First-Time Buyer Mortgages: A 31-Year Commitment?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

First-Time Buyer Mortgages: A 31-Year Commitment? Navigating the Long Haul to Homeownership

Buying your first home is a monumental life event, filled with excitement and, let's be honest, a healthy dose of anxiety. One of the biggest anxieties revolves around the mortgage – a potentially 31-year commitment that can significantly shape your financial future. This article delves into the realities of long-term mortgages for first-time buyers, exploring the benefits, drawbacks, and crucial considerations before signing on the dotted line.

The Allure of the 30-Year Mortgage:

For many first-time homebuyers, the 30-year mortgage seems incredibly attractive. The lower monthly payments compared to shorter-term loans allow for greater affordability, making homeownership a reality for those with tighter budgets. This is especially crucial in today's competitive housing market where prices remain high.

- Lower Monthly Payments: The most significant advantage is undoubtedly the reduced monthly outlay. This frees up cash flow for other essential expenses and allows for more comfortable budgeting.

- Accessibility: A longer repayment period makes homeownership accessible to a wider range of buyers who might otherwise be priced out of the market.

The Long Game: Considering the Drawbacks

While the lower monthly payments are tempting, it's crucial to acknowledge the potential drawbacks of a 31-year (or even 30-year) mortgage:

- Higher Total Interest Paid: Over the life of the loan, you'll pay significantly more in interest compared to a shorter-term mortgage. This can amount to tens, even hundreds of thousands of dollars, depending on the loan amount and interest rate.

- Limited Equity Building: You'll build equity in your home more slowly with a longer-term mortgage. This means it will take longer to reach a point where your home's value exceeds your outstanding loan balance.

- Market Volatility: Thirty-one years is a long time, and the housing market can experience significant fluctuations. Unexpected economic downturns could impact your ability to maintain payments, or even result in negative equity.

Strategies for Managing a Long-Term Mortgage:

Successfully navigating a 31-year mortgage requires careful planning and proactive financial management. Consider these strategies:

- Making Extra Payments: Even small additional payments each month can dramatically shorten the loan term and reduce the total interest paid.

- Refinancing: As interest rates fluctuate, refinancing your mortgage could help you secure a lower interest rate and save money in the long run. (Remember to factor in refinancing costs.)

- Building an Emergency Fund: Unexpected expenses can derail even the best-laid plans. A robust emergency fund provides a safety net in case of job loss or unforeseen repairs. Learn more about building an emergency fund .

Alternatives to the 31-Year Mortgage:

For those seeking a quicker path to homeownership and less interest paid, shorter-term mortgages (15-year or even 10-year) are viable alternatives. While the monthly payments are higher, the long-term savings can be substantial. Explore different mortgage options and compare them thoroughly before making a decision. Use online mortgage calculators to see the impact of different loan terms and interest rates.

Conclusion:

A 31-year mortgage can be a viable path to homeownership, offering accessibility and lower monthly payments. However, it's essential to carefully weigh the long-term implications, including the higher total interest paid and slower equity building. By understanding the benefits and drawbacks and employing sound financial strategies, you can confidently navigate the journey to homeownership and make an informed decision that aligns with your financial goals and long-term aspirations. Remember to consult with a financial advisor for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on First-Time Buyer Mortgages: A 31-Year Commitment?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mental Health Romesh Ranganathans Personal And Powerful Story

Jun 03, 2025

Mental Health Romesh Ranganathans Personal And Powerful Story

Jun 03, 2025 -

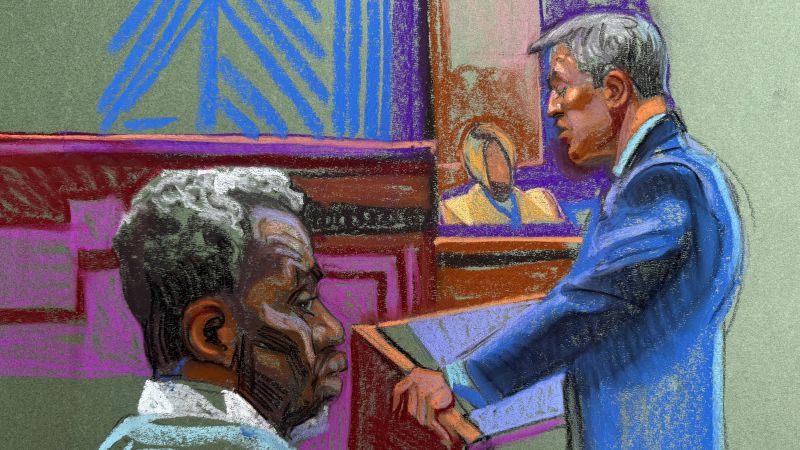

Inside The Sean Diddy Combs Trial A Comprehensive Overview

Jun 03, 2025

Inside The Sean Diddy Combs Trial A Comprehensive Overview

Jun 03, 2025 -

Cnn Investigation Launched After Gardeners Arrest By Masked Agents

Jun 03, 2025

Cnn Investigation Launched After Gardeners Arrest By Masked Agents

Jun 03, 2025 -

Nyt Spelling Bee Strands Complete Guide For June 3rd

Jun 03, 2025

Nyt Spelling Bee Strands Complete Guide For June 3rd

Jun 03, 2025 -

Trump Trade Deals Drive Boeings Rise Bank Of America Upgrades Outlook

Jun 03, 2025

Trump Trade Deals Drive Boeings Rise Bank Of America Upgrades Outlook

Jun 03, 2025