Bonhams Auction Block

Jun 01, 2025

Historic Nancy Astor Diamond Tiara Headed To Bonhams Auction Block

Jun 01, 2025