Financial Instability In The UK: The Shocking Savings Gap

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Financial Instability in the UK: The Shocking Savings Gap

The UK is facing a worrying trend: a significant and widening savings gap, contributing to a growing sense of financial instability amongst households. This isn't just about rainy-day funds; it's a deep-seated issue impacting economic growth, retirement security, and overall societal well-being. The implications are far-reaching and demand urgent attention.

The Stark Reality: A Nation Falling Behind

Recent data paints a concerning picture. Analysis from [insert reputable source, e.g., the Office for National Statistics, Bank of England] reveals a dramatic decline in the savings rate among many demographics, particularly younger generations. This isn't simply a matter of reduced disposable income; it points towards a deeper societal shift in financial attitudes and planning. Many are struggling to even cover essential living expenses, let alone put money aside for the future.

Contributing Factors: A Perfect Storm of Challenges

Several factors contribute to this alarming savings gap:

- The Cost of Living Crisis: Soaring inflation, increased energy prices, and rising food costs have significantly squeezed household budgets, leaving little room for saving. Many are forced to use existing savings just to meet daily needs.

- Stagnant Wages: Wage growth has failed to keep pace with inflation for years, leaving many feeling financially squeezed and unable to save effectively. This impacts both low-income and middle-class families.

- Debt Burden: High levels of personal debt, including credit card balances and loans, further restrict the ability of many households to save. The rising interest rates exacerbate this problem.

- Lack of Financial Literacy: A significant portion of the population lacks the financial knowledge and skills necessary to effectively manage their finances and plan for the future. This includes understanding savings vehicles, budgeting techniques, and investing strategies.

- Shifting Economic Landscape: The gig economy and increasing prevalence of zero-hour contracts contribute to income instability, making consistent saving extremely difficult.

The Consequences: A Bleak Future?

The consequences of this widening savings gap are profound:

- Retirement Insecurity: Many are facing the prospect of inadequate retirement savings, potentially leading to financial hardship in later life. This is particularly concerning given increasing life expectancies.

- Reduced Economic Growth: Lower household savings translate to reduced consumer spending and investment, hindering overall economic growth.

- Increased Vulnerability: A lack of savings leaves households highly vulnerable to unexpected financial shocks, such as job loss or illness, potentially pushing them into poverty.

Addressing the Crisis: A Multi-pronged Approach

Tackling this issue requires a multifaceted approach:

- Government Intervention: Targeted policies aimed at boosting wages, controlling inflation, and providing affordable housing are crucial. Initiatives promoting financial literacy through schools and community programs are also essential. [Link to relevant government initiatives, if available].

- Financial Education: Increased investment in financial literacy programs is paramount. These programs should be accessible, engaging, and tailored to different demographics.

- Employer Support: Employers can play a vital role by offering financial wellness programs and promoting responsible financial planning among employees.

Looking Ahead: A Call to Action

The UK's savings gap is a significant challenge with potentially devastating long-term consequences. Addressing this requires a concerted effort from individuals, businesses, and the government. Promoting financial literacy, implementing supportive policies, and fostering a culture of responsible saving are crucial steps towards ensuring a more financially secure future for all. We need to act now to avert a potential financial crisis. What steps do you think are necessary to bridge this gap? Share your thoughts in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Financial Instability In The UK: The Shocking Savings Gap. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

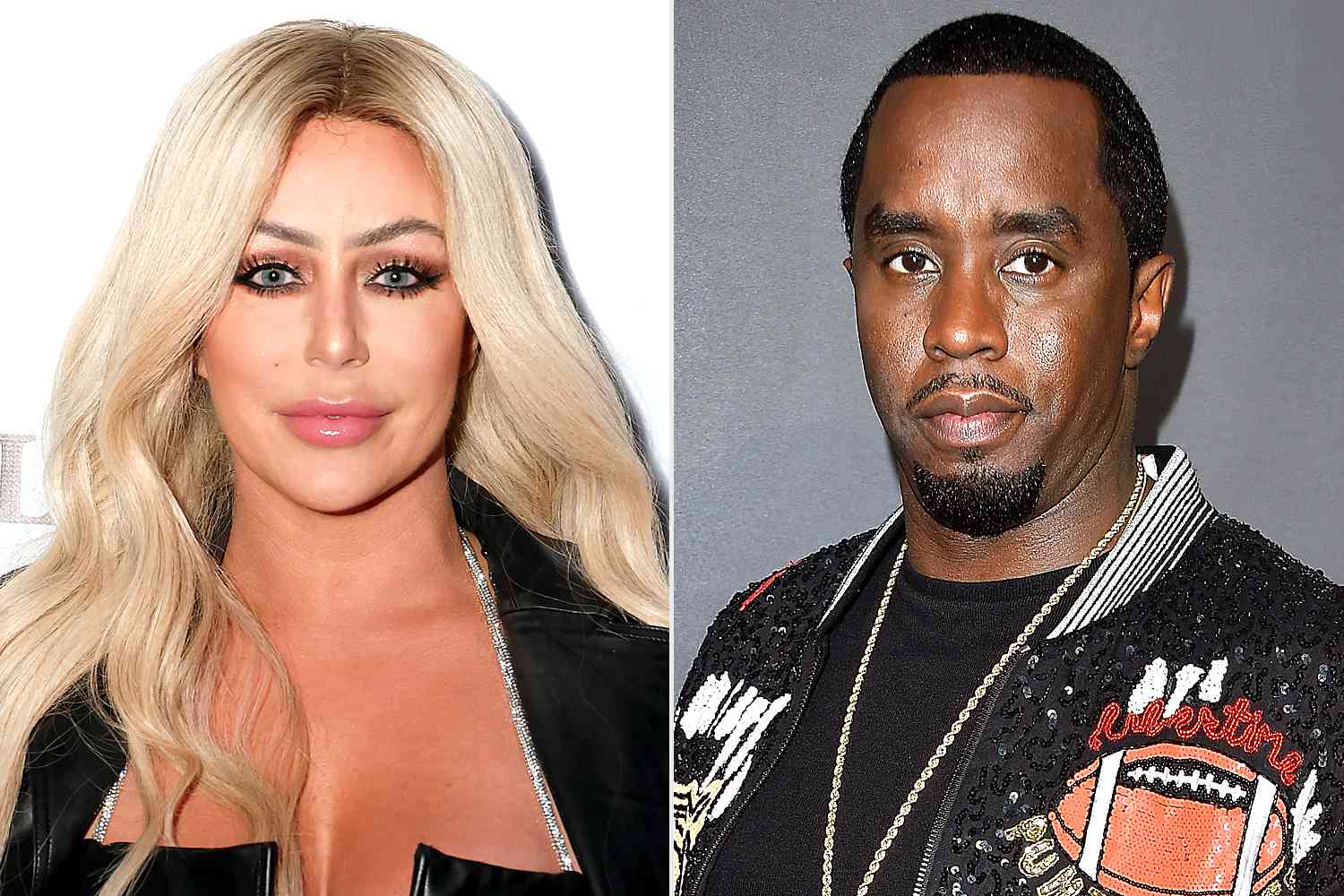

Exclusive Aubrey O Day Will Not Appear As Witness In Diddys Trial

May 18, 2025

Exclusive Aubrey O Day Will Not Appear As Witness In Diddys Trial

May 18, 2025 -

Jeffrey Dean Morgan Opens Up About Destination X And Future Projects

May 18, 2025

Jeffrey Dean Morgan Opens Up About Destination X And Future Projects

May 18, 2025 -

Flight Delays And Blackouts At Newark Airport A Veteran Air Traffic Controller Sounds The Alarm

May 18, 2025

Flight Delays And Blackouts At Newark Airport A Veteran Air Traffic Controller Sounds The Alarm

May 18, 2025 -

The Phoenician Scheme Wes Anderson Discusses His Cannes Trip And Film Appreciation

May 18, 2025

The Phoenician Scheme Wes Anderson Discusses His Cannes Trip And Film Appreciation

May 18, 2025 -

Community Mourns Fallen Firefighters Honored Following Fatal Business Park Fire

May 18, 2025

Community Mourns Fallen Firefighters Honored Following Fatal Business Park Fire

May 18, 2025

Latest Posts

-

Mudanca De Vida Militares Estadunidenses Trocam Os Eua Pelo Brasil Motivos E Implicacoes

May 18, 2025

Mudanca De Vida Militares Estadunidenses Trocam Os Eua Pelo Brasil Motivos E Implicacoes

May 18, 2025 -

Twins Extend Win Streak To 12 Joe Ryans Dominant Performance

May 18, 2025

Twins Extend Win Streak To 12 Joe Ryans Dominant Performance

May 18, 2025 -

Trump Vs Springsteen A Heated Exchange Over Treasonous Accusation

May 18, 2025

Trump Vs Springsteen A Heated Exchange Over Treasonous Accusation

May 18, 2025 -

Rising Seas And Slower Currents The Connection Affecting The Us

May 18, 2025

Rising Seas And Slower Currents The Connection Affecting The Us

May 18, 2025 -

Government U Turns On Winter Fuel As New Eu Deal Emerges

May 18, 2025

Government U Turns On Winter Fuel As New Eu Deal Emerges

May 18, 2025