First American Bank Increases Lockheed Martin (LMT) Stock Holdings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

First American Bank Boosts Lockheed Martin (LMT) Stake: A Sign of Confidence in Defense Sector?

First American Bank's recent increase in its Lockheed Martin (LMT) stock holdings has sent ripples through the financial markets, sparking discussions about the future of the defense industry and the attractiveness of LMT as an investment. The move, disclosed in a recent SEC filing, reveals a significant boost in the bank's position in the aerospace and defense giant, prompting analysts to examine the underlying reasons behind this strategic decision. This article delves into the details of the investment, explores potential implications, and considers the broader context of the defense sector's current landscape.

First American Bank's Growing Confidence in Lockheed Martin

First American Bank's increased stake in Lockheed Martin represents a notable vote of confidence in the company's future prospects. The exact figures of the increased holdings have not yet been publicly released, however, market analysts predict a substantial increase. This strategic move by a respected financial institution suggests a positive outlook on Lockheed Martin's performance and its potential for future growth. The timing of the increase is also significant, considering the current geopolitical climate and the increasing global demand for defense technologies.

Lockheed Martin's Strong Performance and Future Outlook

Lockheed Martin, a leading global security and aerospace company, boasts a robust portfolio of products and services, including advanced fighter jets (like the F-35), missile defense systems, and space exploration technologies. The company's consistent profitability and strong order book have made it a desirable investment for many institutional investors. [Link to Lockheed Martin's investor relations page]. Several key factors contribute to LMT's attractive investment profile:

- Strong Government Contracts: Lockheed Martin benefits from substantial and long-term contracts with the U.S. government and its allies, providing a stable revenue stream.

- Technological Innovation: Continuous investment in research and development ensures Lockheed Martin remains at the forefront of technological advancements in the defense sector.

- Global Demand: Rising geopolitical tensions and increased defense spending globally contribute to a robust demand for Lockheed Martin's products and services.

Implications for Investors and the Defense Sector

First American Bank's investment in Lockheed Martin could signal a broader trend of increased investor interest in the defense sector. This could lead to further price appreciation for LMT stock and potentially boost the entire sector. However, investors should always conduct their own due diligence before making any investment decisions. [Link to a reputable financial news source discussing defense stock investments].

Looking Ahead: Potential Challenges and Opportunities

While the outlook for Lockheed Martin appears positive, it's crucial to acknowledge potential challenges. These include:

- Geopolitical Uncertainty: Shifts in global politics can significantly impact defense spending and consequently, Lockheed Martin's revenue.

- Competition: Lockheed Martin faces competition from other major defense contractors, which could impact market share.

- Supply Chain Issues: Disruptions in the global supply chain could affect the production and delivery of Lockheed Martin's products.

Despite these potential challenges, Lockheed Martin's strong fundamentals, technological leadership, and substantial government contracts suggest a promising future. The increase in holdings by First American Bank further strengthens this positive outlook.

Conclusion:

First American Bank's strategic decision to increase its holdings in Lockheed Martin (LMT) reflects a positive assessment of the company's long-term prospects. This move, coupled with Lockheed Martin's strong fundamentals and position within the growing defense sector, offers investors compelling reasons to examine this stock more closely. However, as with any investment, careful consideration of potential risks is essential. Stay tuned for further updates on this developing story. What are your thoughts on this investment move? Share your opinions in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on First American Bank Increases Lockheed Martin (LMT) Stock Holdings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Unseen Jaws A Look At The Behind The Scenes Production

Jun 22, 2025

Unseen Jaws A Look At The Behind The Scenes Production

Jun 22, 2025 -

Sparks Star Ben Felter Reaches New Heights Girlfriend Cameron Brink Celebrates

Jun 22, 2025

Sparks Star Ben Felter Reaches New Heights Girlfriend Cameron Brink Celebrates

Jun 22, 2025 -

Israeli Aggression Halting Condition For Irans Diplomatic Engagement

Jun 22, 2025

Israeli Aggression Halting Condition For Irans Diplomatic Engagement

Jun 22, 2025 -

Daughter Saga Blade Machine Gun Kelly And Megan Fox Share The Story Behind The Name

Jun 22, 2025

Daughter Saga Blade Machine Gun Kelly And Megan Fox Share The Story Behind The Name

Jun 22, 2025 -

Official Announcement Megan Fox And Mgks Baby Girls Name Revealed

Jun 22, 2025

Official Announcement Megan Fox And Mgks Baby Girls Name Revealed

Jun 22, 2025

Latest Posts

-

Investment Firm Cantor Fitzgerald Raises Position In Lockheed Martin Lmt

Jun 22, 2025

Investment Firm Cantor Fitzgerald Raises Position In Lockheed Martin Lmt

Jun 22, 2025 -

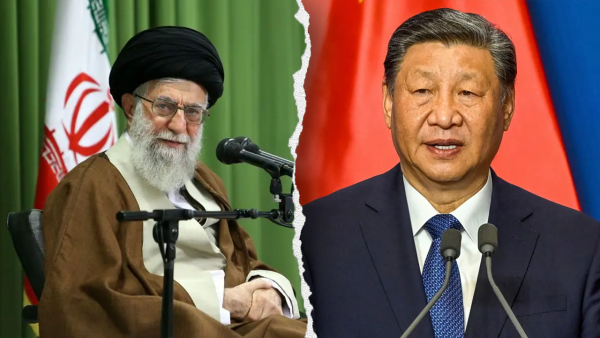

Will China Support Iran After A Western Victory Analyzing The Geopolitical Stakes

Jun 22, 2025

Will China Support Iran After A Western Victory Analyzing The Geopolitical Stakes

Jun 22, 2025 -

Breaking Ex Mlb Star Issues Ultimatum To President Trump Regarding War

Jun 22, 2025

Breaking Ex Mlb Star Issues Ultimatum To President Trump Regarding War

Jun 22, 2025 -

Revealed The Meaning Behind Machine Gun Kellys Daughters Name Case

Jun 22, 2025

Revealed The Meaning Behind Machine Gun Kellys Daughters Name Case

Jun 22, 2025 -

Trumps Influence Kari Lakes Restructuring Of Voice Of America

Jun 22, 2025

Trumps Influence Kari Lakes Restructuring Of Voice Of America

Jun 22, 2025