Financial Fallout? Trump's Executive Order Against "Debanking" Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Financial Fallout? Trump's Executive Order Against "Debanking" Explained

Introduction: Former President Donald Trump's executive order targeting "debanking," the practice of banks severing ties with certain businesses or individuals, continues to generate significant debate and uncertainty within the financial sector. This move, made during his presidency, aimed to curb what he deemed unfair treatment of specific groups, particularly those aligned with conservative viewpoints. However, the order's implications remain complex and its long-term effects are still unfolding. This article will dissect the executive order, exploring its aims, potential consequences, and the ongoing legal and political ramifications.

What is "Debanking"?

"Debanking," also known as de-risking, refers to the process by which financial institutions terminate or refuse to establish business relationships with clients deemed to pose a higher-than-acceptable risk. This risk can stem from various factors, including:

- Regulatory compliance: Banks must adhere to stringent anti-money laundering (AML) and know-your-customer (KYC) regulations. Clients suspected of engaging in illicit activities may be debanked to mitigate legal and financial penalties.

- Reputational risk: Associations with controversial individuals or businesses can damage a bank's reputation, leading to a loss of customers and investor confidence.

- Financial risk: Clients with a history of financial instability or involvement in high-risk ventures may be deemed too risky for banks to handle.

Trump's Executive Order: Aimed at Protecting Conservative Businesses?

Trump's executive order, issued in [insert date], aimed to address concerns that banks were disproportionately targeting conservative businesses and individuals, claiming it was a form of political discrimination. The order sought to investigate and potentially counteract this alleged practice, prompting widespread debate about the intersection of political ideology and financial regulation.

The Arguments For and Against the Order

Proponents argued that the executive order protected businesses from unfair treatment based on their political beliefs, ensuring a level playing field within the financial system. They claimed that "debanking" was being used as a tool to silence conservative voices.

Critics, on the other hand, contended that the order interfered with the independent risk assessment processes essential for maintaining the stability of the financial system. They argued that banks have a responsibility to assess and mitigate risk, regardless of political affiliation. Furthermore, they raised concerns that the order could undermine AML and KYC regulations, potentially facilitating financial crime.

Legal Challenges and Ongoing Uncertainty

The executive order faced significant legal challenges, with several lawsuits questioning its constitutionality and potential impact on regulatory oversight. The outcome of these legal battles significantly impacts the order's practical application and its lasting impact on the banking industry. [Link to relevant legal resources/news articles].

The Future of Debanking and Financial Regulation

The debate surrounding "debanking" and its potential for political manipulation highlights the intricate relationship between financial regulation, risk assessment, and political ideologies. Finding a balance between safeguarding the financial system and preventing discriminatory practices remains a significant challenge for policymakers and regulators. Ongoing discussions about enhancing transparency and accountability within the banking sector are critical to addressing concerns and ensuring fair access to financial services for all businesses and individuals.

Conclusion:

Trump's executive order against "debanking" ignited a fierce debate about the role of banks in assessing risk and the potential for political bias within the financial system. While the order's ultimate impact remains subject to ongoing legal challenges and evolving regulatory landscapes, it undeniably raised important questions about fairness, transparency, and the delicate balance between risk management and political freedom within the financial industry. The discussion surrounding this issue will likely continue to shape future financial regulations and the relationship between government and the banking sector.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Financial Fallout? Trump's Executive Order Against "Debanking" Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Western And Southern Open 2025 Collins Townsend Match Prediction Betting Odds Analysis

Aug 09, 2025

Western And Southern Open 2025 Collins Townsend Match Prediction Betting Odds Analysis

Aug 09, 2025 -

2025 Nfl Trade Block A Preseason Look At Potential Deals One Player Per Team

Aug 09, 2025

2025 Nfl Trade Block A Preseason Look At Potential Deals One Player Per Team

Aug 09, 2025 -

Danielle Collins Vs Taylor Townsend Match Preview And Viewing Options

Aug 09, 2025

Danielle Collins Vs Taylor Townsend Match Preview And Viewing Options

Aug 09, 2025 -

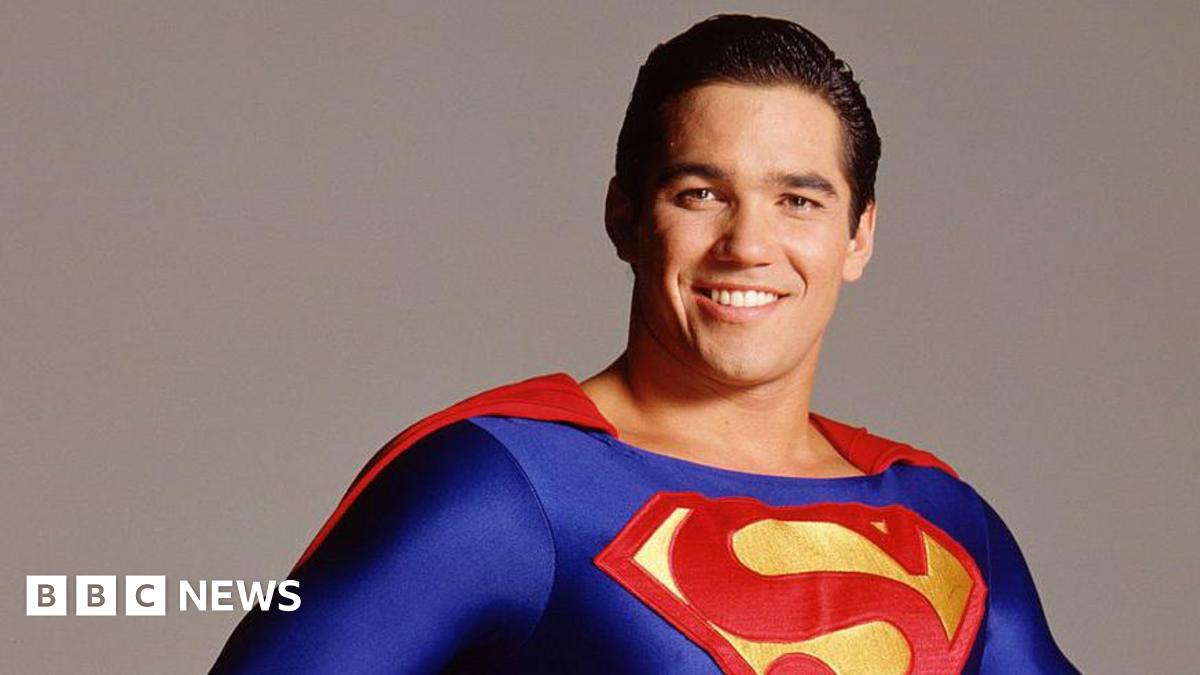

Dean Cain From Superman To Ice Agent Actor Announces Career Change

Aug 09, 2025

Dean Cain From Superman To Ice Agent Actor Announces Career Change

Aug 09, 2025 -

Monaco Vs Inter Tactical Breakdown And Betting Odds

Aug 09, 2025

Monaco Vs Inter Tactical Breakdown And Betting Odds

Aug 09, 2025

Latest Posts

-

Rondale Moore Injury Update Vikings Wide Receiver Hurt In Preseason Game

Aug 10, 2025

Rondale Moore Injury Update Vikings Wide Receiver Hurt In Preseason Game

Aug 10, 2025 -

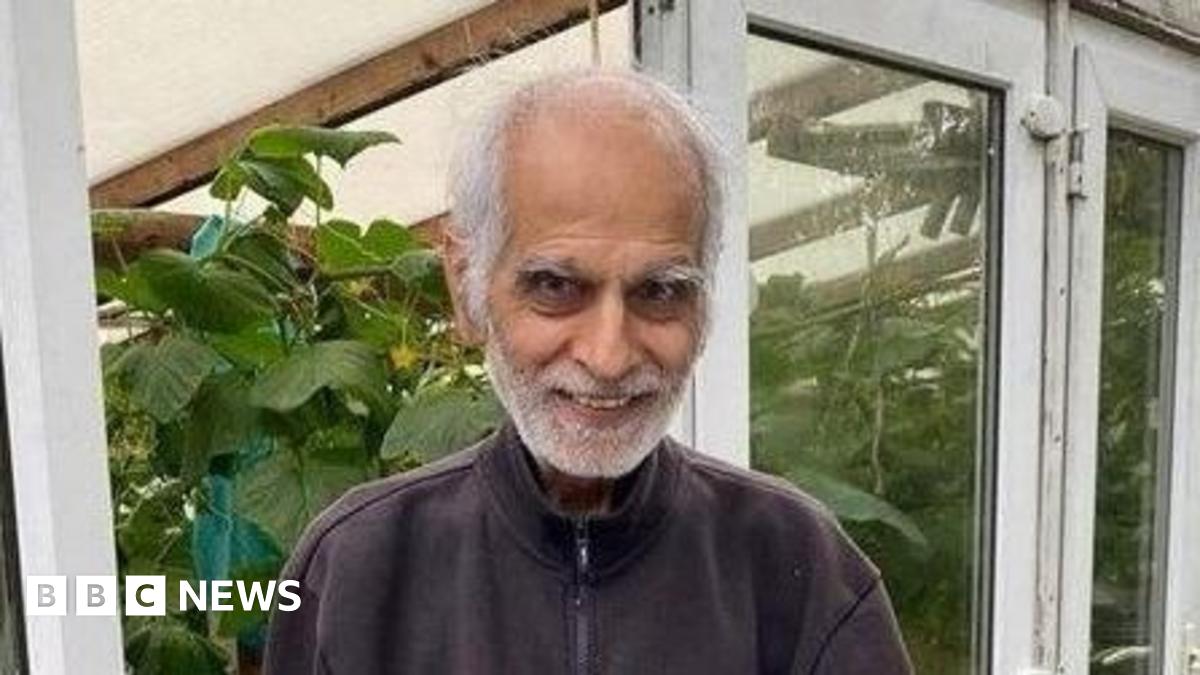

Bhim Kohli Death Investigation Launched Into Police Handling Of Information

Aug 10, 2025

Bhim Kohli Death Investigation Launched Into Police Handling Of Information

Aug 10, 2025 -

Four Dead In Montana Bar Shooting Suspect Arrested

Aug 10, 2025

Four Dead In Montana Bar Shooting Suspect Arrested

Aug 10, 2025 -

Allegations Of Indecent Assault Against Hardeep Singh Kohli At Bbc Studio

Aug 10, 2025

Allegations Of Indecent Assault Against Hardeep Singh Kohli At Bbc Studio

Aug 10, 2025 -

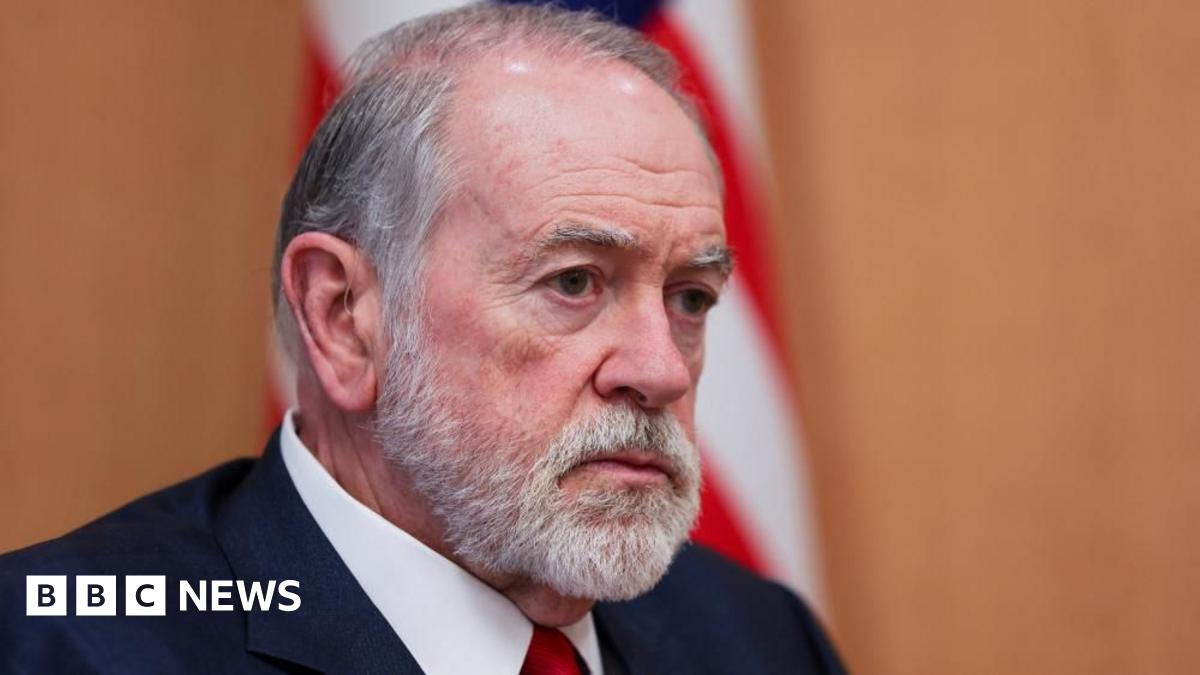

Wwii Hypothetical Us Ambassador To Israel Criticizes Keir Starmers Leadership

Aug 10, 2025

Wwii Hypothetical Us Ambassador To Israel Criticizes Keir Starmers Leadership

Aug 10, 2025