Financial Instability In The UK: One In Ten Lack Savings, Underscoring Economic Concerns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Financial Instability in the UK: One in Ten Lack Any Savings, Underscoring Deepening Economic Concerns

The UK is facing a growing financial crisis, with a staggering one in ten adults reporting they have absolutely no savings, according to a new report from [Source Name - e.g., the Office for National Statistics]. This alarming statistic underscores deeper economic anxieties and highlights the vulnerability of a significant portion of the UK population. The lack of savings leaves millions exposed to unexpected financial shocks, exacerbating existing inequalities and raising serious questions about the nation's economic resilience.

This worrying trend isn't isolated; it's a symptom of a broader malaise affecting household finances across the UK. Rising inflation, the cost of living crisis, and stagnant wages have combined to create a perfect storm, leaving many struggling to make ends meet, let alone build a financial safety net.

The Dire Reality: A Nation Without Savings

The absence of savings among a substantial portion of the population has far-reaching consequences:

- Increased vulnerability to financial shocks: Unexpected events like job loss, illness, or home repairs can quickly spiral into debt for those without savings. This can lead to a vicious cycle of poverty and financial instability.

- Limited access to opportunities: Lack of savings can prevent individuals from pursuing educational opportunities, starting a business, or making crucial investments in their future. This further entrenches inequality and limits social mobility.

- Strain on public services: As more people struggle financially, the demand for social support and welfare services increases, placing a greater burden on already stretched public resources.

Factors Contributing to the Savings Crisis

Several key factors have contributed to the decline in UK savings:

- Inflationary Pressures: Soaring inflation has eroded the value of savings, making it harder for people to build a financial cushion. The rising cost of essential goods and services leaves little room for saving.

- Stagnant Wages: Wage growth has failed to keep pace with inflation, leaving many households with less disposable income and reducing their ability to save. [Link to a relevant article about wage stagnation]

- Increased Cost of Living: The cost of housing, energy, and food has increased dramatically, leaving many struggling to meet their basic needs, let alone save any money. [Link to a relevant article on the cost of living crisis]

- Debt Burden: Many households are already burdened with high levels of debt, making it difficult to save and leaving them vulnerable to further financial hardship.

Looking Ahead: What Needs to be Done?

Addressing this financial instability requires a multi-pronged approach:

- Targeted Government Support: The government needs to implement policies that directly address the cost of living crisis, such as targeted support for low-income households and measures to control inflation.

- Financial Literacy Programs: Increased investment in financial literacy programs can empower individuals to manage their finances more effectively and build savings habits.

- Wage Growth Initiatives: Policies that promote fair wages and strong wage growth are essential to ensure that people have enough disposable income to save.

- Debt Management Solutions: Access to effective debt management solutions can help individuals struggling with debt to regain control of their finances.

The lack of savings amongst a significant portion of the UK population is a serious concern with long-term implications. Addressing this issue requires urgent action from both the government and individuals to prevent further economic hardship and build a more financially secure future for all. We need a concerted effort to tackle the root causes of this crisis and empower people to build a stronger financial foundation. What are your thoughts on this pressing issue? Share your opinions in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Financial Instability In The UK: One In Ten Lack Savings, Underscoring Economic Concerns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Uk Economy Booms Starmers Leadership Challenged By Albania Controversy

May 17, 2025

Uk Economy Booms Starmers Leadership Challenged By Albania Controversy

May 17, 2025 -

A Delicious Tour Of Italy With Stanley Tucci Nat Geos Latest Series

May 17, 2025

A Delicious Tour Of Italy With Stanley Tucci Nat Geos Latest Series

May 17, 2025 -

Britains Shifting Relationship With The European Union

May 17, 2025

Britains Shifting Relationship With The European Union

May 17, 2025 -

Benn Vs Scheifele Nhl Players Involved In Violent On Ice Altercation

May 17, 2025

Benn Vs Scheifele Nhl Players Involved In Violent On Ice Altercation

May 17, 2025 -

Video Captures Escape Pregnant Daughter Of Crypto Executive Kidnapped In Paris

May 17, 2025

Video Captures Escape Pregnant Daughter Of Crypto Executive Kidnapped In Paris

May 17, 2025

Latest Posts

-

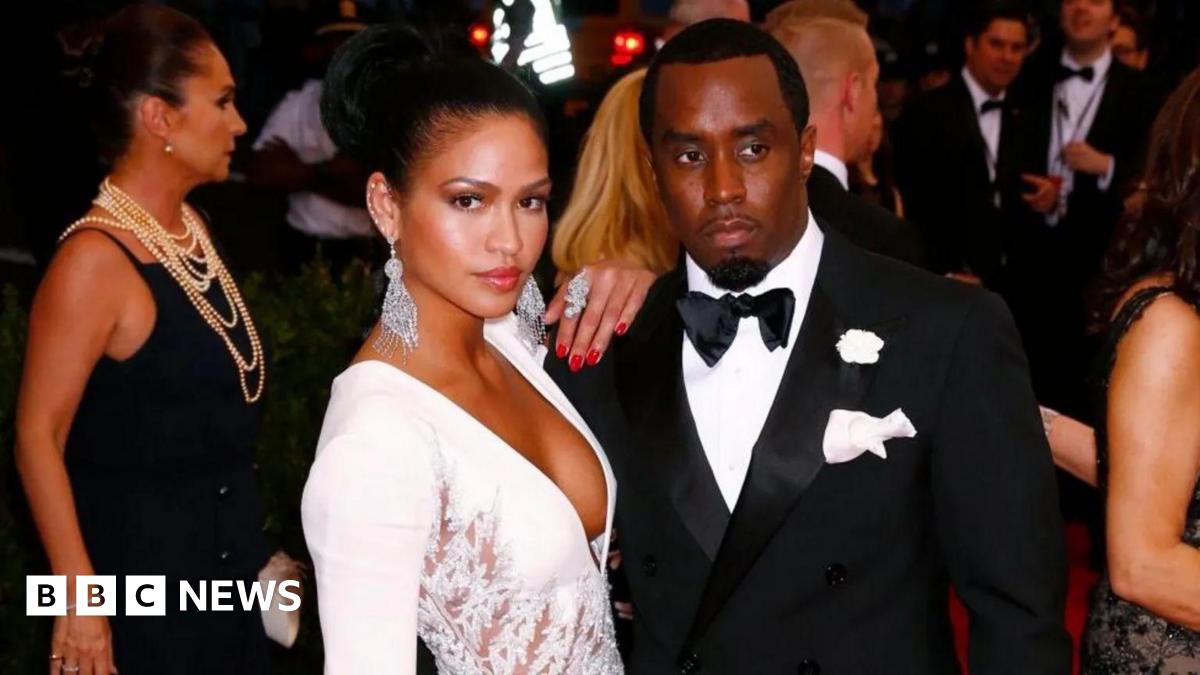

Will Cassies Testimony Sink Or Save Sean Diddy Combs

May 18, 2025

Will Cassies Testimony Sink Or Save Sean Diddy Combs

May 18, 2025 -

Aubrey O Day Skips Sean Combs Trial No Subpoena No Testimony

May 18, 2025

Aubrey O Day Skips Sean Combs Trial No Subpoena No Testimony

May 18, 2025 -

Explore The History Of A Famous New York Football Team And Get Free Spins On Brazilian Slots

May 18, 2025

Explore The History Of A Famous New York Football Team And Get Free Spins On Brazilian Slots

May 18, 2025 -

10 Defining Moments In New York Baseball History Goliath Battles And Broken Bats

May 18, 2025

10 Defining Moments In New York Baseball History Goliath Battles And Broken Bats

May 18, 2025 -

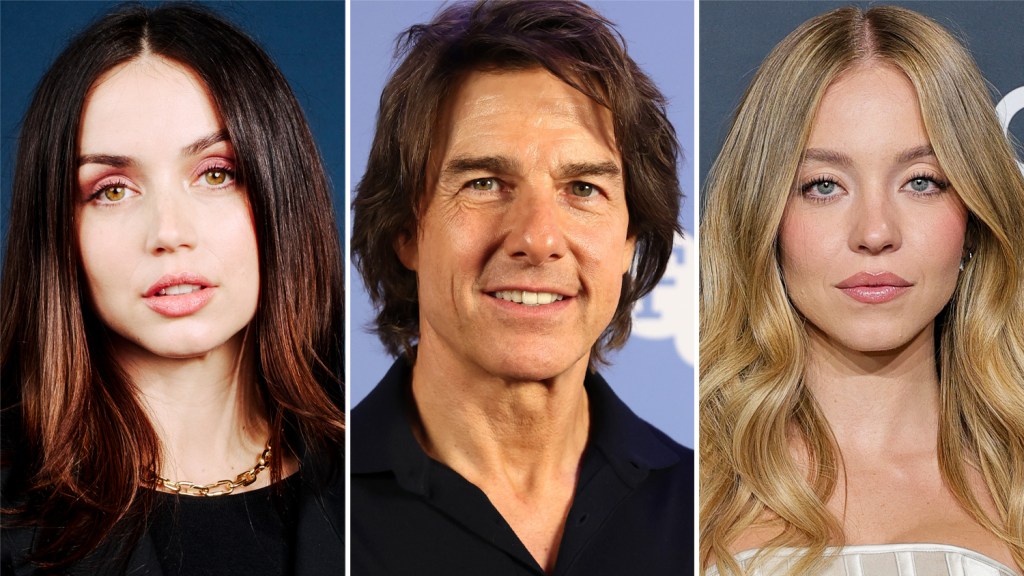

New Movie Project Jon Chu Directs Tom Cruise Ana De Armas And Sydney Sweeney Considered For Lead Roles

May 18, 2025

New Movie Project Jon Chu Directs Tom Cruise Ana De Armas And Sydney Sweeney Considered For Lead Roles

May 18, 2025